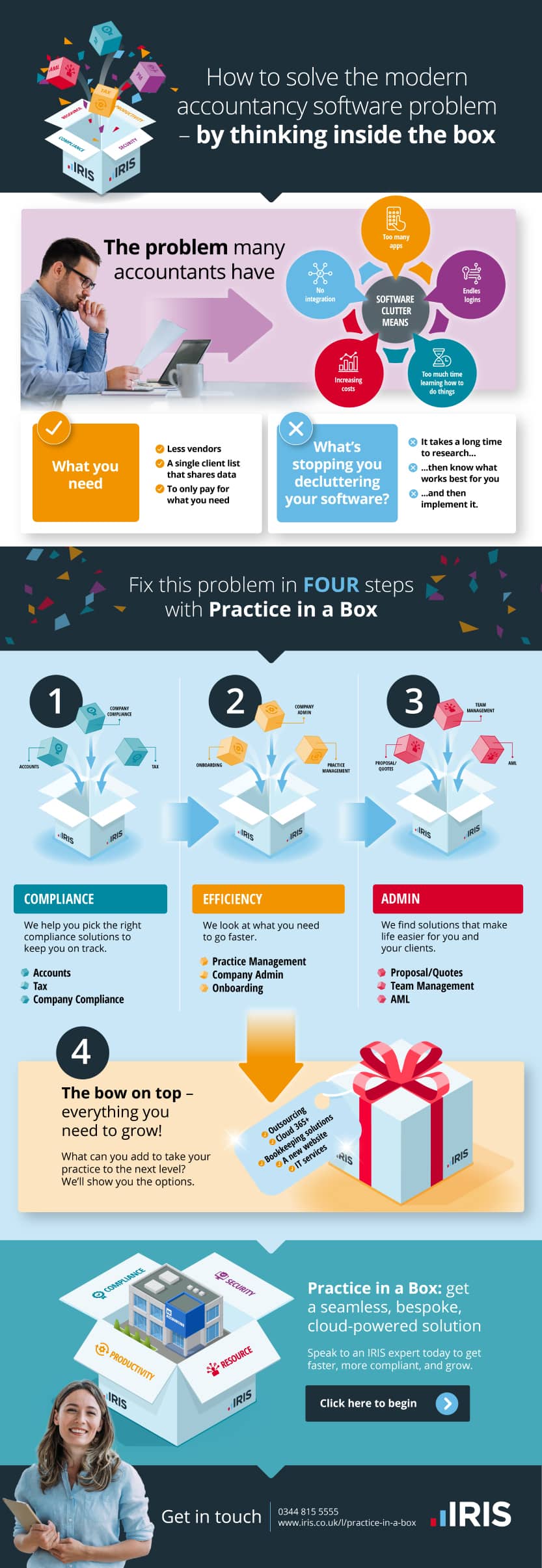

Infographic: how accountants can solve their “software overload” problem

Updated 12th December 2024 | 6 min read Published 30th September 2024

Recently, we discussed how accountants are plagued by problems due to “software overload.”

This tangle of software, caused by relying on a range of vendors, can slow you down. It creates stress and sows confusion in even the most organised accountancy practice.

So, how can you solve this problem if you’re an established accountant or avoid it if you’re just getting started?

Let’s look at four main steps – and one option we’ll save until the end that makes things A LOT easier and has an accompanying infographic, below.

Step 1 – See if you have a software overload problem

Software overload stems from too many vendors offering solutions that clash with one another.

Unfortunately, this adds distraction, workflow inefficiencies and unnecessary costs.

So, you probably want to check if you’re suffering from software overload; see if any of these issues sound familiar:

- You have too many apps littering your desktop or in your browser’s bookmarks

- You’re constantly logging in and out of different solutions

- You often retype data because one software package doesn’t sync with another

- You’re noticing an ever-increasing impact on your bottom line as each vendor revises their costs

- Because they all have different design philosophies, it feels like you’re constantly trying to learn how to use software rather than get on with your job.

Step 2 – Define what will work better for you

You might assume that all these issues I just mentioned are something you have to endure. It’s the price you pay for needing a range of specialist software.

However, this isn’t true. You deserve a better setup if that’s happening to you.

So, what does “better” look like?

- Fewer vendors to deal with

- All your data synchronising, with one client list and one workflow overview at the heart of everything

- Having to only pay for what you need

Step 3 – Research, understand the technology and plan for implementation

You will face obstacles if you try to find a better solution alone.

First among these obstacles is the long time it takes to research new accountancy software. There are many products available, but which ones are the best?

This isn’t a simple league table; what’s good for one business might not be helpful to another. You need to look at the size of your practice and the type of clients you are helping. If you don’t take the time to read up on different solutions, you will almost certainly end up with something that is a poor fit for your goals.

But research can’t give you an in-depth understanding. Yet more work must be done to know the technology. For example, the cloud is the newest thing, but does it suit your operations?

You also need an implementation plan. How do you transition from one system to another? How can you ensure your new software communicates with other solutions?

Does this sound like a lot? Skip to the section called “How to make all this A LOT easier” – and its infographic – if it does!

These are just some of the areas you need to research

Tax

How do you ensure that your tax and accounts software works for you?

For example, you might see appealing software, but it doesn’t handle partnerships. Or perhaps it doesn’t handle the nuance of your employed clients’ professions.

Maybe supplementary pages for things like capital allowances and cross-border royalties are essential, or your client must disclose a tax avoidance scheme. Does the software have facility for any of these?

The list goes on. Double-check your client base to understand if the tax software you’re considering is up to scratch. Look carefully at the list of features the vendor sets out.

Company formations and accounts

How often do you need to help a business establish itself quickly on Companies House?

Additionally, do you need software to help you with any ongoing secretarial duties?

You also need to consider how much easier life could be if your system communicated directly with Companies House and received responses and certificates from it directly.

AML

There are many things you can ill afford to get wrong, but high up on that list is Anti-Money Laundering.

Ensure the solution you’re looking at is widely used by the industry – ideally undertaking tens of thousands of checks annually.

Note as you research: does the software you are looking at seamlessly link with the rest of your admin for new clients? Does it also cover you for annual ongoing compliance and give you peace of mind that you’re not leaving any clients out?

Practice Management

Whether you’re handling your own tasks or those of a team, keeping everything on track is essential.

Make sure you have a bird’s-eye view of everything and can automate as much as possible to keep processes running smoothly.

Other, extra support

It’s important to consider if outsourcing can help.

Ask yourself whether you have enough internal resources to meet all deadlines or if you and your team will be struggling, leading to additional stress and burnout.

Is your team doing the type of work that’s appropriate for their level? Or do you have a senior accountant doing bookkeeping – all because you don’t have an experienced bookkeeper to do the work?

You can get help with all the volume-heavy, repetitive tasks such as payroll, tax returns, bookkeeping or year end.

What reliable help can you get in this area? Will it be scalable to your needs? Can you sign up for these services and use them as you require? Perhaps critically, how well integrated will this outsourcing be with your new software system?

Additional software and solutions

Of course, when setting up or revamping your accountancy systems, you need more than just accounting software and services. It would be best if you also had things like a professional website, word processing and communication software, and perhaps the help of IT specialists.

How to make all this A LOT easier

What if specialists could help you do all this in a day?

That’s why IRIS created Practice in a Box.

Practice in a Box is a way of getting everything you need all at once. You deal with one vendor, and all your software is built to sync together.

It’s easy. We talk to you about what you need and then help you build a package that suits you. You only pay for what you need and nothing else.

What can you get with Practice in a Box?

The Practice in a Box process helps you get the perfect systems for:

- Compliance

- Practice management

- Admin (including onboarding)

- Anything else (such as outsourcing or getting a new online storefront)