What’s new in Staffology Payroll: autumn 2024 update

Updated 30th December 2024 | 3 min read Published 16th October 2024

While it may be getting darker and colder outside, things are heating up in Staffology Payroll.

Our team have been hard at work, upgrading and expanding the system functionality.

In this blog, we've covered some of the recent updates, highlighting the changes and what they mean for you.

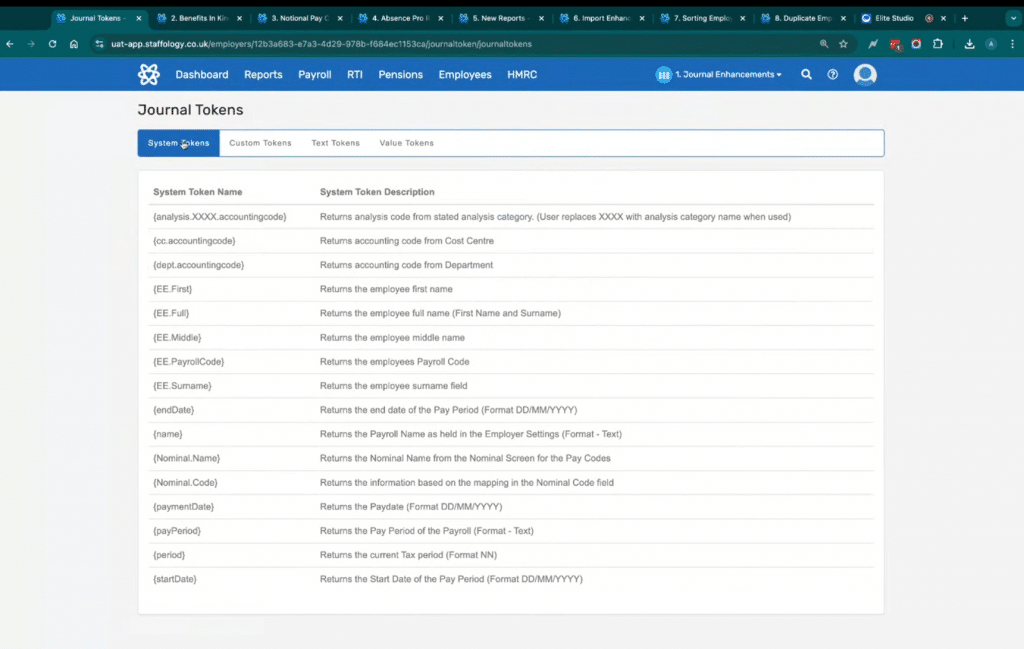

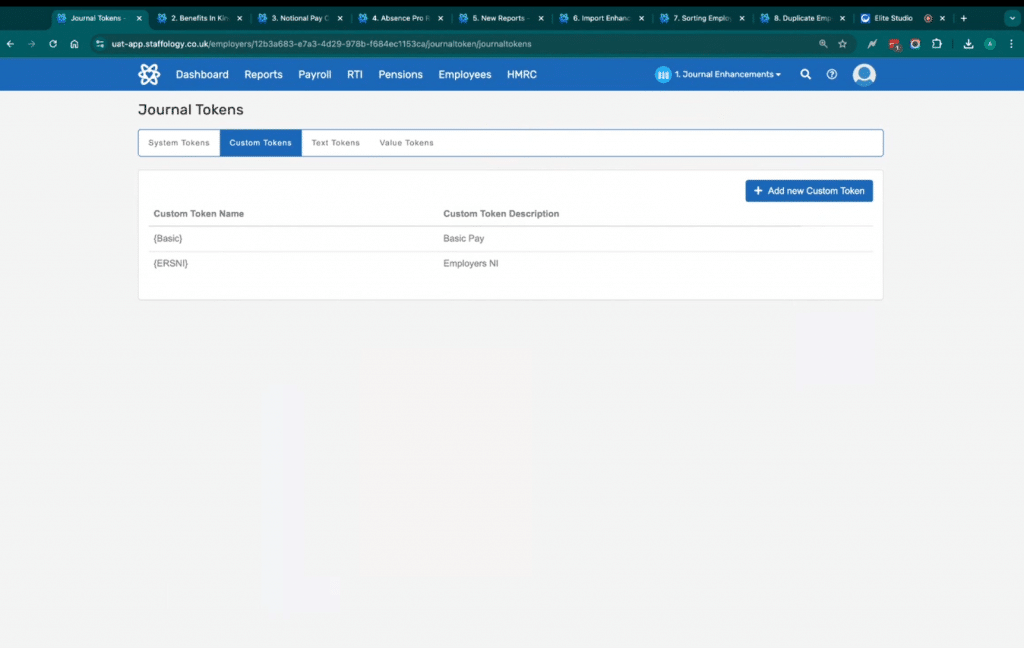

Custom journal tokens and mapping

The team has upgraded the system functionality, allowing you to create custom journal tokens, as well as being able to map a journal output.

Firstly, within Staffology Payroll, you will see the pre-set journal tokens; for example, you will find a code which correlates with returning the employee's payroll code.

Where this gets exciting is that the team have now added the option for you to create your own custom tokens.

These custom tokens enable you to provide overrides to certain departments.

Perhaps basic pay needs splitting based on the department it was worked in - these custom tokens enable you far more flexibility on how journals are mapped out and how costs are split amongst employees.

Staffology Payroll expert, Alex Hay, demos this new feature in our recent software update webinar, which you can watch here.

Additionally, updated functionality now allows you to create custom outputs and nominal mappings in the system.

Help centre: Staffology Payroll journal tokens

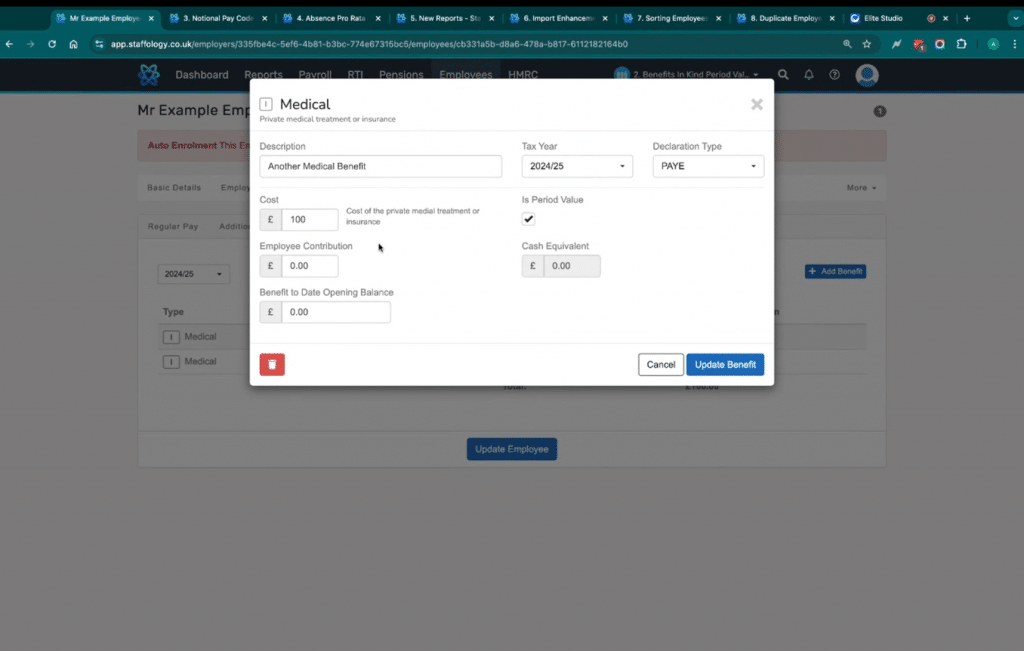

Read hereBenefits-in-kind module

The team has enhanced this module; now, when you add a benefit, you choose a period amount which will be deducted for that benefit.

Historically, when adding benefits to Staffology Payroll, you would have to add the annual cost, and the system would then divide it over the remaining periods in the tax year.

However, with the new period value option, you can simply add the actual value needed to be deducted each pay run.

Regardless of the frequency you're running, the system will treat the period's benefit value as that amount.

At the end of the year, when submitting your benefits submission, the system will take the updated value which is topped up as the year goes on.

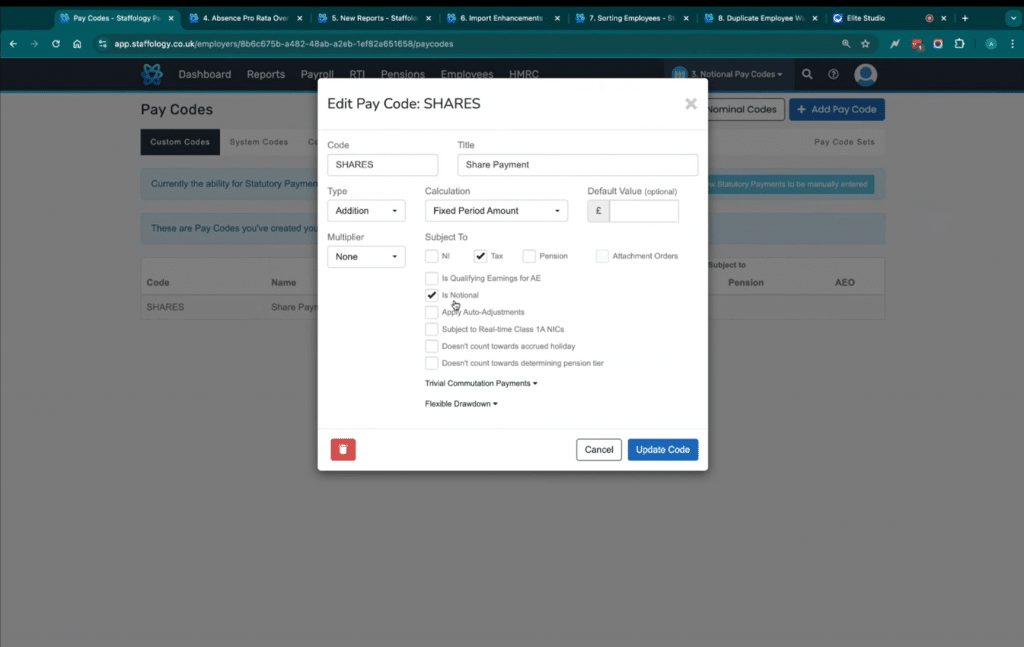

Notional pay codes

The team have built out Notional pay codes, within the system.

Now when creating a new pay code, you have the option to select whether it is Notional and if it is subject to National Insurance (NI) or tax.

What this effectively means is that the payment isn't actually going to be paid to the employee but it is going to increase their taxable pay, based on the selection criteria you selected.

For example, this might be used with share payments, which are subject to tax but not paid directly to staff.

Help centre: Staffology Payroll guide to notional payments

Read hereWatch the full Staffology Payroll update

We hosted a live session with our payroll product experts, covering the above in greater detail as well as showcasing upcoming changes, demos, Q&A and more!

Interested? Watch the full Staffology Payroll update session here.