Avoid paying fines, don’t avoid the Declaration of Compliance

Updated 7th July 2022 | 4 min read Published 2nd April 2015

The workplace pension reform was introduced in 2012 to help people save more for their retirement and it is the job of TPR to ensure that this process is smooth and streamlined.

It is also their job to make sure that businesses actually embrace the new legislation by way of a Declaration of Compliance. Recently at the Bristol Friends of Auto Enrolment meeting, Jeremy Leslie-Smith, Industry Liaison Manager of TPR was quizzed by members in regards to how many penalty notices and fines (£400 fixed) had been issued. Jeremy explained:

“At the end of September 177 statutory notices and 3 fines were issued. By the end of December that had gone up to 1,300 notices/investigations and 169 fines. There has been an increase in the number of statutory notices and fines quarter on quarter. The majority of fines issued are due to late filing of the Registration of Compliance and many different excuses were given for not doing this in time.“

As you can see, Jeremy explained that the majority of fines that were issued were due to the late filing of the Declaration of Compliance. One of the most common reasons for this failing was that people simply didn’t know it needed to be done or that it was filled in correctly.

What is the Declaration of Compliance?

Simply, the Declaration of Compliance is your chance to tell the government that you are doing what you are supposed to be doing! It is an online process where you give details to TPR about your auto enrolment preparation. There is a checklist that you can download to find out more about what needs to be included in the Declaration of Compliance.

When does it need to be completed?

Your Declaration of Compliance needs to be completed at the latest of 5 calendar months after your staging date. So, for example if your staging date is September 1st 2015, you will need to have completed your Declaration of Compliance by no later than January 31st 2016. (Also note that if your deadline falls on a Saturday, Sunday or Bank Holiday, you can submit it by the follow day).

TPR recommend that you start your Declaration of Compliance as early as possible to stay well prepared for auto enrolment and ensure that you are not rushing through the procedure as you are approaching the deadline. To begin with, you can enter the simple details such as your business’ name, address and your contact details. You can then add information as and when it becomes available to you and by doing this, you are engaging in an ongoing process that won’t seem like such a huge task.

Who completes the Declaration of Compliance?

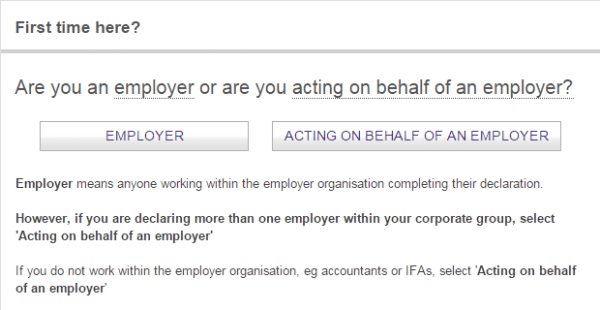

(https://www.autoenrol.tpr.gov.uk/)

As you can see, when you first begin your Declaration of Compliance, you can opt to start the process as an employer, or acting on behalf of an employer. This second option is available for accountants, IFAs and also anyone that has a carer who may not be able to complete the Declaration of Compliance themselves.

One useful aspect that should be noted is that for accountants and IFAs completing the Declaration of Compliance for many different employers can access the service with one set of login details, meaning that they do not have to create new details for each client.

Can I “Set it and forget it”?

Auto enrolment is a long term commitment that businesses make to their employee’s futures by enrolling them into qualifying pension schemes in order to help them to maximise their retirement incomes. This being said, after the initial staging date has been reached and the Declaration of Compliance has been submitted, three years later, a Re-declaration of Compliance needs to be submitted to show to TPR that you are continuing with your responsibilities as an employer and that all eligible employees have been enrolled into a qualifying pension scheme again.

Compliant Communications

One of the most important aspects, although heavily overlooked, is the communications aspect of auto enrolment; of which the Declaration of Compliance falls under.

The free 11-page IRIS guide to “how to avoid auto enrolment fines with compliant communications” gives you a step by step guide to how you can stay compliant when it comes to auto enrolment.

For more guides on auto enrolment, visit our insight page: