Correcting FPS submission

Article ID

11672

Article Name

Correcting FPS submission

Created Date

1st May 2019

Product

IRIS PAYE-Master, IRIS Payroll Business, IRIS Bureau Payroll, IRIS GP Payroll, IRIS Payroll Professional, Earnie

Problem

I've sent an FPS with the wrong information, how do I correct this?

If you have received an underpayment notification from HMRC check the information here:

PAYE-Master and GP Payroll users click here.

Payroll Business and Bureau Payroll users click here.

Earnie or Earnie IQ user click here.

Resolution

All of our payroll programs will allow you to send an FPS for a previously submitted period. There is currently no restriction in software OR HMRC about repeat submissions, HOWEVER, what you should do depends on the situation in payroll and what incorrect information has been sent.

Important Note: If you do resend any RTI submissions HMRC might recognise these as late, potentially incurring a fine. For this reason, we would recommend you make every effort to make any necessary corrections in the next pay period(s) where ever practical. You should contact HMRC to discuss the implications of these repeat submissions; employers helpline: 0300 200 3200, HMRC Online Services: 0300 200 3600.

FPS Submission sent without final submission of the year ticked

If you find that your last FPS should have been your final RTI submission for the year but it was sent without the box ticked you need to resend the FPS. This needs to be submitted before the 19th April. Tick the option for final submission and select the reason for late reporting as “H-Correction to earlier submission“.

If you have missed the 19th April deadline you will need to send an EPS marked as the final submission. Please note that your software may warn you about sending zero values or no changes as part of the submission wizard. You will need to skip past any such warnings and complete the submission.

FPS Submission skipped / missed / resend for previous period

In this case, simply go to send the FPS as you normally would but use the select week/month options to roll back to the appropriate period that was missed or needs resending. You will not need to undo or reprocess payroll to send this information.

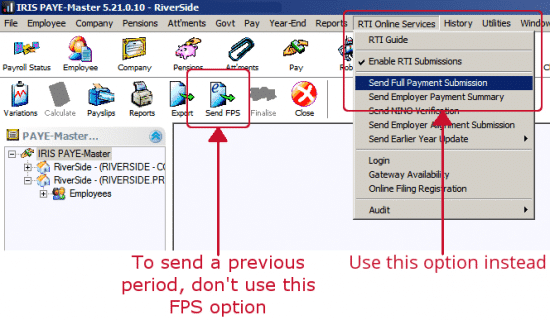

Important for PAYE-Master users: If you are using PAYE-Master you will need to use the menu option “RTI Online Services” > “Send Full Payment Submission“. The option from the menu will allow you to select a previous period to send, the regular option from the “Send FPS” button will only allow you to send the current period:

Prompt to complete an FPS submission after restoring a backup

The audit history for each of your RTI submissions is held in your company payroll data file. If you need to restore a backup this audit history will be reset to the status it had when that backup was created.

As such RTI submissions sent after that backup was created will not report as being sent. In this situation how you proceed depends on why the backup was restored.

If you haven’t made any changes that would affect tax/NI calculations or the amount of PAYE remittance for a month and you are certain HMRC did receive the original submission (check for their confirmation emails sent independently of your payroll software) you would not need to resend any submissions.

The software will warn you that it does see the submissions as being sent but in this instance, these can be ignored until you get back to your current pay period.

If you have made alterations in the payroll calculation you would need to resend each affected pay period.

You will most likely need to select a reason for late reporting, in this situation you should choose option “H – Correction to earlier submission“.

In-correct Employee personal details eg. Wrong address / wrong start date etc.

In this instance simply correct the details in the employee record and continue with payroll. The corrected details will be sent on the next submission.

PLEASE NOTE: If an employee’s personal details CHANGE, (eg Surname after getting married) the employee needs to contact HMRC to inform them of the change. Click here for details.

Wrong tax code / previous pay details / NI number

In this situation, it depends on what information, if any, has been received from HMRC.

For example, a new starter provides you with an out of date p45 and the tax code / previous pay details get sent to HMRC. If the employee then provides the correct p45 BEFORE you get a P6 / P9 message from HMRC, simply match the details of the P45 in payroll and continue as normal, the corrected details will be sent on the next FPS.

If HMRC have issued a P6/P9 message BEFORE the employee provides the correct P45 you should use the information supplied by HMRC. If the employee thinks this is incorrect THEY need to contact HMRC to confirm their employment / tax status.

Employee(s) pay is incorrect

How to correct this situation depends on if the employee actually got paid the incorrect amount or not.

Employees pay processed incorrectly and they actually got paid this amount:

The FPS you send to HMRC should match what the employee is paid. In this situation, the FPS is not technically wrong. The FPS for this period should NOT be amended and corrections should be made in the next payroll run. So in the case of an overpayment to an employee, a corresponding deduction should be made in the next period.

Underpayments are a little more difficult. If an underpayment to an employee is going to cause hardship before it can be corrected in the next pay run the best solution is to treat an additional payment to the employee as a company loan. A company loan doesn’t need to be reported to HMRC on an FPS. You would pay the employee an amount to cover the underpayment/prevent hardship before the next period. In the next pay period, you add the GROSS pay the employee missed out on in the last run. You should then make a NET deduction from the employee to pay back the company loan.

Employees pay processed incorrectly and sent on FPS but they actually received the correct amount:

In this situation the FPS you have sent IS incorrect. You should make sure the pay details for the employee are correct in payroll for the period and resend the FPS to correct the values ASAP. If this correction isn’t received before the employee actually gets the payment HMRC will treat this as a late submission and you could be fined.

The process for correcting a previous pay period varies between payroll software. Refer to the help files or search the knowledgebase for assistance.

Employees pay incorrect for a final payslip ie. They have left employment with the company.

The same rules apply as above, the FPS should reflect what the employee actually got paid. If the employee got paid the correct amount but the FPS was wrong you should restore the leaver and choose the option to correct the final payslip. Make the correction in payroll and send the updated FPS details. If the leaver actually received this incorrect amount the FPS isn’t incorrect. You should restore the leaver and choose the option for payment after leaving.

Special situation with leavers not paid in current period – For example, you run month 3 as normal. Before starting month 4 you get details of a leaver from the last period. Their pay was correct but there is nothing due in month 4. Under RTI, once you set a leave date, this gets included on the next FPS you send. Because the employee was last paid in month 3 the month 4 FPS could be recognised by HMRC as a late submission. In this situation we recommend, once you have set the employee as a leaver, resend the FPS for the period they were last paid selecting option “H – Correction to earlier submission” for the reason for late reporting. On the payroll software, where possible, send the FPS for this employee ONLY.

The payment values are correct but the payroll was run with the wrong pay date

This needs correcting first in payroll, the FPS will then be recreated with the correct details to be resent to HMRC. Again send this ASAP to avoid HMRC recognising a late submission.

Employee not marked as a leaver before FPS submission

For example, you receive the information regarding a leaver from a client late. In this situation, you will need to make sure your payroll records are correct in the software. This may require undoing pay period(s) or restoring a backup, depending on your software.

Once the pay record is corrected, and the leave date correctly entered, resend the FPS for the last period this employee actually received pay. Select the option to send for a single employee and choose the affected individual. You will most likely need to select a reason for late reporting, in this situation you should choose option “H – Correction to earlier submission”. After completing the “correcting” submission we would recommend you contact HMRC and verify they hold the correct closing YTD values for this employee.

Employee incorrectly sent as a leaver (or has returned to work with the company)

HMRC now permit employers to restore a leaver and then continue paying them as a current employee even if their leaving date has been sent on a Full Payment Submission.

However, this only applies in the current tax year; if you are restoring a leaver from a previous tax year, you can only do so to make a payment after leaving.

From now on, if you attempt to restore a leaver in the current tax year, and their leaving date has already been sent to HMRC, you will see the following message: “Are you restoring this employee to continue paying them or are you making a payment after leaving?”

Click ‘Yes’ to continue paying the employee or make an adjustment to their final pay

Click ‘No’ to make a one off additional payment to the employee after they left’

Important Note: If you do resend any RTI submissions HMRC might recognise these as late, potentially incurring a fine. For this reason, we would recommend you make every effort to make necessary corrections in the next pay period where ever practical. You should contact HMRC to discuss the implications of these repeat submissions; employers helpline: 0300 200 3200, HMRC Online Services: 0300 200 3600.

If you have received an underpayment notification from HMRC check the information here:

PAYE-Master and GP Payroll users click here.

Payroll Business and Bureau Payroll users click here.

Payroll Professional, Earnie or Earnie IQ user click here.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.