How to process Statutory Sick Pay (SSP)

Article ID

11230

Article Name

How to process Statutory Sick Pay (SSP)

Created Date

19th November 2019

Product

IRIS Bureau Payroll, IRIS Payroll Business

Problem

How do I pay SSP to an employee?

If you are unfamiliar with SSP we recommend you read this short guide first:

Resolution

Paying SSP Manually

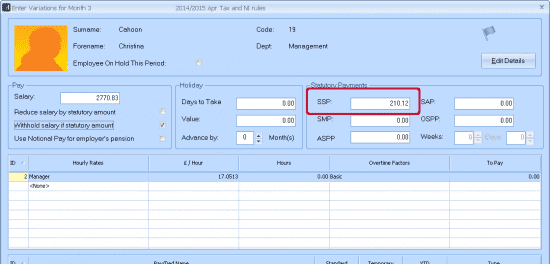

SSP can be paid manually to any employee, if you can calculate the value of the payment you would like to make you can type this directly into the “Statutory Payments” section on the enter variation screen, type the value into the “SSP” field.

Paying SSP using the Employee Absence Diary

You can also record a sickness period in the employee diary to get the system to calculate the SSP values for you.

To set up an auto absence calculation:

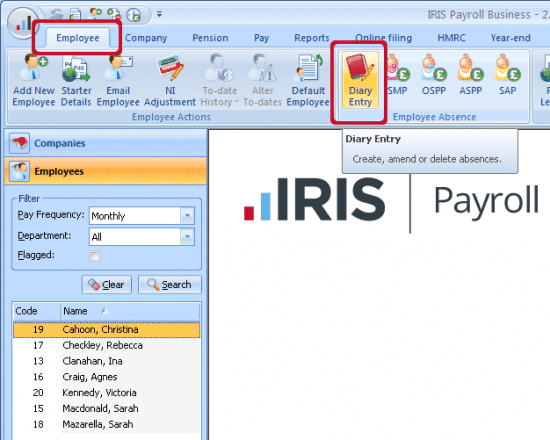

Click once on the name of the employee in the list down the left-hand side.

Go to “Employee” > “Diary Entry”.

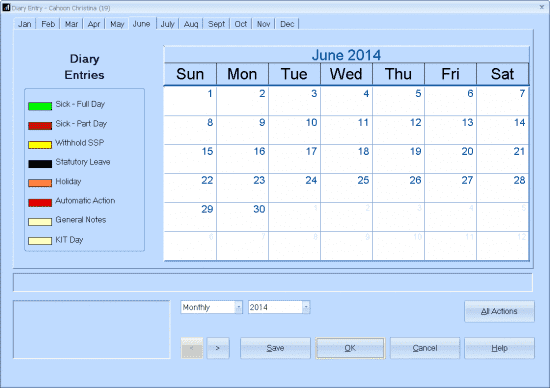

You will be presented with the diary calendar view:

Double click on the green box for “Sick – Full Day” down the left-hand side of the window:

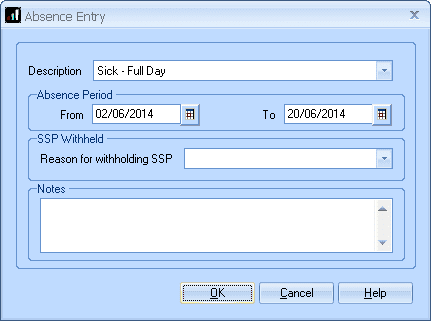

The “Absence Entry” window will appear. Set the “From” and “To” dates you want to indicate the employee absent for.

If the system believes the employee is not entitled to SSP it will populate a “Reason for withholding SSP” after you click “OK“.

You can type notes into the text field if you wish as a reminder of the absence details. This is optional.

NOTE: The system will automatically knock off the waiting days. Record the sick leave from the first day of absence NOT the first paid day of absence. If the period of incapacity to work is linked to a previous absence the waiting days will not be applied again.

Click “OK”.

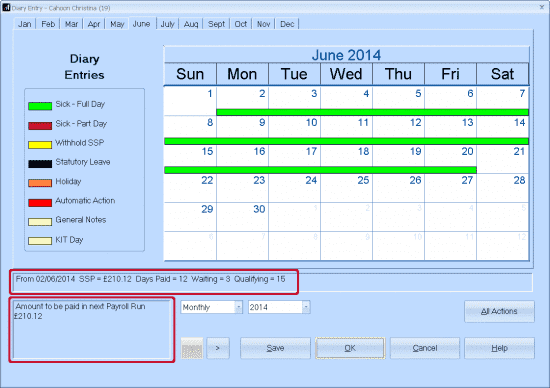

On the calendar view, you should now see a green bar running over the dates you selected. If you hover the mouse pointer over this bar you will a breakdown of the qualifying, waiting and paid days during the absence period. You will also see, in the bottom left-hand corner, the amount to be paid in the next pay run:

Click “Save” and “OK”.

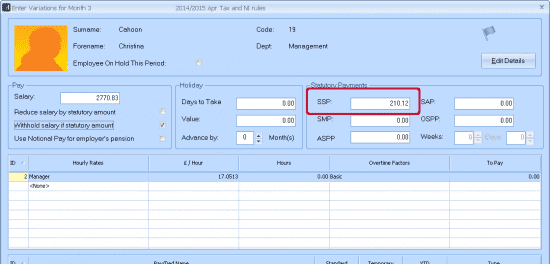

When you go to “Pay” > “Enter Variations” the amount of SSP paid in the period will be automatically filled in for the employee:

NOTES:

• If an employee’s absence runs over more than one pay period you should split the diary entries. Enter the absence “to date” up to the pay date you are processing. In the next period extend the absence up to the next pay date and so on until the employee returns to work.

• If a period of absence is 3 working days or less it is NOT a period of incapacity to work and no SSP will be paid.

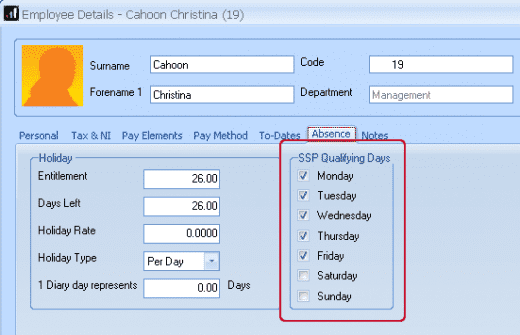

• Payroll will only count the “working” days of the employee as configured in employees details “Absence” tab:

• As you can not longer reclaim the cost of any statutory sick pay from your remittance to HMRC there is no requirement for you to send an EPS (employer payment summary) when you pay SSP. Any employee receiving SSP payments will have the relevant information included in their section of the FPS (full payment submission)

Linked Period of SSP

If an employee is off sick twice within a certain period of time, the second absence might be ‘linked’ to the first one – this is known as a Linked Period of Incapacity for Work. In a Linked Period of Incapacity for Work, there are usually no Waiting Days so the employee receives SSP for all the working days (Qualifying Days) they were off sick. In simple terms, sickness periods are linked if:

• They are both four days or longer

• The gap between them is eight weeks or less

For more information see Statutory Sick Pay – the basics

Enter the Second Period of Sickness

Enter the second sickness period in Employee | Diary Entry

Position the mouse pointer over the new green bar so you can see the details of the SSP that IRIS Payroll has calculated.

If the absence is linked to a previous period of incapacity to work you will see that there are no waiting days to be served.

Please Note: Any linked period of sickness still needs to be classed as a period of incapacity to work (PIW) ie. greater than 3 days. If the linked period of absence is 3 days or less it isn’t classed as a PIW and no SSP will be paid.

Phased Return To Work

If you agree a phased return to work or altered hours after a period of sickness, pay SSP for the days that your employee is sick in the normal way. Any day for which SSP is paid will count towards the maximum entitlement of 28 weeks.

Your employee’s absence must form a Period of Incapacity of Work (PIW) ie. before SSP is paid. Remember, that is Statutory Sick Pay. You are not limited in what you decide to pay to the employee as salary/hourly rates.

For more details please refer to:

https://www.gov.uk/guidance/statutory-sick-pay-employee-fitness-to-work

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.