Processing Opt Outs & Pension Refunds under Auto Enrolment

Article ID

11667

Article Name

Processing Opt Outs & Pension Refunds under Auto Enrolment

Created Date

6th April 2018

Product

IRIS PAYE-Master

Problem

How do I refund pension contributions?

How do I opt-out an employee?

Resolution

The easiest way to opt an employee out of AE pensions is via the Company Pension Dashboard.

Please Note: The Company Pension Dashboard is available to IRIS PAYE-Master customers with the AE module on their licence.

For a full AE Pension guide, click here.

The Company Pension Dashboard

We have introduced the “Company pension Dashboard” to simplify the management of your AE pension schemes. From this single screen, you can process opt-ins. opt-outs, joins and cease contributions along with publishing your pension communications to the OpenEnrol service.

Where can I find the Company Pension Dashboard?

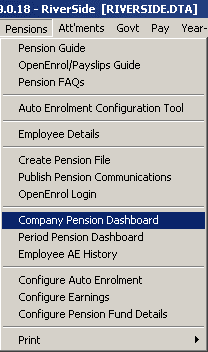

The dashboard is accessed from the “Pension” menu:

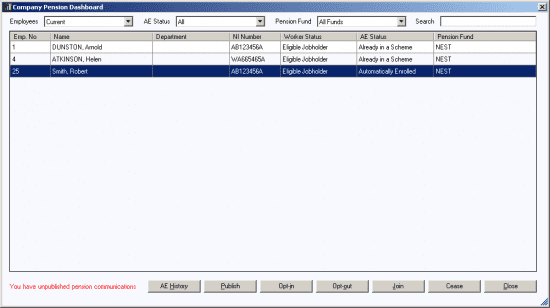

This screen will then show you a summary of the current AE status of your employees:

From here we can process employee Opt-ins, Opt-outs, joins and cease contributions.

Opt-out Employee

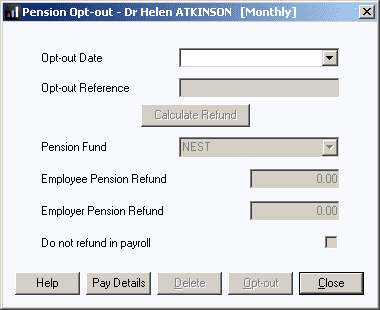

To opt-out an employee, click on their name in the Pension Dashboard list and then click the “Opt-out” button.

• Enter the Opt-out Date

• Enter the Opt-out Reference, this would normally be given to the employee by the pension provider when they inform them of their intention to opt out.

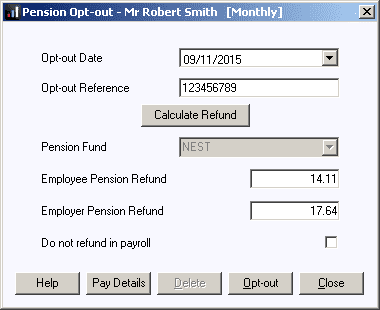

• Click Calculate Refund – a refund may be due to the employee/employer for deductions taken between the Pay Reference Period that includes the Opt-in Date or the AE Date (whichever is the latter) and the Opt-out Date for Automatic Enrolment pensions. Click Calculate Refund to automatically calculate the amount due, this value can be adjusted if required.

Click Pay Details for a breakdown of the periods and contributions used to calculate the refunds due.

Employee and Employer pension deduction standard values will be set to zero and the Pension Fund set to none.

If you do not want to issue the refunds in payroll, tick the option ‘Do not refund in payroll‘. With this option ticked, the payroll will not make any refund and the year-to-date values will not be altered

• Click Opt-out to complete the process

Please Note: The Calculate Refund button will only be enabled if refunds have not yet been processed in payroll. The current and year-to-date pension values on the FPS and Pension Output Files will be updated

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.