What to do when an employee dies

Article ID

11058

Article Name

What to do when an employee dies

Created Date

1st July 2020

Product

IRIS Payroll Professional, Earnie

Problem

How do I record an employee as deceased? How does this affeect payroll?

Resolution

HMRC have not included a “date of death” field or “deceased indicator” on the FPS. You should make the deceased employee a leaver and make the leaving date the employee’s date of death.

If you have outstanding payroll to process this should be calaculated without NI contributions.

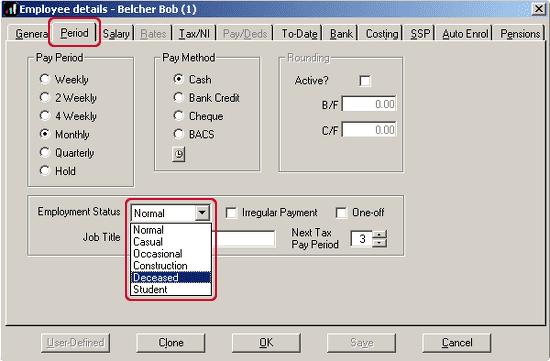

First, go to the “Period” tab in the employee details. Set the “Employment Status” to “Deceased”.

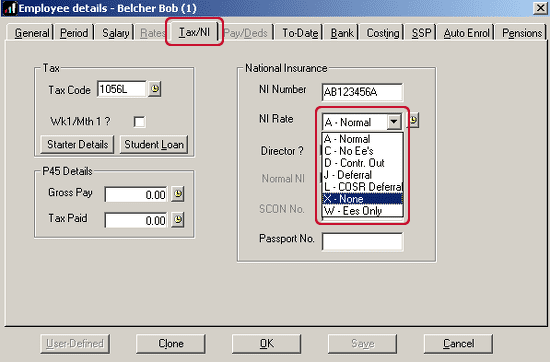

If you are running payroll for the deceased employee this should be run on NI rate X.

Go to the “Tax/NI” tab in their details and set the NI rate to “X – None”:

Save and close the record. Process any outstanding pay for the employee as normal.

Then process them like any other leaver:

Go to “Employee” > “P45 Routines” > “Issue P45”

The leaving date you enter should be the employee’s date of death. You DO NOT produce the P45 form.

Guidance from gov.uk website:

“You must make all outstanding payments when an employee dies.

Put the date they died into the ‘Date of leaving’ field in your next Full Payment Submission (FPS), and deduct tax using their existing tax code. Don’t deduct and pay National Insurance or produce a P45.“

Full link here:-

https://www.gov.uk/what-to-do-when-an-employee-dies/paying-employee-died

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.