Council Tax AEO calculation not correct

Article ID

11844

Article Name

Council Tax AEO calculation not correct

Created Date

11th March 2015

Product

IRIS Earnie IQ

Problem

User finds that the council tax AEO isn't calculating the correct deduction value.

Resolution

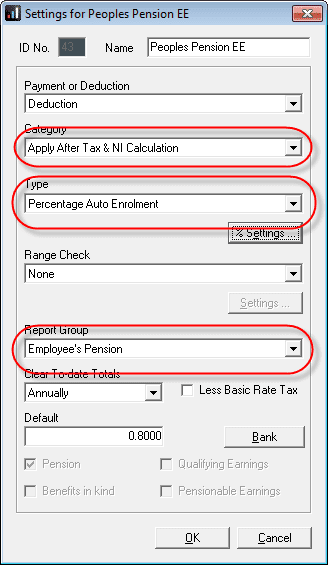

If you have a Pension setup you must make sure that the Report Group is set correctly, otherwise, there is the potential that Council tax will not be calculated correctly.

As part of the council tax calculation it takes gross pay and takes off tax, NI and after Tax/NI Pensions. It uses the report group to determine which pay/ded is a pension. This calculation has been in the software for quite sometime before automatic enrolment so, historically, the report group was the only way to determine if a pay/ded is a pension.

To calculate Council Tax correctly the report group ‘Employee’s Pension’ must be set for Employee pension deductions so the calculation can work correctly.

Example Employee’s Pension Deduction Setup:

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.