Sending a previous months EPS

Article ID

11492

Article Name

Sending a previous months EPS

Created Date

1st April 2019

Product

IRIS PAYE-Master

Problem

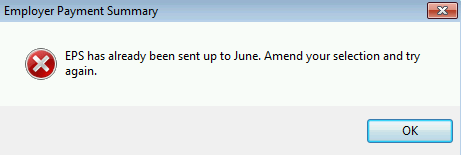

I missed an EPS for a previous month or submitted the wrong values. PAYE-Master will not let me return to send it:

Resolution

The EPS always updates running Year To Date totals with HMRC. As such it is not necessary to go back and resend previous months, you can correct the year to date amounts in your next submission, or resend your last EPS with the correct YTD values

The exception to this rule is when we are reporting that no employees have been paid in the month, in this event, HMRC do require the EPS for the specific period.

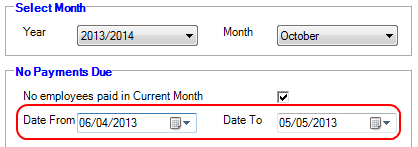

To get around this in the software go to send the EPS and change the month named at the top of the form to match the last EPS submission sent.

• Tick the option “No employees paid in current month”

•Then set the “Date From” and “Date To” to cover the tax month we wish to report as no employees paid i.e.:

6th April – 5th May – Tax Month 1 April

6th May – 5th June – Tax Month 2 May

NOTE: The HMRC will process the “No employees paid” status based on the from and to dates selected NOT the month named at the top of the form.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.