Auto Enrolment percentage calculation

Article ID

11447

Article Name

Auto Enrolment percentage calculation

Created Date

27th February 2019

Product

IRIS Payroll Professional, Earnie, IRIS Earnie IQ

Problem

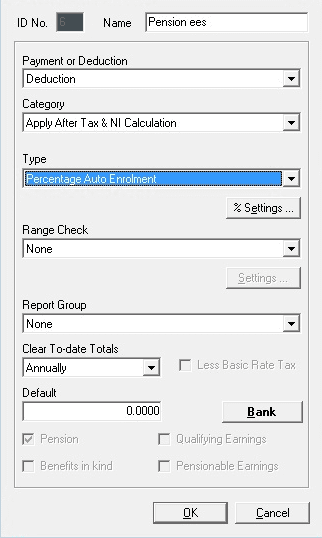

When “Pension Auto Enrolment” is selected as the payment/deduction type, the pension is calculated as a percentage of earnings between the Qualifying Earnings Lower Threshold and the Qualifying Earnings Upper Threshold

Resolution

When Pension Auto Enrolment is selected as the payment/deduction type, the pension is calculated as a percentage between the qualifying earnings lower threshold and the qualifying earnings upper threshold.

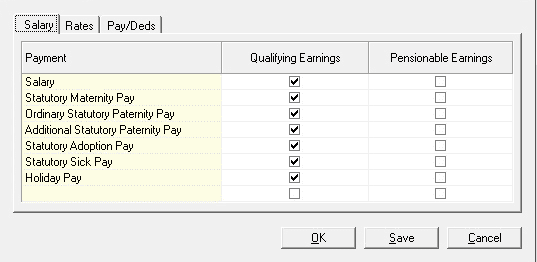

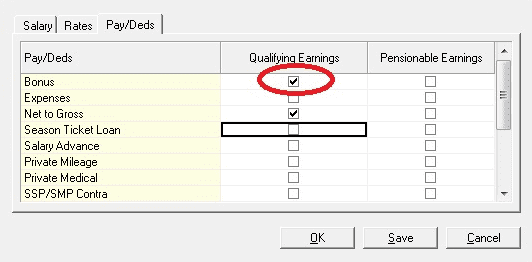

The earnings used for the calculation are whatever is ticked in Qualifying Earnings section of Pension -> Configure Earnings.

Note: The qualifying earnings in the Salary tab are not changeable – salary, statutory payments and holiday pay are always classed as Qualifying. The Rates and Pay/Deds, however, can be selected as required for the particular pension scheme.

Example

Monthly paid employee gets a salary of £2000 in month 5 and bonus of £500. The employee’s contribution rate is 6%. The bonus has NOT been ticked as qualifying. His pension is calculated as follows:-

Salary: £2000.00

Bonus: £500.00

Total Gross Pay: £2500.00

Qualifying Earnings £2000.00

Qualifying Earnings Lower Threshold (monthly 2019/2020): £512.00

Qualifying Earnings Upper Threshold (monthly2019/2020): £4,167.00

Earnings on which pension calculated: 2000.00 – 512.00 = 1488.00

Pension contribution: 1488.00 * 6% = £89.28

Example 2

If the bonus had been included as qualifying earnings, the calculation would be as follows:-

Salary: £2000.00

Bonus: £500.00

Total Gross Pay: £2500.00

Qualifying Earnings £2500.00

Qualifying Earnings Lower Threshold (monthly 2019/2020): £512.00

Qualifying Earnings Upper Threshold (monthly2019/2020): £4,167.00

Earnings on which pension calculated: 2500.00 – 512.00 = 1988.00

Pension contribution: 1988.00 * 6% = £119.28

Example 3

Where an employee earns over the Qualifying Earnings Upper Threshold, the calculation would be:-

Salary: £3500.00

Bonus: £1000.00

Total Gross Pay: £4500.00

Qualifying Earnings £4500.00

Qualifying Earnings Lower Threshold (monthly 2019/2020): £512.00

Qualifying Earnings Upper Threshold (monthly2019/2020): £4,167.00

Earnings on which pension calculated: 4,167.00 (Earnings over Qualifying Earnings Upper Threshold ignored) – 512.00 = £3655.00

Pension contribution: £3655.00 * 6% = £219.30

Important Note: Remember, if you are applying basic rate tax relief the employee will only have 80% of the value of the deduction taken from their pay. The remaining 20% will be claimed by the pension provider as tax relief from HMRC and added to the employees fund.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.