Assumed Pensionable Pay

Article ID

11717

Article Name

Assumed Pensionable Pay

Created Date

13th January 2020

Product

IRIS Payroll Professional, Earnie, IRIS Earnie IQ

Problem

What is the field assumed pensionable pay used for?

Resolution

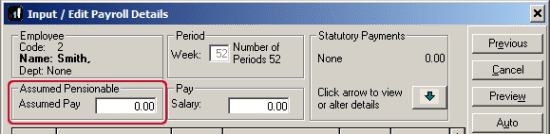

On pay variations, you will see the field “Assumed Pensionable Pay” underneath “Salary”.

Assumed Pensionable Pay is required by some employers to calculate employer pension contributions when an employee is receiving a reduced salary but the employer is not reducing their pension contribution.

If required, you need to enter this amount; payroll will not calculate it for you.

Assumed pensionable could also be referred to as “whole time equivalent” by the pension provider.

Essentially this means if an employee’s “normal” salary is reduced (E.G. due to sick leave) they will make their pension contribution on their actual (lowered) pay while the employer still makes contributions based on what they would normally be paid.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.