-

616

UK employers pay their people with Staffology Payroll

-

1 in 0

people in the UK are paid using IRIS payroll solutions

-

0

out of the top 30 accountancy firms use IRIS for payroll

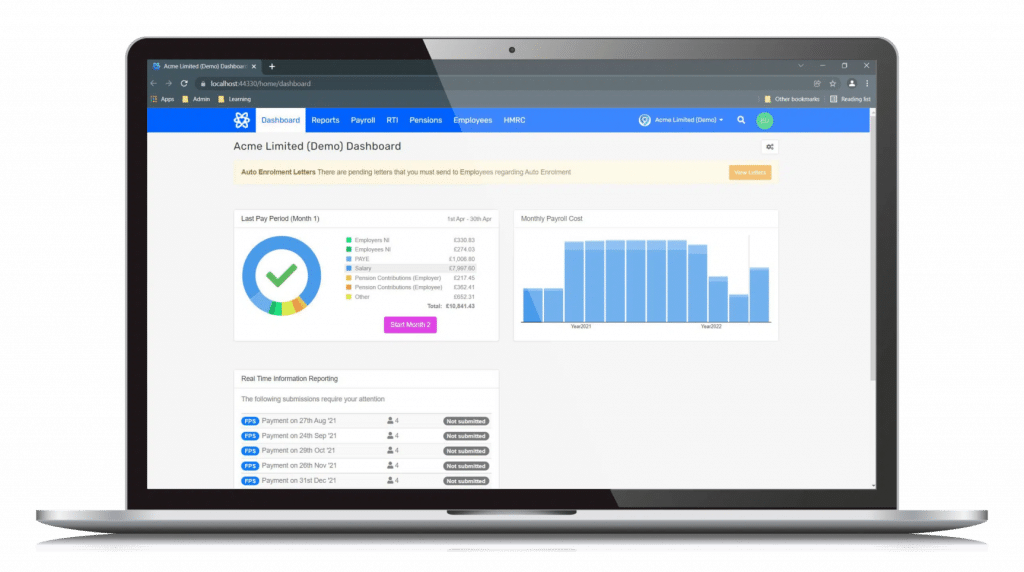

Cloud payroll software that can flex to your needs

Staffology Payroll is a cloud payroll solution for all UK businesses, from start-ups to large enterprises.

Whether you want to run a stress-free payroll for your small business or need a payroll powerhouse to integrate with your other systems, Staffology Payroll has you covered.

Staffology Payroll features

Cloud-based payroll software for every pay run

Managing payroll can be a challenge. But with Staffology Payroll, you can handle any kind of pay run and get the job done faster, too.

- Pay workers in the construction industry with CIS payroll.

- Manage employee benefits with P11D reporting.

- Simplify holiday pay and time-off for ad-hoc workers.

- Automate pay runs for umbrella companies.

From automating admin to calculating complex payroll, we’ve got you covered.

Payroll API and integration

Payroll systems that integrates with QuickBooks, Xero and more

Need a payroll system that integrates with Xero, QuickBooks, or Sage One?

Thanks to its advanced API, Staffology Payroll can integrate with a range of systems, like Staffology HR, sharing payroll data back and forth with:

- Accounting software

- Time and attendance software

- Payment software

- HR software

- Pension providers

Save time and improve accuracy with cloud payroll software that slots right into your existing system.

Book a demo

“Of all the software we’ve used in the last two years, Staffology Payroll has exceeded all our expectations. The team at IRIS is investing in the product, and enhancements have been added since we’ve been using it. I think it’s fantastic value for money and a payroll system I would highly recommend.”

Peter Cannan, Upp

888,000 UK employees are paid through Staffology Payroll

Start using Staffology Payroll from just £39 + VAT per month

All prices are subject to VAT.

-

1 to 19 payslips

Pay a flat fee of £39 per month

-

20 to 50 payslips

Pay £39 + £1.95 per payslip, per month

-

51 to 10K+ payslips

Contact us for a bespoke quote today

Frequently asked questions about Staffology Payroll

-

Absolutely – you can use Staffology Payroll’s customisable CSS functions to format your employees’ PDF payslips with your company’s branding.

-

The cost of Staffology Payroll depends on your business needs and is based on the number of RTI submissions to the HMRC within the billing period.

Staffology Payroll customers are charged a flat fee of £39 per month, and additional fees may apply depending on the number of payslips you process per month:

- For 19 payslips or fewer per month, you’ll pay the £39 flat fee only.

- For between 20 and 50 payslips, you’ll pay the £39 fee PLUS an additional £1.95 per payslip.

- For any amount above 51 payslips, please contact us for a bespoke quotation.

The total fee is calculated using the payslip rate multiplied by the transactional payslip volume. There is a minimum fee that applies, so you will pay the higher amount between the calculated fee and the minimum fee.

All prices listed here are subject to VAT. -

Yes, Staffology Payroll provides complete support for managing, calculating, and processing Scottish and Welsh payroll tax codes and rates.

-

Staffology Payroll can help you handle holiday allowances and record days off automatically.

Many of our clients use our software to pay ad-hoc workers. So, instead of providing the statutory holiday entitlement in the form of days off work, they instead pay out holiday pay – and the software takes care of all the necessary calculations.

You can choose to pay immediately as soon as it’s incurred or track it so employees can request payment from it when needed. No matter your approach, we've got you covered. -

If you’re an accountancy firm or payroll bureau, we recommend you take advantage of Staffology Bureau, our specialist payroll software for payroll providers.

This HMRC recognised payroll software helps payroll providers to save time, boost efficiency, and improve outcomes for clients. -

Our engineering and product teams are always interested in finding new ways to improve Staffology Payroll – and we welcome your ideas and suggestions.

To submit your ideas, review existing suggestions, and vote on your favourite concepts, check out the Staffology Payroll Ideas Portal today. -

Need help with Staffology Payroll or want to learn more about how software works?

Visit the Staffology Payroll by IRIS Help Centre to find tutorials, view software updates, and get help based on user-level (admin, line manager, employee etc).

Trusted by businesses like yours

Read more about Staffology Payroll software

Case Study

The only way is Upp thanks to partnership with Staffology Payroll

Guide

Free guide: The future of payroll software is in the cloud

Webinar

Stay ahead with Staffology Payroll's latest updates

Discover more IRIS payroll solutions

-

Payroll bureau software for payroll providers

Staffology Bureau’s cloud payroll software helps payroll providers automate admin and offer clients faster, more efficient pay runs.

-

The complete managed payroll solution you can trust

Rely on an end-to-end payroll outsourcing solution backed by CIPP-accredited payroll managers using HMRC-recognised software.

-

Specialist payroll software for schools and trusts

Discover cloud-based payroll and pensions software designed specifically for schools and trusts to run payroll in-house.

Take the pain out of payroll

The right cloud payroll software can make all the difference – try Staffology Payroll today.