IRIS Autumn 2021 Full Features v21.3

Overview

The IRIS Accountancy Suite Autumn release version 21.3 includes all legislative updates to ensure your ongoing compliance and some product enhancements based upon user feedback, more detail on these can be found below. It also includes solutions to issues reported in earlier releases.

IRIS Accounts Production

FRC 2021 Taxonomy

We have applied the latest Taxonomies issued by the FRC and HMRC for 2021. This will give qualifying accounts formats access to the most current iXBRL tagging to support electronic filing requirements for both Companies House and HMRC.

Shareholders’/Members’ Deficit

Following this request by a group of customers in the Ideas Portal, www.iris.co.uk/ideas, we have included the option to refer to the Shareholders’ funds as Shareholders’ deficit.

This can be toggled in the Data Screens from the Balance Sheet / Options folder, selecting the first data screen FRS 102 (or FRS101) – Options and scrolling down to the bottom of the screen.

If there is a comparative year or period present the narrative will be defined based on corresponding prior year or period Data Screen.

The tick in the Data Screen will not carry forward year on year to avoid accidentally referencing the total as a deficit when it may not necessarily be the case.

The same change is also available for LLP Accounts in the event of a Members’ deficit.

Statement of Income and Retained Earnings

Similarly, following another request by another group of customer in the Ideas Portal, the Statement of Income and Retained Earnings will now automatically carry forward year on year once ticked for the first time, saving time and ensure the disclosure remains consistent year on year.

Updated Data Screen Autopilot

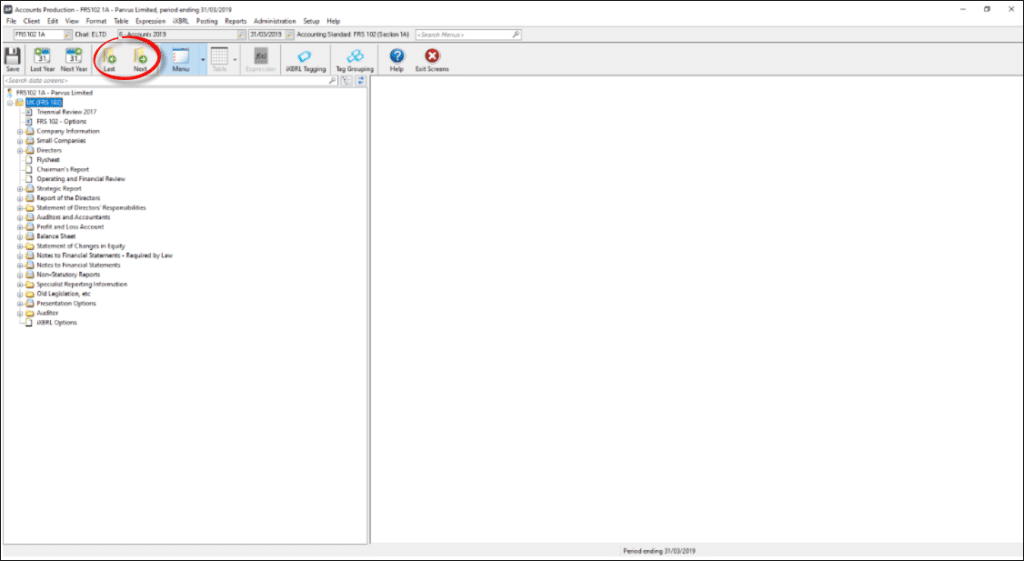

We have updated the Autopilot routine for Data Screens. The Autopilot can be accessed from within the Data Screens by clicking on the Last and Next buttons as shown in the screen shot below.

Clicking Next, will take you forward through the mostly commonly used data screens filtering out those that are less commonly needed and if you make a change to that individual screen by clicking Next it will automatically save the changes and move onto the subsequent screen in the Autopilot sequence automatically.

This solution saves time particular for first year or period sets of accounts or when using the Data Screens for the first time.

Option to Disable Capital Account in Partnerships

Historically when preparing Partnership Accounts even though postings had not have been made to Capital Account codes 975 to 978, the Balance Sheet would still show a Capital Account by default.

For this release we have included an option within the data screens to refer to the Capital Account as the Current Account. To enable this function, from within the Presentation Options Data Screen folder select Balance Sheet Data Screen and tick the override box at the bottom of the screen.

Fixed Asset Investments increased Additional Items

From within the Related Undertakings data screen folder, we have increased the number permissible for each of the following, Subsidiaries (from 15 to 30), Joint Venture (from 3 to 10), Associated Companies (from 3 to 10). For Subsidiaries Not in Parent this has been increased (from 8 to 15). This is to help with more complex sets of accounts.

Additional Directors/Members’ changes since Year End

Within the Company Information report for Limited Companies, it has always been possible to show Directors’ that have been appointed and resigned since the period or year end.

For this release we have doubled the number permissible for each scenario from 5 to 10. To access this disclosure from the Data Screens, go to the Directors folder and select ‘Directors’ Changes since Year End’. A similar enhancement has also been made for Members’ of LLP’s.

Updated Default Accounting Standard for new sets of Accounts

When preparing accounts for the first time in Accounts Production where applicable the software has historically set the default accounting standard to the FRSSE.

For this release we have altered this to be set to FRS102 section 1a by default for the appropriate entity types. The other accounting standards are still available from the same drop-down list, but overall, this will save you time in this area.

IRIS Personal Tax

SmartTax

IRIS SmartTax is now available to all Personal Tax users. To enjoy the benefits of this new feature please ensure that you have installed version 21.2.0 (Summer release) prior to updating to the latest version of IRIS 21.3.0 (Autumn release).

SmartTax is a cloud based component which is surfaced in IRIS Personal Tax. This component will host a range of value added features, the first being the live ‘Real-time’ tax calculation, which reflects the clients financial position immediately as you enter data within the selected client.

Ensure that you have your IRIS updated to the latest version, to get started using this feature.

Resolved issues

- SmartTax doesn’t reflect HMRC values in the tax calculation

- SmartTax duplicating bank interest where parent records are linked to the same bank

- SEISS grant appearing as a negative figure on the schedules of data

- Amount in box [SA104S:Adjusted profit] must equal ([SA104S:Share of partnership profit or loss] + [SA104S:Adjustment for basis period] + [SPS9.1] + [SA104S:Change of accounting practice adjustment] + [SA104S:Averaging adjustment]

- Personal tax crashes when attempting to check employment details with HMRC

IRIS Business Tax

Research and Development updates

Updates have been made to the RDEC (R&D) feature within Business Tax. Any excess brought forward the RDEC credit will now be taken into consideration earlier on in the RDEC claim allowing for discharge against CT liability for the period and subsequently taken into consideration when calculating the Net value/Restricted Credit.

Resolved issues

- Rejection error 9263 – Box 575 must equal (the sum of boxes 545 and 560) minus (the sum of boxes 525 and 570). If the results is negative please enter 0 (Zero).

- R&D addback isn’t reflected on the basis computation

- Farmers averaging isn’t correctly reflected in the 2019 tax calculation

- RDEC (Box F) Net expenditure credit is calculated at 39% for periods prior or straddling 01/04/2017

- Loans to participators warning updated to reflect correct section, s455 oppose to s419

All Tax

SEISS (Self-Employment Support Scheme) mapping update

To cater for the transfer of SEISS via AP/Btax/Ptax and due to the temporary nature of SEISS, we have updated the mapping in Business Tax to cater for any coronavirus support claims made from a sole trade.

It is now possible to update the mapping globally or for a specific client via Setup | Accounts for self-assessment, for SEISS to transfer directly to box 70.1 on the SA return.

Please note you will need to configure the mapping for SEISS to transfer through.

Tax legislation and annual updates

Updates to cater for the latest HMRC Exclusions for tax year 2021

Individuals (IRIS will automatically prompt where a client hits the specified criteria)

- Exclusion 127, 128, 129, 130 and 131

Updates to cater for the latest HMRC Specials for tax year 2021

Individuals

- Special 39

Partnerships

- Special 10 and 12

All other legislative and annual updates

- Updated Dividends databases

- Corporation Tax taxonomy updates

- Corporation Tax RIM Artefacts