Accountancy tax software

Take care of compliance without a second thought

For a busy accounting practice, maintaining compliance with HMRC legislation and tax law can feel like a full-time job in of itself.

IRIS Personal Tax is accounting software designed to keep your business compliant across the board.

As easy to use as it is useful, the software helps you accurately calculate client tax returns, while ensuring you have Making Tax Digital (MTD) covered.

UK personal tax software

How can IRIS Personal Tax help you?

-

Manage tax returns

Create, manage and submit all required UK tax documentation for individual clients, including supplementary pages of the self-assessment tax return.

-

Sync up systems to save time

Connect with other IRIS Accountancy Suite products like Business Tax and Trust Tax, or use CSV imports to transfer data from all major third-party data sources.

-

Import data from HMRC

Import data directly from HMRC, including employment info, income, benefits, tax, marriage allowance, and National Insurance.

-

Making Tax Digital (MTD)

Prepare to become MTD-ready from April 2025 onwards with IRIS Personal Tax and join HMRC’s MTD pilot a year ahead of mandatory rollout.

-

Improve client communication

When integrated with IRIS OpenSpace, you can communicate with your clients quickly and easily and take advantage of a convenient Tax Return approval process.

-

Free bookkeeping tool

Access IRIS Elements Cashbook for free and support your sole trader clients with an intuitive, step-by-step bookkeeping tool and unlimited bank feeds.

Personal tax accounting software

Free up time to build your business

IRIS Personal Tax helps you cut down your day-to-day to-do list, so you can spend your time growing your business or advising clients.

- Navigate legislative complexities like a client’s FTCR liability with automated and HMRC-compliant calculations.

- Skip manual data entry by syncing with other IRIS solutions and automatically sharing data system-wide.

- Bring clients online and manage their Making Tax Digital (MTD) journey from April 2025

Tax-planning simulator software

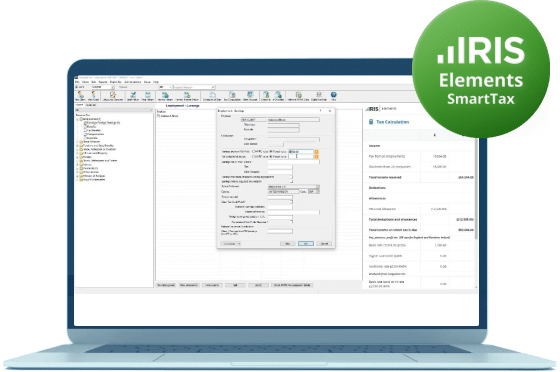

Improve tax planning with real-time tax simulator

Take advantage of our real-time tax-planning simulator, IRIS Elements SmartTax – included in your IRIS Personal Tax package at no extra cost.

- Generate real-time updates to your clients’ tax calculations to improve future planning

- Add value to your clients with simple ‘what if’ scenarios, helping you spot superior tax strategies

- Automatic updates from HMRC means SmartTax always reflects the latest legislation and tax laws.

Frequently Asked Questions (FAQs)

-

While IRIS Personal Tax is an integrated part of the IRIS Accountancy Suite, you can use the Personal Tax module as a standalone solution. You do not need to purchase and use the full suite to use the Personal Tax module.

IRIS Accountancy Suite is a comprehensive yet flexible accountancy solution, allowing you to pick and choose from a wide range of accountancy modules to meet your unique needs.

If you’d like to learn more about IRIS Accountancy Suite, get in touch via this contact form and one of our expert advisors will be in touch shortly.

-

IRIS Personal Tax is part of the IRIS Accountancy Suite; a complete solution made with accountants in mind.

As such, IRIS Personal Tax works seamlessly with IRIS Accountancy Suite modules like:

- IRIS Accounts Production

- IRIS Business Tax

- IRIS Practice Management

- IRIS OpenSpace

- IRIS Trust Tax

- IRIS P11D

- IRIS Time and Fees

- IRIS Company Secretarial.

To learn more, view the complete list of IRIS Accountancy Suite modules.

-

As an integrated part of IRIS Accountancy Suite, IRIS Business Tax is available as either a self-hosted desktop solution or you can begin your transition to the cloud by hosting it with IRIS Anywhere.

This gives you the flexibility to choose which type of access option best suits the needs of your practice.

-

Current customers and users can visit the IRIS Personal Tax Help Centre for a wealth of information on how to use the software, including comprehensive FAQs.

Simply email support@iris.co.uk to submit an enquiry or call 0344 815 5555 to be connected to our software support team.

-

To purchase IRIS Personal Tax, please fill in the contact form on this page to arrange to book a demo of the product.

Once you’ve submitted your details, our helpful team of product experts will be able to advise you on how to set up the demo – or, if you’d prefer to skip the demo, how to purchase the software.

-

With IRIS Personal Tax, you don’t necessarily need to use other IRIS accountancy solutions to seamlessly import data.

The software includes functionality to import data via CSV files, which means you should be able to import data into IRIS Personal Tax from the major third-party accountancy solutions.

You can also use CSV files to import data on sole traders and UK land and property, to assist with MTD filing.

-

IRIS Personal Tax allows you to generate and calculate all required UK tax documentation for individual clients. This includes all supplementary pages of the self-assessment tax return except those intended for Members of Parliament.

Using this software, you can submit documents reflecting the full financial position of any individual – regardless of the complexity or how niche the client situation is – directly to HMRC.

-

One of the key functions of IRIS Personal Tax is carrying out complex legislative calculations automatically, including those calculations relating to client liability.

The software can automatically calculate a client’s liability in areas such as Foreign Tax Credit Relief (FTCR), top slicing relief, basis period reform, and Capital Gains Tax (CGT). All the user needs to do is populate a simple form within the software to generate the calculation.

Related products

-

Free 30 Days Manage tax returns efficiently

Simplify how you manage corporate, partnership, and personal tax with scalable cloud software.

-

Specialist business tax software

File accurate and compliant tax returns for limited companies, partnerships and sole traders.

-

Prepare client accounts in record time

Generate client accounts in minutes and ensure compliance with UK GAAP and IFRS reporting requirements.

-

Secure document sharing and electronic approval

Upload and share accountancy documents with clients for fast and convenient electronic approval.

Fast, fully compliant personal tax returns

See how this personal tax software works firsthand – book a free product demo today.