Avoid fines, know the payroll year end legislation

Updated 11th July 2022 | 3 min read Published 30th March 2015

First of all here is a reminder of the key dates for the year ahead in regards to Year End:

- 5th April – Tax year 2014/15 comes to an end

- 6th April – Tax Year 2015/16 begins

- 19th April – Final date for FPS submissions for tax year 2014/15

- 31st May – P60s to be given to employees by this date

- 6th July – P9D and P11D forms to HMRC by this date

- 19th July – Payment of Class 1A NIC on P11D benefit in kind

Please note – Fines and penalties have now been introduced for late or incorrect submissions.

Information about penalties and fines:

You will receive a penalty from HMRC if:

- Your FPS was late

- You didn’t send the expected number of FPS

- You didn’t send an Employer Payment Summary (EPS)

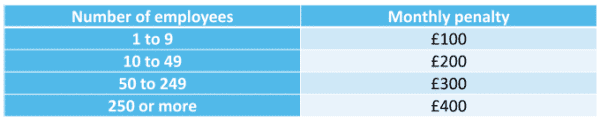

Penalties imposed:

These fines can be imposed if your submission is late or incorrect. So please take time to familiarise yourself with the process.

So, what changes are being made for the 2015/16 tax year?

These are the main changes to Payroll Year End:

National Insurance for under 21s

Employers National Insurance has been abolished for any employee under the age of 21, up to the new Upper Secondary Threshold.

4 new NI rates have been introduced – M K I Z

Limit Tax to 50% of taxable earnings

Income tax has now been limited to 50% of gross taxable earnings for all tax codes

Transferable Tax Allowance

This has been introduced for married couples and civil partners which allows the employee who is not liable to income tax above the basic rate to transfer up to £1,060 of their personal allowance to their spouse/civil partner. These will be denoted by tax codes M and N.

Shared Parental Leave

This is the new statutory entitlement to replace Additional Statutory Paternity Leave and Pay. Shared Parental Leave and Pay will be available to parents where the child is due, or in the case of adoption matched or place, on or after 5th April 2015.

Shared Parental Leave consists of up to 50 weeks of untaken Maternity of Adoption Leave and up to 37 weeks of untaken Statutory Maternity of Adoption Pay shared between both parents/adopters and can be taken in discontinuous blocks.

Statutory Adoption Pay

For placement dates on or after 5th April 2015, Statutory Adoption Pay will be paid at 6 weeks at 90% of the average weekly earnings followed by up to 33 weeks at the standard weekly rate, or 90% of the average weekly earnings, whichever is lower.

So how do I avoid the fines?

Keeping on top of the legislation and maintaining a high level of understanding over Payroll Year End is extremely important to ensuring that you provide your submissions complete and on time.

IRIS have a number of different training sessions that you can attend via webinar to help you fully understand how to run your Payroll Year End concisely and on time.

Find out more about IRIS Payroll Year End Training

IRIS also have a Payroll Year End pack that includes a DVD that helps walk you through the process from the comfort of your own desk.