IRIS Trust Tax

IRIS Trust Tax software helps accountancy practices to tackle the often complicated area of trust tax that usually only specialist staff members can handle. Through a simple approach to data entry, no pre-existing trust return knowledge is required; any staff member can process trust client data.

With IRIS Trust Tax, simple menu-driven data entry means that no pre-existing trust return knowledge is required, allowing all of your staff to process trust client data. This frees up valuable time to focus on higher fee-earning added value planning tasks, helping you to meet client expectations for this low-value compliance work to be accurate and done on time.

Book a free demo, read on to find out more about IRIS Trust Tax, or take a look at our full range of tax software.

What IRIS Trust Tax can do for you:

For many accountancy practices, trust tax is considered a complex area of tax that only specialist staff members can be involved with. It can be problematic if pre-existing trust return knowledge is required for your staff to process trust client data. This work can take up large amounts of valuable time which you could be spending on focusing on higher fee-earning added value planning work.

- Tackles specialist area of trust tax that usually only specialist staff members can handle.

- Frees up valuable time to focus on higher fee earning added value planning work.

- Comprehensive online filing – including amended and earlier year returns.

- Rest assured when filing tax returns to HMRC; a 98% acceptance rate cuts the need for corrections.

- Easily computes double taxation relief and retains portfolio data for assets and securities.

IRIS Trust Tax provides instant solutions for:

-

Handling all trust types including personal representatives, interest in possession and accumulation/discretionary trusts.

-

Gaining quick and easy approval, cutting costs and time, thanks to integration with IRIS OpenSpace.

-

Being able to work remotely thanks to import/export facilities.

-

Getting tax return validation completed prior to submission to HMRC so that you are warned of any entry that might cause a rejection.

Key Features

Efficiency

IRIS Trust Tax automatically carries out all tax calculations using the data already entered, including foreign tax credit relief, capital gains tax and tax pools, so there is no need for separate tools or manual calculations. Net distributable income is calculated and displayed on screen, so it’s easy to see what income is available for distribution when completing form R185 and then transferring to Personal Tax for completion of the beneficiaries’ personal tax returns.

Payment tools

Automatically updated accounts enable you to keep track of each client’s tax due and payments made, allowing calculation of any interest due on late payments so you can advise clients about these, as well as charges and penalties.

Automation

With IRIS Trust Tax, many processes are automated, such as completing Form R185 and Form 50(FS). It easily computes double taxation relief and retains portfolio data for assets and securities, as well as computation of share pools and taper relief. Shareholding, property and deposit accounts are automatically brought forward.

Integration

Integration with IRIS Business Tax, IRIS Personal Tax and IRIS Dividend Service means that data is not rekeyed, saving time and helping to improve accuracy.

FAQs

-

We have a dedicated support section on this website. We also have live chat and a dedicated support telephone number: Support contact numbers.

-

Assurance and compliance are the primary services of any firm, practice, business or organisation. We understand that you rely on software solutions to get it right, every time – no compromise. Speak to us and find out why IRIS are the leaders in compliant software; call 0344 844 9644.

-

Speak to us today about how you can get started with IRIS. Call 0344 844 9644 to discuss your requirements; we’ll help you get started.

Related Products

Product

IRIS Elements Practice Management

Intuitive cloud accounting practice management software with integrated email and text messaging, customisable workflows and easy to configure CRM.

Product

IRIS Elements Tax and Accounts

A cloud accounting solution with everything you need to get started. With Personal, Partnership, Trust and Corporation Tax as well as Accounts production all included.

Product

IRIS Elements

The first end-to-end cloud accountancy solution offering flexible, affordable, and scalable solutions for start-ups, sole practitioners, bookkeepers, small practices and medium practices.

Product

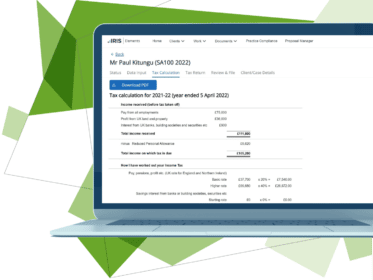

IRIS Personal Tax

HMRC-recognised personal tax accounting software, IRIS Personal Tax, enables your journey to Making Tax Digital (MTD) and allows you to complete and submit self-assessment tax returns across your clients’ full financial position; from all income sources to submitting P11D forms.

-

Tax Software

View all tax softwareIf you’re looking for tax software, you’re in the right place. As one of the UK’s leading providers, we understand that there are many different solutions depending on your requirements. Browse our wide range of tax solutions to find what you need.