Activating Employment Allowance - GP Payroll

Article ID

11812

Article Name

Activating Employment Allowance - GP Payroll

Created Date

6th April 2017

Product

IRIS GP Payroll

Problem

How do I activate employment allowance in IRIS GP Payroll?

Resolution

The option to claim employment allowance is available in GP Payroll but before activating this be aware, HMRC guidance states you can’t claim employment allowance if:

• You’re a public body or business doing more than half your work in the public sector(eg local councils and NHS services) – unless you’re a charity.

If you are unsure about your eligibility to claim employment allowance please contact HMRC for advice.

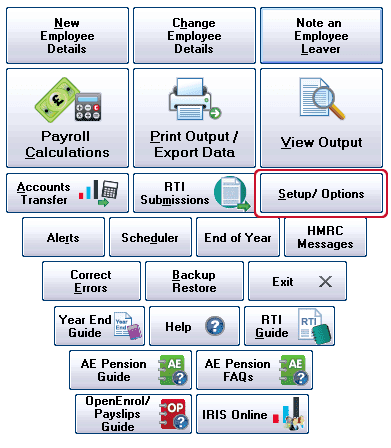

Employment allowance can be activated in “Setup/Options“:

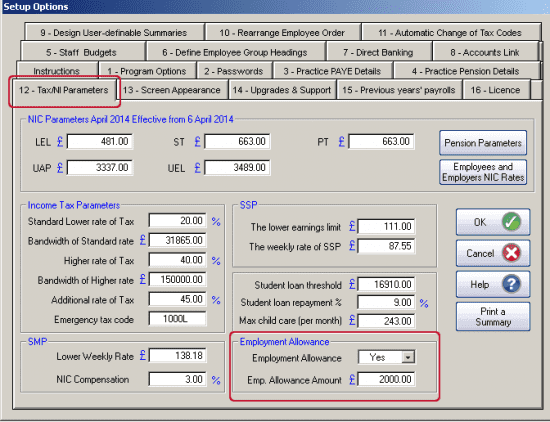

Open “Tab -12 – Tax/NI Parameters“:

Note: You should only alter the “Emp. Allowance Amount” value if you are taking over a payroll part way through a tax year. From tax year 2017/18 the Emp. Allowance Amount is £3000.00.

Once the employment allowance option is set to “Yes” the remittance reduction will be calculated when you print your month end reports.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.