I have received an underpayment notification from HMRC - Earnie/IPP

Article ID

11649

Article Name

I have received an underpayment notification from HMRC - Earnie/IPP

Created Date

1st April 2019

Product

Earnie, IRIS Payroll Professional

Problem

In the first instance you should contact HMRC and get further details on the issue and how they wish for you to proceed.

Common reasons why HMRC recognise an underpayment of liabilities:

• HMRC haven't received RTI submissions for the PAYE scheme and have estimated an amount due.

• HMRC don't know the PAYE scheme has reduced liabilities due to recovery or compensation on statutory payments.

• HMRC don't know the PAYE scheme has reduced liabilities because it is claiming employment allowance.

• HMRC don't know the PAYE scheme has reduced liabilities due to CIS (Construction Industry Scheme) deductions suffered.

• HMRC haven’t received the correct information for the period.

• Duplication of employee records has occurred on HMRC systems.

Resolution

HMRC haven’t received RTI submissions for the PAYE scheme and have estimated an amount due.

If you have a period of a whole tax month with no employees being paid you need to send an Employer Payment Summary (EPS) to HMRC by the 19th of the following tax month. This will prevent them from estimating an amount due, known as a “Specified Charge“. For details on and help sending the EPS click here.

Please Note: There is no submission necessary for Period of Inactivity of less than a whole tax month. Remember tax month’s run from the 6th to the 5th.

HMRC do not know the PAYE scheme has reduced liabilities due to recovery or compensation on statutory payments.

When you perform month end processing the software adjusts the amount to be paid to HMRC by any recovery or compensation amounts on Statutory Payments. The amounts of these reductions need to be sent to HMRC on an EPS otherwise, they will believe you have underpaid.

It is possible HMRC have the wrong amounts for your recovery/compensation values. Common EPS mistakes include:

- Sending the EPS before finishing the pay period

- Sending the EPS before the end of the tax month and editing the year to date values on the report prior to sending.

- Sending the EPS after the 19th of the following tax month and HMRC have allocated the values to a different month than you expected.

If HMRC do recognise this underpayment of PAYE due to an incorrect value for recovery or compensation values you should correct the YTDs on the next EPS submission. When working through the EPS wizard, type in whatever value is required to make the YTD value on the final screen correct. HMRC only receive the YTD values on the EPS submission, not a month-by-month breakdown. As long as you are sending the correct YTD values, it should resolve the issue with HMRC.

Remember always send the EPS after completing your last pay period in the tax month. Remember tax months run from the 6th of the month to the 5th of the following month.

For help correcting EPS submission, click here.

HMRC don’t know the PAYE scheme has reduced liabilities because it is claiming Employment Allowance.

If you have turned on Employment Allowance in the software, when you print the PAYE remittance report, the software adjusts the amount to be paid by any class 1 employers NIC contributions up to a maximum of £2000 in the tax year (14/15). Most PAYE schemes qualify for this allowance, click here for details if you are unsure.

If you have activated Employment Allowance you need to tell HMRC with an EPS. Unlike the recovery/compensation or CIS deductions suffered, you don’t send HMRC a value but a status. The EPS file you send to HMRC will include a “Yes” indicator after turning Employment Allowance or a “No” indicator after turning Employment Allowance off. If there is no change in Employment Allowance status since the last EPS nothing needs to be included.

You will see this if you print the EPS summary as part of the submission wizard.

If you have activated Employment Allowance without sending any EPS, you should send one as soon as possible to inform HMRC.

If you believe you have sent at least one EPS since you activated Employment Allowance but HMRC aren’t reducing your liability, check the status of your EPS submissions:

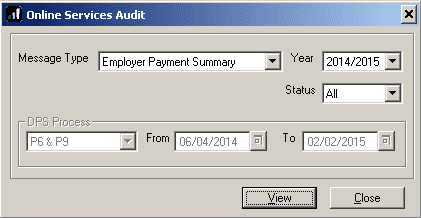

• Go to “Online Services” > “Audit” > “View“

• Set the following options:

• Click “View”

This will give you a list of all EPS submission attempts for the selected tax year. Do the EPS submissions show as successful? If so, make a note of the correlation ID and contact HMRC. The correlation ID is a receipt number generated by HMRC systems. With the correlation ID, HMRC should be able to track the details of your submission to confirm you are claiming Employment Allowance.

If the EPS submission turns out not to have been completed successfully OR the Employment Allowance indicator never reported “Yes”, make sure the Employment Allowance option is activated and send an EPS as soon as possible to inform HMRC.

HMRC do not know the PAYE scheme has reduced liabilities due to CIS (Construction Industry Scheme) deductions suffered.

CIS deductions suffered doesn’t link to any other process in payroll. As such this item needs to be completed manually on each EPS submission.

If HMRC recognises an underpayment of PAYE due to an incorrect value for CIS deductions suffered you should correct the YTD value on the next EPS submission. When working through the EPS submission wizard, type in whatever CIS deductions suffered value is required to make the YTD value on the next screen correct. HMRC only receive the YTD values on the EPS submission, not a month-by-month breakdown. As long as you are sending the correct YTD values, it should resolve the issue with HMRC.

Click here for more details about the EPS and CIS deductions suffered.

HMRC haven’t received the correct information for the period.

This could be due to changes made in payroll without sending a corrected submission. For example, a backup is restored to correct an employee’s pay but a corrected FPS for the period isn’t sent. With weekly, 2-weekly or 4 weekly payrolls there is sometimes confusion over where the weekly periods fit into the tax month boundaries. Based on your FPS submissions, HMRC will expect the remittance to cover all the pay periods between the 6th of the month and the 5th of the following month. The pay periods to include in the tax month are based on the pay date. If you produce your PAYE remittance report too early in the month, HMRC may be expecting a higher payment than you expect to make.

To correct this issue, first contact HMRC to try and identify the pay periods / employees causing the discrepancies and confirm how HMRC want the issue correcting. Gather as much detail as you can and contact our support team for further assistance if required.

Duplication of employee records has occurred on HMRC systems

This is the most difficult situation to resolve, fortunately, it is very uncommon. There is potential for duplication of employees (and therefore PAYE liabilities) in situations where someone takes over a payroll mid year e.g. when the same employees have been included in RTI submissions from 2 different payroll systems. Unfortunately, there is nothing you can send from payroll to correct this situation and it needs to be corrected directly by HMRC. If duplication of employee records has occurred we recommend you contact HMRC online services helpdesk on 0300 200 3600.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.