Paying Holiday Pay

Article ID

11638

Article Name

Paying Holiday Pay

Created Date

6th April 2018

Product

IRIS PAYE-Master

Problem

How to process holiday pay.

Resolution

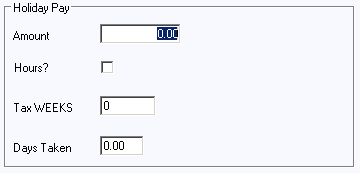

Holidays are processed from the “Holidays” tab on the variation window.

Amount – Holiday pay may be entered as a cash value or as a number of hours. If you are entering hours make sure you tick the Hours? box below.

Hours? – This sets the box above to read as a value or a number of hours.

Tax Weeks – Use this option to advance an employees tax/NI allowance for more than one pay period. For example, you may wish to pay a weekly member of staff a normal weeks pay and a week holiday. To prevent the employee overpaying tax/NI enter 1 in the box. (this weeks allowance + one additional week).

NOTE: This employee will then be unavailable to pay for the number of periods their allowances have been advanced.

Days Taken – Enter the number of days taken (for example, five and a half days would be 5.50). This will have the effect of decreasing the entitlement remaining held in the employee record if used.

Holiday pay may be entered in addition to any standard inclusions and of course basic pay etc.

If you wish holiday pay alone to appear on the payslip, then the basic pay and any standard inclusions will have to be set to zero by pay variation entry.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.