IRIS Elements Cashbook

Simple bookkeeping software

for sole traders

Support your self-employed clients with easy-to-use Making Tax Digital (MTD) bookkeeping software.

Already using IRIS compliance software? IRIS Elements Cashbook is available for FREE with selected products.

Who gets IRIS Elements Cashbook for free?

Offer your sole trader clients an easy-to-use bookkeeping tool that includes our market-leading invoice payment solution, IRIS Pay.

IRIS Elements Cashbook is available for FREE if you subscribe to select IRIS compliance products, including:

- IRIS Elements Tax and Accounts

For the full list of eligible products, check out the FAQ section.

What can IRIS Elements Cashbook do for my clients?

Get the tools you need to help your clients digitalise their bookkeeping to ensure compliance with MTD for Income Tax Self Assessment (ITSA).

Clients can use simple customer and supplier management, issuing up to 300 invoices each year. With unlimited bank feeds, your clients will always know their current financial status.

The software also includes access to IRIS Pay, allowing clients to request and receive payments on-the-go, from their mobile device.

What’s Included

-

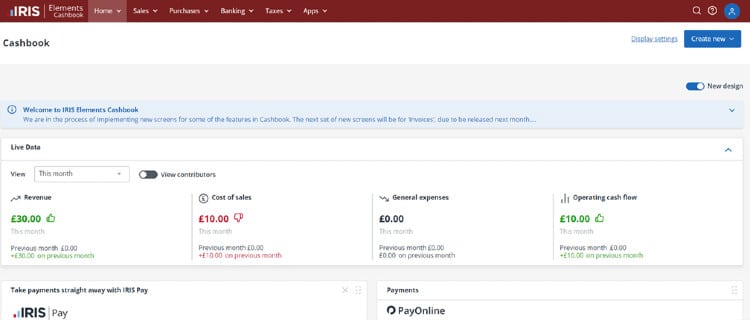

See a live data summary on the dashboard

The IRIS Cashbook dashboard shows your sole trader clients live information about their business so they can stay on top of their finances. In IRIS KashFlow Connect, you can control the widgets that are displayed and publish announcements to their dashboard – instant bulk communication with all of your clients!

-

Maximise cashflow with smart invoices

Your clients can send online invoices to their customers in seconds and accept payments instantly with IRIS Pay.

-

Save time with secure bank feeds

Your clients can set up automatic bank feeds to allow their bank transactions to automatically synchronise with IRIS Elements Cashbook making sure they don’t miss a thing.

-

Everything you need for self-assessment returns

Access the figures required to complete Income Tax Self-Assessment tax returns pages SA100 and SA103.

-

Seamless integration with IRIS Elements

You can export a trial balance from IRIS Elements Cashbook and import into any IRIS Elements Tax or Accounts Production product.

-

Manage your IRIS Element Cashbook clients in one place

With your IRIS KashFlow Connect account you can give your clients access to IRIS Elements Cashbook and manage them all in one place. You can also apply your practice branding and choose which features you’d like your clients to see.

Why choose IRIS Elements Cashbook?

-

Simple

An easy, step-by-step tool to help sole traders start the digital journey without needing another subscription.

-

Free of charge

This sole trader-friendly bookkeeping tool is available for free with selected IRIS accountancy and compliance solutions.

-

Time-saving

There is no better way to get ready for MTD ITSA, with integrations making it quicker to get paid and digitalise your future.

Accountancy solutions trusted by businesses like yours

Sign up to use IRIS Elements Cashbook

FAQs

-

If you already subscribe to any of the following IRIS compliance products, you get FREE access to IRIS Elements Cashbook:

- IRIS Personal Tax

- IRIS Business Tax

- IRIS Accounts Production

- IRIS Elements Tax

- IRIS Elements Tax and Accounts

- IRIS Elements Accounts Production

- IRIS Options

- IRIS Starter Pack or Starter Pack Lite. -

To start getting your sole trader clients signed up and using IRIS Elements Cashbook, you’ll first need to create a free IRIS KashFlow Connect account.

To create a free KashFlow Connect account, complete the sign-up form on the IRIS KashFlow website. You can also visit the IRIS KashFlow help centre for additional guidance.

After you’ve done this, sign up to access IRIS Elements Cashbook by completing the contact form on this page. Our team will be in touch to help you get set up, and in the meantime, you can explore the Elements Cashbook Help Centre for more insight. -

Once you’ve signed up to access IRIS Elements Cashbook, you can start creating accounts for your clients and get them using this accessible bookkeeping tool.

Visit the IRIS Cashbook Help Centre to learn how to create new accounts for your clients and get them set up on their new bookkeeping software. -

If you’re a small business, sole trader or self-employed individual looking for a bookkeeping tool, you can currently only use IRIS Elements Cashbook if your accountant or bookkeeper provides you with access.

Please contact your accountant or bookkeeper to explore whether they’re eligible to receive IRIS Elements Cashbook and can provide you with access.