How to advance payroll (paying for more than one payroll period)

Article ID

11794

Article Name

How to advance payroll (paying for more than one payroll period)

Created Date

21st November 2019

Product

IRIS Payroll Business, IRIS Bureau Payroll

Problem

How can I pay an employee for more than one pay period?

Resolution

Normally this would only apply to a weekly payroll but periods can be advanced on any pay frequency in the same way.

Occasionally you may wish to pay employees for a period(s) in advance, ie during shut-down over Christmas you may want to pay employee for several weeks at once.

In this situation, we need to “advance” the tax weeks so the employees do not overpay tax & NI.

Go to “Pay” | “Enter Variations“

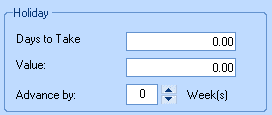

The option to advance is with the “Holiday” options:

In the box “Advance by:” type in the number of additional weeks you wish the calculation to run over. ie. If you type 1 into this box the system will apply 2 weeks of allowances to the calculation (current week + 1 additional week). If you type 2 into this box the system will apply 3 weeks worth of allowances to the calculation (current week + 2 additional weeks).

You do not need to type in anything else under the holiday options.

In the pay amounts record as temporary amounts what you wish the total pay across all periods to be (ie. 2x normal weekly pay).

Save the variations and repeat for each employee you want to advance. Once saved continue with your payroll as normal.

IMPORTANT NOTE: When you are advancing payroll in the manner there a few things to be aware of:

Because you are using the tax/NI allowances in advance you will not be able to pay these employees again until you come to the end of the advanced period.

When sending RTI submissions the values of payment for advanced employees will show on the last period they are advance to.

Payslips for advanced employees will show the period number as the period they are advanced to.

When exporting automatic enrolment pension data select the FROM and TO dates to cover the pay date shown on the payslips.

If your advance period straddles the change over of the tax year we recommend you actually process the periods as individual payments with their own payslips. You can pay the total NET pay in one payment in advance and send the FPS early for the periods that fall in the new year. Do select the option to send the FPS for a single/selected employees. If you pay via BACS you will need to amend the net pay value on the export before submitting to the bank.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.