How to set up a salary sacrifice deduction E.g. Childcare Vouchers

Article ID

10981

Article Name

How to set up a salary sacrifice deduction E.g. Childcare Vouchers

Created Date

5th October 2017

Product

IRIS PAYE-Master

Problem

How to set up a salary sacrifice deduction.

NOTE: These steps can be used to set up all types of salary sacrific deduction. E.g. Cycle to work scheme, Give as you earn scheme, etc. The only difference is the name you type into the "Pay Description".

For further legislation information about salary sacrifice schemes, check gov.uk here.

Exceptions: A salary sacrifice pension scheme would be configured from the pension options instead:

PLEASE NOTE: The pension module is an optional extra for PAYE-Master and may not be available on your current licence. Contact out sales team to upgrade.

For more details on setting up pension contributions click here.

Resolution

To set up a salary sacrifice deduction:

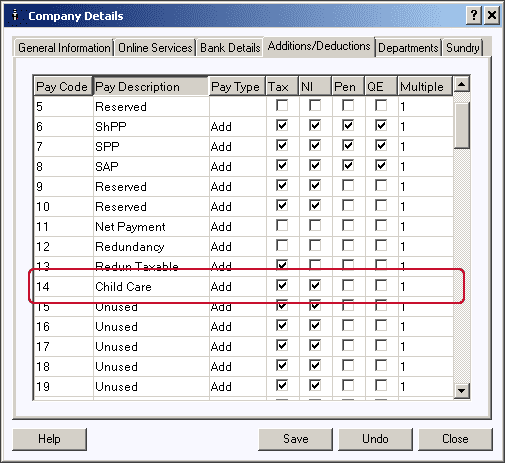

• Go to “Company” > “Details” > “Additions/Deductions“

• Scroll to first “Unused“

• Delete the word unused and type in what you want to show on payslip e.g. child care

• Leave pay type as add

• Leave ticks in Tax and NI:

•”Save” and “Close“

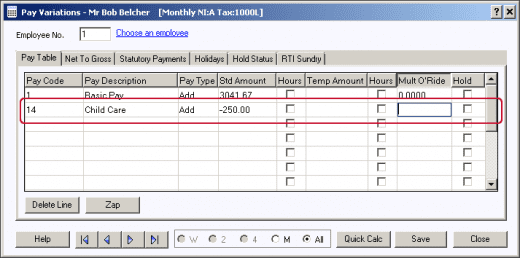

• Go to “Pay” > “Variations” for the desired employee

• Select the “Child Care” pay code

• Enter the child care figure as a minus e.g. -250.00:

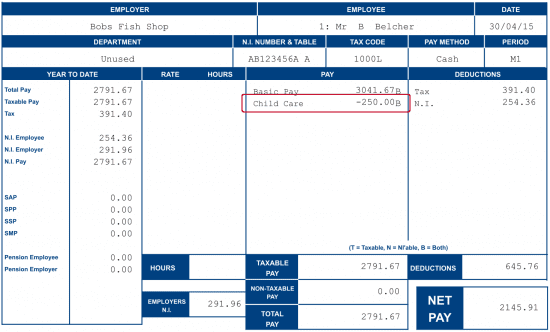

The reason we recommend you process this as a negative addition is that it shows on the payslip in a way that’s easier to understand at a glance:

If you would prefer the salary sacrifice to show on the deductions side of the payslips instead.

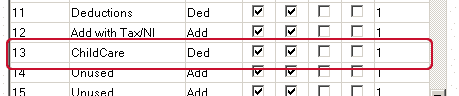

• Follow the steps as above EXCEPT:

• Set the paytype as “ded“

• Put ticks in “Tax” & “NI“

• In the employee variations set the standard amount as a POSITVE value eg £250.00

Both methods process the deduction in the same way, the only difference is how it diplays on the payslip. Pick whichever option you prefer.

Employees should consider carefully the effect, or potential effect, that a reduction in their pay may have on:

• their future right to the original (higher) cash salary

• any pension scheme being contributed to

• entitlement to Working Tax Credit (WTC) or Child Tax Credit (CTC)

• entitlement to State Pension or other benefits such as Statutory Maternity Pay (SMP)

For further legislation information about salary sacrifice schemes, check gov.uk here.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.