CIS and the EPS Submission

Article ID

11104

Article Name

CIS and the EPS Submission

Created Date

19th November 2019

Product

IRIS Bureau Payroll, IRIS Payroll Business, IRIS Payroll Professional, Earnie, IRIS PAYE-Master, IRIS Earnie IQ

Problem

How does RTI affect the reporting of CIS figures to the HMRC?

Resolution

CIS Deductions suffered appear on the EPS because you are allowed to reduce your PAYE costs to HMRC by the value of any tax deduction that was automatically made from your invoices by a contractor.

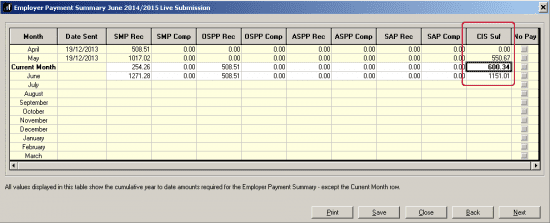

You can type in the amount of CIS deductions suffered in a tax month when sending the EPS. Type the value in the line labelled “Current Month“. The named month line (ie April, May, June etc.) will total up the running year to date value:

CIS deductions suffered cannot link to any process in the payroll software therefore if you are reporting these to HMRC you will need to type in the appropriate figure while working through the send EPS wizard.

If you make deductions from subcontractors that deduction will be reported to HMRC via the monthly CIS return. There is no place in RTI for this value because HMRC will know what it is from the CIS return.

HMRC will reconcile what you pay against FPS, EPS and CIS submissions

FPS = Tax, NI, Student Loan liability for employees

EPS = Reductions of PAYE remittance for Statutory payments etc. including CIS Deductions suffered

CIS = Deductions made from subcontractors

The result of the three submissions should match the amount you pay to HMRC.

HMRC expect any required EPS submission to be received by 19th of the following month, in line with the remittance period.

Apprenticeship Levy

Since 6th April 2017, Apprenticeship Levy is included on your EPS submissions. This is reported as an additional cost to the PAYE remittance due to HMRC, if you have used all of your levy allowance.

For further details on Apprenticeship Levy, click here.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.