Month end summary screen is missing values

Article ID

11185

Article Name

Month end summary screen is missing values

Created Date

6th April 2018

Product

IRIS Bureau Payroll, IRIS Payroll Business

Problem

I've completed my payroll but my month end summary (p32) or p30 hasn't filled in my PAYE totals.

Resolution

The p32 & p30 figures are completed as part of the month-end processing routine.

You should be prompted to perform month-end processing when you finalise the period that will close your tax month. Click here for more details.

If you haven’t seen the prompt you will have a pay frequency still open in the tax period, wait until you’ve finalised all the periods with the tax month and you will be prompted to perform month-end.

If all your pay frequencies have been finalised within the month you might have clicked “No” by mistake when you saw the month-end processing prompt.

To refresh the report

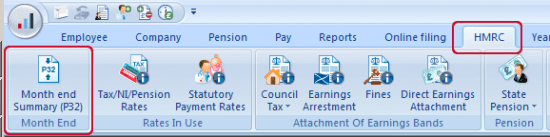

Go to > “HMRC” > “Month end summary (p32)”

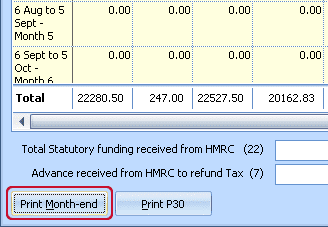

Click “Print Month-End” (bottom left hand corner):

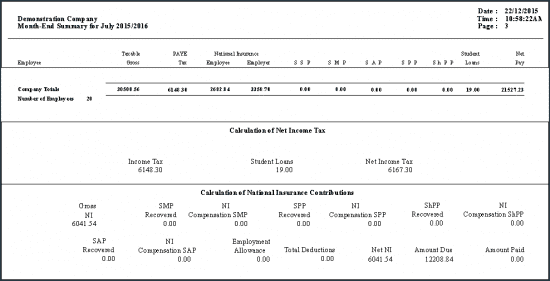

This will bring up a preview of the last tax month the payroll software recognises as finalised and complete:

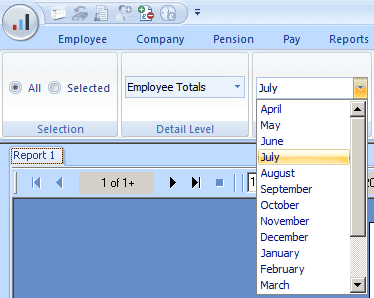

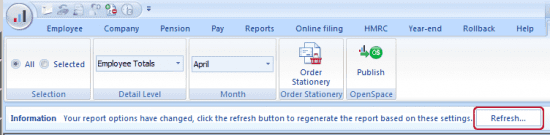

If you need to get the month end values for a previous month, select the appropriate period in the report options along the top of the preview:

Then click the “Refresh” button:

Either print or close the preview.

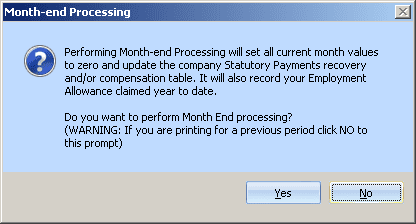

You will then see the prompt to perform month end processing. Click “Yes” to complete the processing:

You will then see the values in the month end summary grid updated with the values shown on the report.

No Reporting Options On Screen

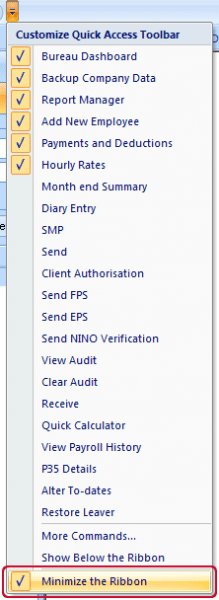

If you cannot see the report options ribbon when a report preview is on screen it will be because Windows is set to minimise the ribbon. To restore to screen, click on the “Customise Quick Access Toolbar” arrow icon near the round application button (top left of screen):

Click on “Minimize the Ribbon” to un tick the option:

This will ensure the report options are visible whenever a report is brought to screen.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.