Lease accounting software that simplifies compliance

Take control of your lease accounting and meet compliance demands with confidence.

With IRIS Lease Accounting, you can rely on sophisticated automation to ensure compliance with the latest lease accounting standards, including IFRS 16, FRS 102, and ASC 842.

Plus, improve your leasing processes, get a clearer overview of leasing operations, and enjoy better outcomes for your business.

-

Control

Oversee, manage, and control every step of the lease lifecycle

-

Comply

Ensure compliance with the latest lease accounting standards

-

Centralise

View your entire lease portfolio in real-time, from one platform

Lease management compliance

Lease accounting compliance sorted

Keep up to speed with the latest lease accounting standards and ensure complete compliance with all new and existing leasing legislation, including:

- IFRS 16

- ASC 842

- FRS 102

Lease accounting software

Smart software that’s easy to use

Alongside intelligent automation, real-time calculations, and powerful reporting, this lease accounting software provides you with:

- specialist implementation support for a stress-free upgrade experience

- a software interface that’s easy to navigate and use, so you can get started right away

- a user experience backed by accountancy expertise

Improve your lease management approach

IRIS Lease Accounting helps you and your team control every step of the compliance process thanks to the following tools and features.

-

A leasing sub-ledger

The software functions as a leasing sub-ledger, recording all transactions and generating accounting outputs so you can upload them into your ERP with ease.

-

Automatic modifications

When changes to lease agreements occur, the system calculates and adjusts right-of-use assets and lease liability, so your general ledger is always accurate.

-

Liability schedules

The system automatically updates ROU asset and liability schedules, ensuring accurate depreciation and improved financial oversight.

-

Multi-calendar support

Benefit from calendars tailored to your business’s accounting needs—whether standard, retail, manufacturing, or custom—for seamless alignment.

-

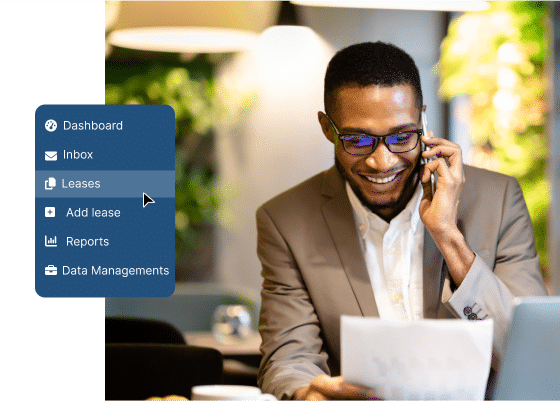

Accurate audit reporting

Get comprehensive, ready-to-use reports for IFRS 16, ASC 842, or FRS 102 disclosures and forecasting for simpler financial reporting and auditing.

-

End-of-lease notifications

Stay on top of expiring leases with timely alerts, preventing unnecessary payments and inconvenient renewals through proactive management.

Free guide

Lease Accounting: A Simple Guide to FRS 102

In this free PDF guide, we delve into the changes being made to UK GAAP FRS 102 and what strategic steps you can take to embrace the new standard.

Frequently asked questions (FAQs)

Learn more about IRIS Lease Accounting software and how to optimise your lease contract management.

-

Yes, IRIS Lease Accounting is an ideal piece of lease accounting software if you’re concerned about FRS 102 compliance.

The software’s powerful calculation engine ensures your lease accounts are always fully compliant with FRS 102.

The software is always up to date with any new or emerging lease accounting legislation, and will automatically make and apply the correct calculations to all accounts across your lease portfolio.

-

IRIS Lease Accounting has been designed to help you stay compliant with multiple lease accounting standards including IFRS 16, ASC 842 and the recently revised FRS 102 standards.

Whatever kind of lease accounting standards you need to report under, you can rest assured that you’re completed covered with IRIS Lease Accounting.

-

IRIS Lease Accounting provides you with a range of flexible calendars that can support and align with your company-specific accounting frequencies.

Some of the out-of-the-box calendars you can access include:

- standard calendars (5-5-4)

- retail calendars (4-4-5)

- and manufacturing calendars (13-week 4-4-4).

The software also allows you to create any bespoke accounting calendar you may need for your business.

-

The best lease accounting software is designed to make your life easier, as is the case with IRIS Lease Accounting software. You’ll find a full suite of out-of-the-box accounting and standard reports when you power up this software, including reports for IFRS 16, ASC 842 or FRS 102.

Some of the reports you can find already set up in the software include:

- Disclosure reports

- portfolio run-off reports for forecasting

- reports to support detailed auditing.

-

Yes, the software allows you to meet both lessee and lessor accounting requirements for IFRS, FRS 102, and FASB standards, across all asset categories.

-

Yes, IRIS Lease Accounting can help you create and maintain an accurate amortisation schedule.

When a new lease begins, the system creates a right of use (ROU) asset and amortisation schedule for that lease. This displays how the lease asset is depreciated and how liability is going to be amortised over time.

Whenever something changes regarding the lease or a modification is made, the software automatically generates a new ROU asset and liability amortisation schedule.

This means your lease accounts are always accurate and up to date.

-

Yes, IRIS Lease Accounting can be seamlessly integrated with a range of popular ERP systems – including SAP, Oracle, and Microsoft Dynamics – thanks to its robust API functionality.

This level of integration ensures:

- smooth and uninterrupted data flow

- efficiency and accuracy of financial reporting

- compliance with lease accounting standards

- and improved overall operational processes.

Additionally, IRIS Lease Accounting allows for customisation to meet the specific needs of various enterprise environments, providing greater flexibility and scalability.

-

Yes, our software is available in cloud-based SaaS format.

This delivery model provides the benefits of scalability, accessibility, and automatic updates, ensuring you always have access to the latest features and security improvements.

Additionally, cloud-based solutions reduce the need for in-house IT infrastructure and maintenance, allowing you to focus on your core operations.

-

To reassure users and their auditors of the quality of our financial reporting controls, the IRIS Lease Accounting solution undergoes an annual audit. This audit, conducted by a reputable third party, follows ISAE 3402 (SOC Type II) standards and aims to fulfil the following objectives:

- Checking Control Design: We ensure our controls meet specific goals to support smooth operations.

- Assessing Effectiveness: The audit checks that our controls work well over time, giving clients peace of mind.

- Helping Audits: Our reports explain how our controls affect user financial statements, making audits easier.

- Building Trust: We aim for transparency to build trust with stakeholders and show our commitment to strong controls.

- Ensuring Compliance: This process helps us meet regulatory and contractual obligations.

- Detailed Reporting: The report provides clear insights into control performance, reassuring clients and stakeholders.

This audit process helps users and auditors make informed decisions and supports their financial reporting needs in line with lease accounting standards.

Learn more about lease accounting management

Blog

FRS 102: What might change for revenue and leasing

Blog

IFRS 16 Leases: what the standard means for businesses

Blog