How do I report a company that has ceased trading under RTI?

Article ID

11279

Article Name

How do I report a company that has ceased trading under RTI?

Created Date

1st May 2019

Product

IRIS PAYE-Master

Problem

My company/client has ceased trading, how do I report this to HMRC under RTI?

Resolution

If your company ceases trading, the Ceased Trading Date on the General Information tab of Company Details will be used by either the EPS or FPS process to identify the final submission.

This will report to HMRC that the PAYE scheme has ended. If the company resumes paying PAYE employees later in that tax year on the next tax year HMRC can reactivate the PAYE scheme. If it is after this period a new PAYE scheme will need to be registered with HMRC.

The process for a company that has ceased trading depends on whether you have to complete an EPS or not.

• If you ARE submitting an EPS, the Ceased Trading Date should be set AFTER you have submitted your final FPS

• If you DO NOT have to submit a final EPS, set the Ceased Trading Date BEFORE you send your final FPS

If you are not sure if you need to send an EPS please check this KB:

https://www.iris.co.uk/support/knowledgebase/kb/11579

To set ceased trading date

Go to “Company” > “Details”. On the General tab enter the “Ceased Trading” date

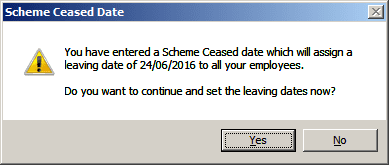

Click ‘OK’ after entering the Ceased Trading Date and the following message will be displayed:

Click ‘Yes’ to issue leaving dates to all employees.

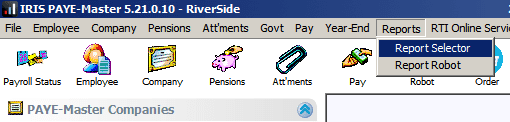

You can then print all due P45s. Go to “Reports” > “Report Selector“:

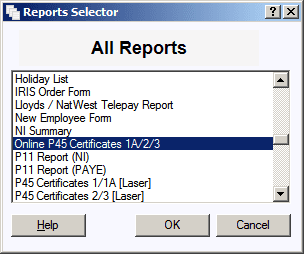

From the list select the option “Online P45 Certificates 1A/2/3“:

This will print out P45’s for all employees onto plain A4 paper, no pre-printed stationery is required.

Proceed to send your final FPS/EPS and make sure you tick the option “Final Submission for Year”

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.