Plans and pricing

IRIS Elements Tax

HMRC-recognised, MTD-ready tax software for accountants.

NEW for Enterprise: Multiple Trades, Jointly Held Income, and more new features.

Partner with IRIS Elements and get a free bookkeeping tool* to help your sole trader clients go digital.

From £10 per month

Tax Essentials

Save 0%

£0.00

£0.00/ year *

0 clients

12 month contract + £108 User/year

Try for freeFree 30-day trial, no credit card required.

The Tax Essentials plan includes:

- 1 user

- Tax Returns for Individuals, Partnerships & Companies

- Tax computations and calculations

- Submissions direct to HMRC

- Retrieval of personal data from HMRC

- MTD Compliant

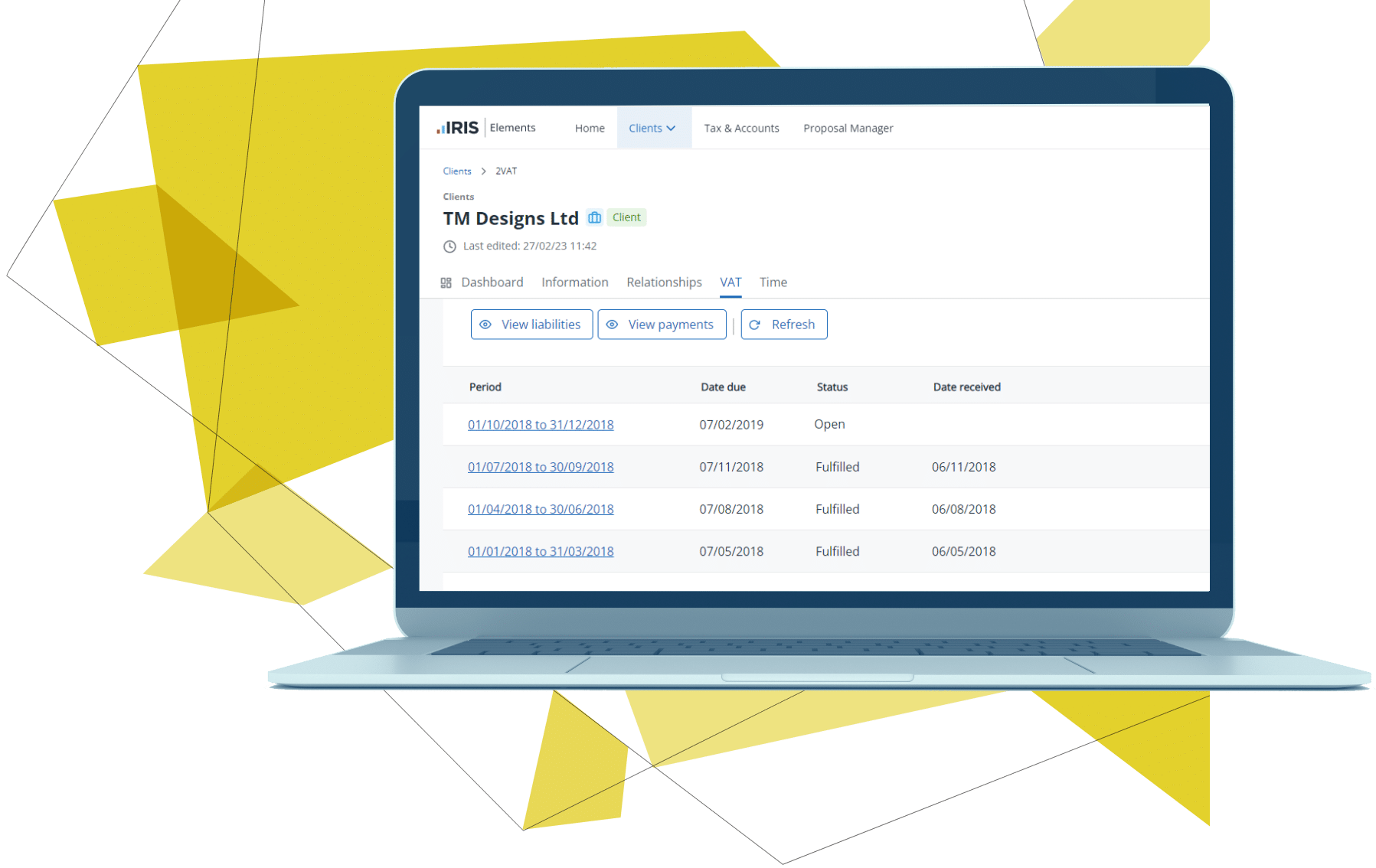

- VAT Filer

- IRIS Elements Cashbook

Tax Professional

Save 0%

£0.00

£0.00/ year *

0 clients

12 month contract + £162 User/year

Book a demoThe Tax Professional plan includes:

- Everything in the Tax Essentials plan

- Supported returns: SA102M, SA102MP, SA102MS, SA102MLA, SA102MSP

- Supplementary pages: CT600B, CT600D, CT600E, CT600H, CT600J

- Capital allowances for Full Expensing and Super-deduction

- Feed with updates on FTSE100 & FTSE250 dividends

- Foreign Tax Credit Relief

- Farmers’ averaging over 2 years

- Part disposals of capital assets

- Business asset disposal relief

Tax Enterprise

Let’s talk

Book a demoThe Tax Enterprise plan includes:

- Everything in the Tax Professional plan

- Jointly Held Income

- Multiple trades for Ltd companies

- E-Checklists in personal tax

- Bulk online filing

- Storage of multiple HMRC credentials

- Completion of CT600N

- Asset Register

- 2- or 5-years farmers averaging

- Dividend feed for all listed companies

- Customisable accounts production integration

- Client Account

- Quarterly Instalment calculation for LTDs

- Enhanced partnership profit calculation

- Tax credits hub

- Enhanced Corporation tax losses; Groups & Consortiums; Loans to participators

* Get IRIS Elements Cashbook for free when you subscribe to one or more of the following IRIS Elements products: IRIS Elements Tax, IRIS Elements Tax and Accounts, or IRIS Elements Accounts Production.

** Please note that the minimum subscription cost covers up to 5 clients/users for Tax Essentials and 10 clients/users for Tax Professional. If you have fewer clients than this (whichever plan you subscribe to), you will still pay the minimum subscription cost.

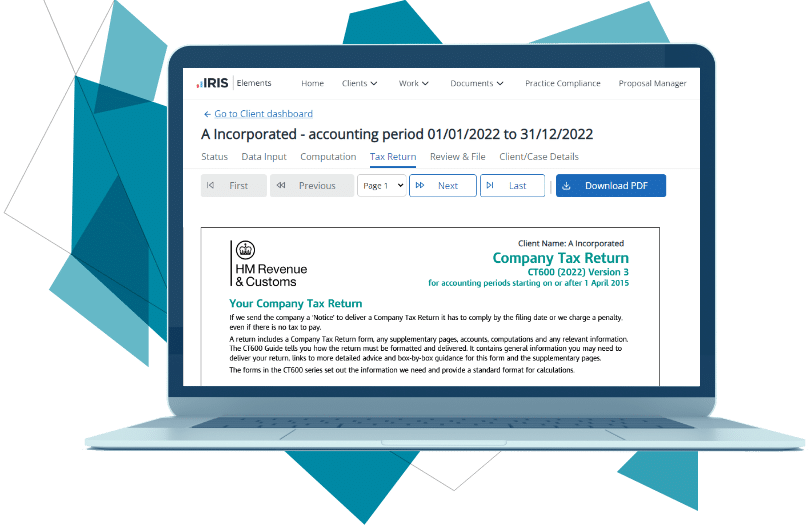

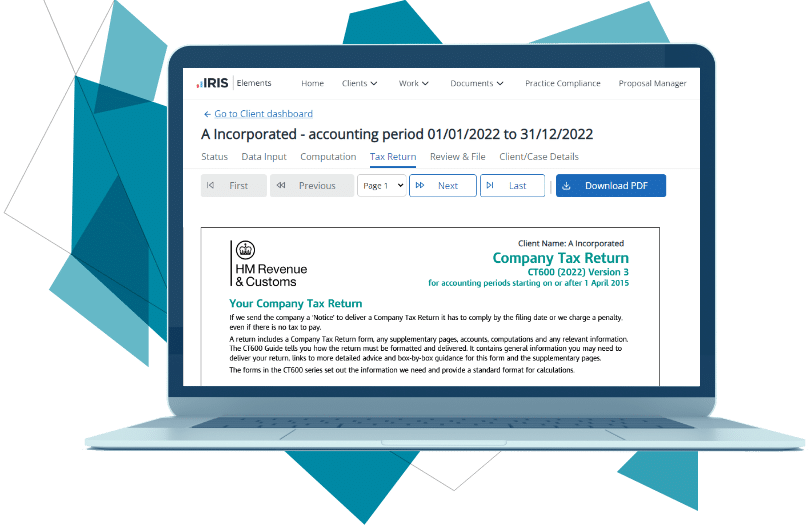

IRIS Elements Tax accountancy software

Your MTD-ready cloud accountancy solution for tax

HMRC-recognised and MTD for ITSA-ready, IRIS Elements Tax simplifies tax compliance for your firm.

From automating admin to speeding up workflows with integration, IRIS Elements Tax is designed by tax experts, for tax experts.

Ensure complete compliance for your firm and clients. Sign up for our MTD ITSA pilot today to get ahead of legislation and work out what’s best for your firm.

Don’t just take our word for it…

Take a quick tour

IRIS Elements

Welcome to IRIS Elements Tax Essentials

Ready to experience just how easy filing can be?

Start the tourNot sure which plan is right for you?

Answer all of the questions below to discover your recommended Elements Tax accounting software plan.

Your recommended IRIS Elements plan:

Tax Essentials

For small practices with simpler client needs, our Essentials plan is the perfect fit. Includes tax returns for Individuals, Partnerships and Companies.

Includes:

- Tax Returns for Individuals, Partnerships & Companies

- Tax computations and calculations

- Submissions direct to HMRC

- Retrieval of personal data from HMRC

- MTD Compliant

- VAT Filer

- IRIS Elements Cashbook

Packages:

- IRIS Elements Tax Essentials

Recommended for:

- Small businesses

- Medium businesses

Pricing

Free 30-day trial, no credit card required

£ 10 .00 / month *

12 month contract + £108 User/year

£120.00

£ 99 .00 / year *

Save 18%

12 month contract + £108 User/year

Your recommended IRIS Elements plan:

Tax Professional

For medium and large practices with complex client needs, our Professional plan is the perfect fit. Includes tax returns for Individuals, Partnerships and Companies.

Includes:

- Everything in the Tax Essentials plan

- Supported returns: SA102M, SA102MP, SA102MS, SA102MLA, SA102MSP

- Supplementary pages: CT600B, CT600D, CT600E, CT600H, CT600J

- Capital allowances for Full Expensing and Super-deduction

- Feed with updates on FTSE100 & FTSE250 dividends

- Foreign Tax Credit Relief

- Farmers’ averaging over 2 years

- Part disposals of capital assets

- Business asset disposal relief

Packages:

- IRIS Elements Tax Professional

Recommended for:

- Large businesses

- Medium businesses

Pricing

£ 60 .00 / month *

12 month contract + £162 User/month

£720.00

£ 618 .00 / year *

Save 14%

12 month contract + £162 User/month

Your recommended IRIS Elements plan:

Tax Enterprise

For large practices with complex client needs, our Enterprise plan is the perfect fit. Includes tax returns for Individuals, Partnerships and Companies.

Includes:

- Everything in the Tax Professional plan

- Completion of CT600N

- Asset Register

- 2- or 5-years farmers averaging

- Dividend feed for all listed companies

- Customisable accounts production integration

- Client Account

- Quarterly Instalment calculation for LTDs

- Enhanced partnership profit calculation

- Tax credits hub

- Enhanced Corporation tax losses; Groups & Consortiums; Loans to participators

Packages:

- IRIS Elements Tax Enterprise

Recommended for:

- Large businesses

- Businesses with over 250 clients

Let’s talk

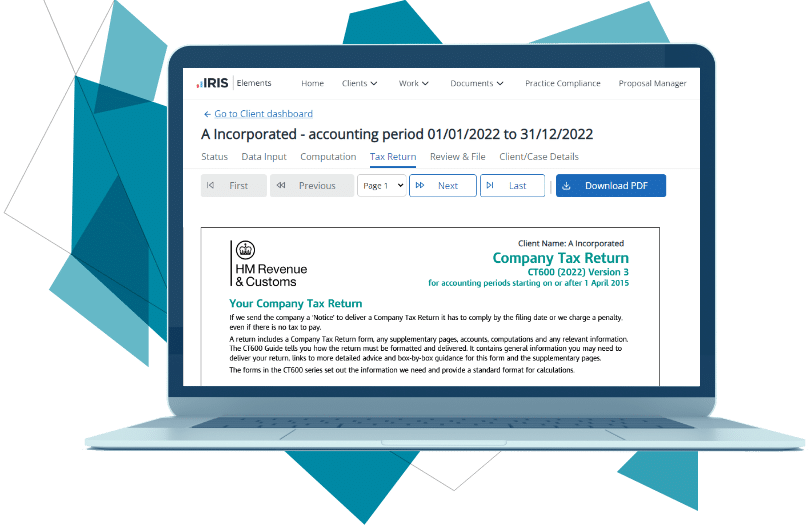

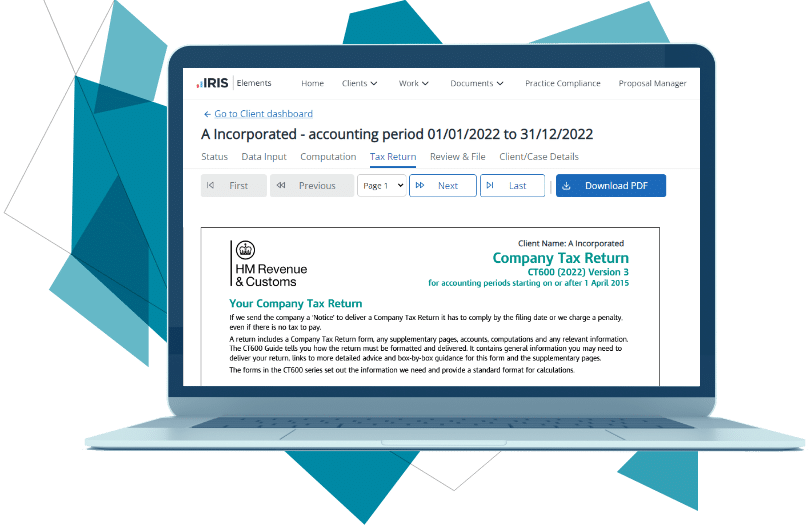

Introducing IRIS Elements Tax Professional

File tax returns faster than ever – and with a 98% submission acceptance rate with HMRC

Case studies

Case Study

Flexible software for the modern accountant

IRIS Elements has been on a real journey to become the product it is today, with one specific challenge to overcome: helping users get to the cloud.

Case Study

Power Accountants reveals secret element that puts them ahead of the curve

With a team of three, and the ability to access IRIS Elements from anywhere, the team at Power Accountants can work from within the office, from home, or remotely with clients.

Case Study

How Louisa Burton found accountancy bliss with IRIS Elements

Now using IRIS Elements for almost a year, Louisa has already begun adding additional modules, such as AML, and with plans to add Elements Proposal Manager later in the year.

Start using IRIS Elements Tax Essentials for free

Trial our Essentials plan for 30 days free of charge

Start free trialFrequently asked questions

-

In your trial you can add new users, import client data, and trial the tax functionality. After 30 days, your free trial will expire, and you will not be charged going forward. To start using the tax accounting software beyond the free trial, upgrade to a paid plan at any time.

You can trial multiple IRIS Elements products at the same time, including Elements Tax. You can choose to trial them simultaneously or one at a time, but you can only trial each product once.

-

Anyone can sign up for the 30-day free trial of the IRIS Elements Tax Essentials product.

However, because the free trial is only for Tax Essentials, it’s suitable only for those with simple client requirements. It is our starter Elements Tax product, perfect for sole practitioners and micro practices.

For more significant tax and compliance needs, you’ll need IRIS Elements Tax Professional or Enterprise.

-

Yes, you can trial multiple IRIS Elements products at the same time. You can choose to trial them simultaneously or one at a time, but you can only trial each product once.

-

If you are only looking for up to 100 clients for either Tax Essentials and Tax Professional, you can create an account through our trial form and buy online.

-

Simply open the admin settings (top right corner), select Plan and Billing and follow the steps.

-

Yes, you will be able to pull any necessary accounts data through to IRIS Elements Tax. Thanks to an integration between this product and IRIS Elements Accounts Production, your accounts data will transfer seamlessly, saving you time and reducing the chance of any inaccuracies cropping up.

In terms of data for the tax year prior, all tax data is remembered and rolled forward each year, ready for the completion of the following year’s tax return. This means you will not need to re-key the same source data year after year.

-

Yes – you can access the FTSE350 dividend feed as part of the IRIS Elements Tax Professional plan at no extra cost.

This function automatically populates dividend values for your client’s Tax Returns based on their shareholdings, meaning you don’t need to manually search for this information outside of your accountancy software.

-

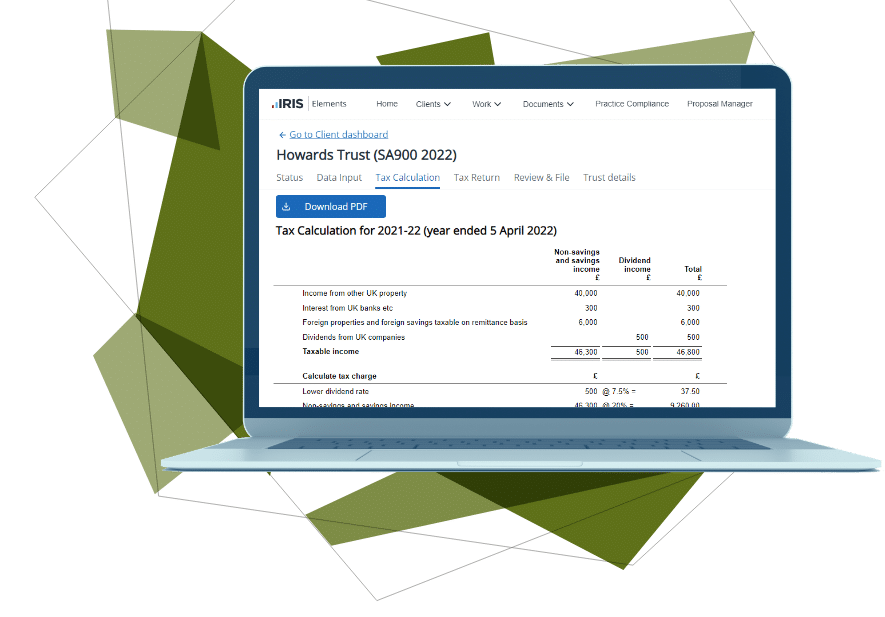

Yes, our IRIS Elements Trust Tax product allows you to use IRIS Elements Tax to generate, submit and manage Trust Tax Returns.

-

IRIS Elements Tax and Accounts has been replaced by IRIS Elements Tax (Essentials and Professional plans) and IRIS Elements Accounts Production (Essentials and Professionals plans).

Existing customers of IRIS Elements Tax & Accounts will continue to be supported and can move to the IRIS Elements Tax Professional product should you need further functionality.

All tax data will automatically flow through to the different Tax editions.

Get started with our award-winning accountancy software today

- Easy to setup

- Free trial, cancel anytime

- Cloud-based security

Book a demo

VAT Filer

A simple bridging solution that helps you comply with the requirements of Making Tax Digital. Easily transfer data from spreadsheets or bookkeeping solutions via digital links before submitting on to HMRC.

- Making Tax Digital compliant

- Import values from spreadsheets and bookkeeping solutions

- Retrieve data directly from HMRC

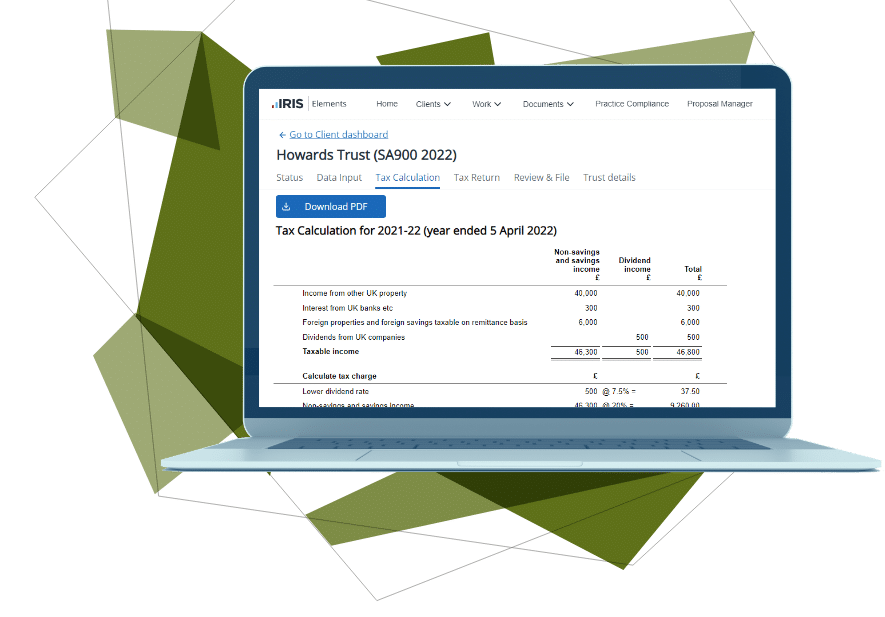

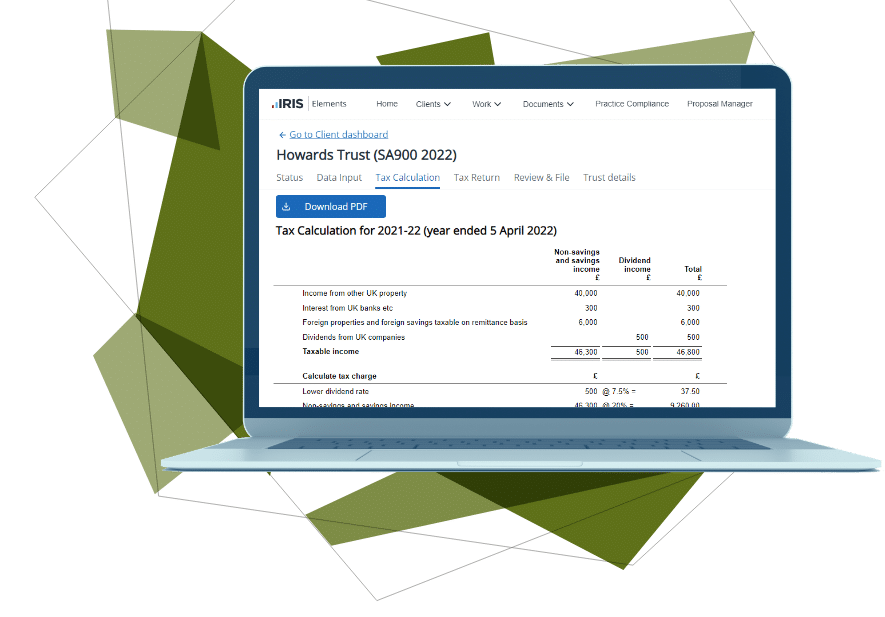

IRIS Elements Trust Tax

Simple and intuitive Tax Return completion software for a variety of trust types, including charitable and non-resident trusts. Fully integrated within IRIS Elements to avoid workload duplication, reduce errors and free up time. Gain peace of mind with automated calculations and warnings to prevent errors. All variations of the R185 forms containing details of trust payments can be generated and distributed to beneficiaries.

- Complete Trust and Estate Returns together with all supplementary pages

- All variations of R185 can be generated for distribution to beneficiaries

- Online filing to HMRC (including previous years)

IRIS Elements Trust Tax

Simple and intuitive Tax Return completion software for a variety of trust types, including charitable and non-resident trusts. Fully integrated within IRIS Elements to avoid workload duplication, reduce errors and free up time. Gain peace of mind with automated calculations and warnings to prevent errors. All variations of the R185 forms containing details of trust payments can be generated and distributed to beneficiaries.

- Complete Trust and Estate Returns together with all supplementary pages

- All variations of R185 can be generated for distribution to beneficiaries

- Online filing to HMRC (including previous years)

IRIS Elements Trust Tax

Simple and intuitive Tax Return completion software for a variety of trust types, including charitable and non-resident trusts. Fully integrated within IRIS Elements to avoid workload duplication, reduce errors and free up time. Gain peace of mind with automated calculations and warnings to prevent errors. All variations of the R185 forms containing details of trust payments can be generated and distributed to beneficiaries.

- Complete Trust and Estate Returns together with all supplementary pages

- All variations of R185 can be generated for distribution to beneficiaries

- Online filing to HMRC (including previous years)

IRIS Elements Service Plan Essentials Plus

£250 annual fee

IRIS Elements Service Plan Essentials Plus gives you access to friendly and knowledgeable analysts, who will help and guide you with any IRIS Elements queries over the phone.

- Telephone IRIS Elements support to talk through your questions, or find answers to the most common questions on our Community Portal

- Speak to our experts, Monday-Friday 9am-5pm

IRIS Elements Professional Services

A focused training webinar for all our Elements products, which is delivered by subject matter experts who have many years of experience.

- Bespoke training to fit your practice – tailored to your requirements

- Cover process, functionality and provide guidance on how to get the most out of our products

- Experienced professionals supporting accountancy practices

IRIS Elements Professional Services

A focused training webinar for all our Elements products, which is delivered by subject matter experts who have many years of experience.

- Bespoke training to fit your practice – tailored to your requirements

- Cover process, functionality and provide guidance on how to get the most out of our products

- Experienced professionals supporting accountancy practices

IRIS Elements Professional Services

A focused training webinar for all our Elements products, which is delivered by subject matter experts who have many years of experience.

- Bespoke training to fit your practice – tailored to your requirements

- Cover process, functionality and provide guidance on how to get the most out of our products

- Experienced professionals supporting accountancy practices