Paying maternity pay - SMP

Article ID

11602

Article Name

Paying maternity pay - SMP

Created Date

27th February 2019

Product

IRIS Bureau Payroll, IRIS Payroll Business

Problem

How to set up SMP for an employee.

Resolution

Paying SMP Manually

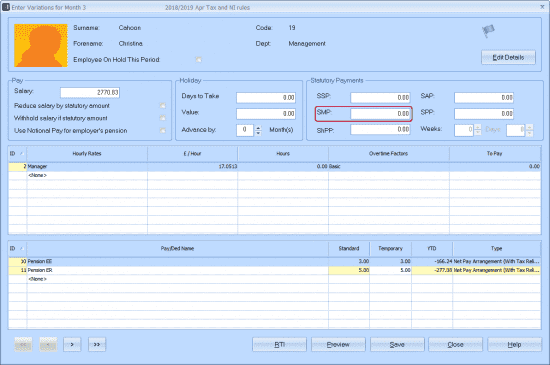

SMP can be manually paid to an employee on the pay variation screen:

If you know the value of SMP you wish to pay, simply type the value into the field here.

Alternatively, if you wish the software to calculate the SMP payment for you, follow the instructions below.

Setting up automatic SMP payments

Click below to watch a short tutorial:

Configuring the SMP

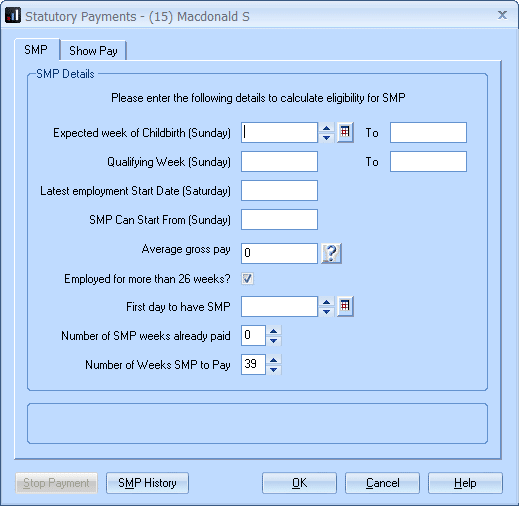

To open the Statutory Payments screen’s SMP tab, select the employee using the Selection Side Bar then click on the Employee tab and click SMP.

Use the Statutory Payments SMP tab to enter or amend SMP details for your employee.

Note: if you select a male employee then click SMP, the Statutory Payments screen opens on the SPP tab because men cannot receive maternity pay.

Expected Week of Childbirth – You must enter the date of the Sunday of the Expected Week of Childbirth. If you enter a date that is not a Sunday, payroll will automatically amend it for you.

Payroll automatically calculates other dates on this screen based on the Expected Week of Childbirth you have entered. The calculated dates cannot be amended and are shown in grey.

Average Gross Pay – Payroll will automatically calculate the employee’s average weekly pay based on the payments she received in the 8-week ‘set period’. To see the amounts used in this calculation, click on the Show Pay tab.

You can amend the Average Gross Pay if you need to. This might be necessary, for example, if you have recently started using payroll and it does not contain information about all the employee’s payments in the 8-week ‘set period’.

Employed for More Than 26 Weeks – Payroll automatically ticks this box if your employee’s start date is before the 26-week limit.

First Day to Have SMP – If your employee has given you a date when she wants to begin her SMP, you can enter it here. If she has not yet given you a date, you can enter the same date as the Expected Week of Childbirth then amend it later.

NOTE on SMP Calculation: Payroll allocates SMP in weekly blocks. If the PAY DATE is less than 7 days AFTER the “First day to have SMP” no SMP will be allocated and will start in the next pay period you process.

Payroll calculates the first day SMP can start using the Expected Week of Childbirth, then displays this date in the SMP Can Start From field. If you enter a date in the First Day to Have SMP field that is earlier than the calculated date, Payroll will display a warning message and amend the date for you.

Note: Payroll only calculates the earliest date SMP can start if the employee has earned enough in the 8-week ‘set period’ and has worked for the company long enough. If either of these conditions are not met, you will see a message telling you why the employee is not entitled to SMP.

Number of Weeks Already Paid – This field is useful if you started paying SMP using a different payroll system then transferred your payroll to IRIS Payroll.

Number of Weeks SMP to Pay – If the employee tells you that she wants to come back to work before receiving her full entitlement, you can reduce the number of weeks.

Employee is entitled to SMP at the following rates – Once payroll has sufficient information and has determined that the employee is entitled to SMP, the amounts she is entitled to and the relevant qualifying dates are shown in this section in the lower part of the screen. These are the amounts that will be applied automatically when you calculate the payroll.

Stop Payment – SMP payments stop automatically after the full entitlement has been paid. However, you may need to stop the payments earlier than this if, for example, the employee decides to return to work early. Use Stop Payments button to stop payments of SMP to your employee.

The Stop Payment button does not appear until after you have entered the SMP details and saved them; if you then go back into the Statutory Payments SMP tab, the Stop Payments button appears.

SMP History – The SMP History button also does not appear until after you have entered the SMP details and saved them; if you then go back into the Statutory Payments SMP tab, the SMP History button appears.

Click the SMP History button to view the amount of SMP paid in each pay period.

Show Pay Tab – Click on the Show Pay tab to view the payments made to the employee during the 8-week ‘set period’.

Statutory payment recovery and compensation

Statutory payment recovery and compensation are applied when you perform month end processing. This will produce a remittance report (month end summary) which reduces your amount due by the relevant recovery/compensation amounts.

If you have statutory payment recovery/compensation on your month end summary you will need to submit an EPS (Employer Payment Summary) report to HMRC. For more details on sending an EPS, click here.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.