Correcting Employee PAYE totals for a previous tax year

Article ID

11871

Article Name

Correcting Employee PAYE totals for a previous tax year

Created Date

1st September 2020

Product

IRIS GP Payroll

Problem

An earlier year update (EYU) is used to correct the PAYE totals for an individual employee for a previous tax year for tax years 2017/18 or earlier.

EYU No Longer Required to update 18/19 PAYE Values after 19th April 2019

For amendments to data for 2018/2019 tax year onwards, HMRC have removed the restriction of the 19th April, allowing you to submit an FPS to update their records. For tax year 2018/2019 you can submit an EYU or an FPS to report amended data, however, you need to choose one method for reporting amendments for the whole tax year.

Please Note: For ammendments to the 19/20 tax year, you will no longer be able to use Earlier Year Update (EYU) to amend data. All changes will be via FPS.

An EYU will still be required if you are amending data for tax years 2017/2018 or earlier.

Using an FPS to correct earlier year totals

There is no difference between your normal FPS and one used to correct a previous years PAYE totals, both follow the same formatting rules.

However, there are a few things to note if you are using an FPS to correct previous year totals.

• Late Reporting Reason: The reason for late reporting must be completed. You must select the option H - Correction to earlier submission.

• The payment date that should be shown: As the format of the FPS isn’t changing it should be completed to include the latest payroll information. I.e. payment date, monetary values; leaving date etc.

As the FPS will be an adjustment to the pay in that tax year the payment date should be equal to, or later than, the last payment date reported in that year to ensure HMRC records are updated.

For example:

a) An individual is in employment all year and the final FPS for the year is submitted on 30 March 2019, with a payment date of 30 March 2019

b) It is then identified in June 2019 that an error occurred in their Month 11 FPS. The FPS should include the final pay date of 30 March 2019 (as the latest pay date in that tax year) and amended monetary values.

Remember, with an FPS, you can send multiple or individual employees on a submission. Take care to only include employees that need their PAYE values for the tax year changing.

Payroll Process

• Create a back up of your current payroll position

• Restore a backup to year-end data for the affected tax year

• Rollback the employee(s) Using the option "Correct Errors" | "Delete the record of a single payslip" deleting the payslips from newest to oldest, back to the period the correction needs to be applied.

• Apply any necessary corrections to the pay record and run employee payroll back up to year end(or when they were a leaver if they left your employment before the end of the tax year).

• Send your correcting FPS with the payroll date in your software set to match the last pay date originally send for this employee(s)

• If the changes you have made have affected statutory payment recovery or compensation or affected totals for the Apprenticeship Levy you will also need to send an EPS to correct the year to date values.

• Restore back to your current payroll position using the back up taken at the start of this process

Resolution

If you are correcting PAYE totals for an employee in tax year 2017/18 or earlier, you must still use an EYU

Before beginning, a few things to note:

• The EYU sends only employee data. Company-level information such as ceased trading date, apprenticeship levy, etc is not included on an EYU

• If you are correcting statutory payment recovery or compensation values or CIS deductions suffered, these are sent on an EPS submission. HMRC will still accept EPS submission for previous tax years. An EYU submission will NOT affect these values.

• If you are trying to correct employee PAYE totals before the 19th April of the following tax year (tax years run from the 6th April to the following 5th April) you will still be able to send through an FPS with these corrections. When prompted for the reason for late reporting select option “H-Correction to earlier submission“. HMRC only accept these changes via an FPS prior to the 20th April in the current tax year. If the date is on or after 20th April, use the Earlier Year Update facility to submit the new details to HMRC.

• The Earlier Year Update can only be sent for a single employee at a time, you cannot select multiple employees.

• With the earlier year update you are sending the DIFFERENCE between the correct figures and what the HMRC already have on record. It is important, therefore, that before making any submissions you are absolutely sure what values HMRC currently hold on record.

EYU No Longer Required to update 18/19 PAYE Values after 19th April 2019

For amendments to data for 2018/2019 tax year onwards, HMRC have removed the restriction of the 19th April, allowing you to submit an FPS to update their records. For tax year 2018/2019 you can submit an EYU or an FPS to report amended data, however, you need to choose one method for reporting amendments for the whole tax year.

An EYU will still be required if you are amending data for tax years prior to 2018/2019.

Please Note: starting for tax year 2019/2020, you will no longer be able to use Earlier Year Update (EYU) to amend data. All changes will be via FPS.

PLEASE NOTE: While the video below refers to the EYU for 14/15, the process has not changed for correcting totals for the 15/16 tax year.

To submit an Earlier Year Update

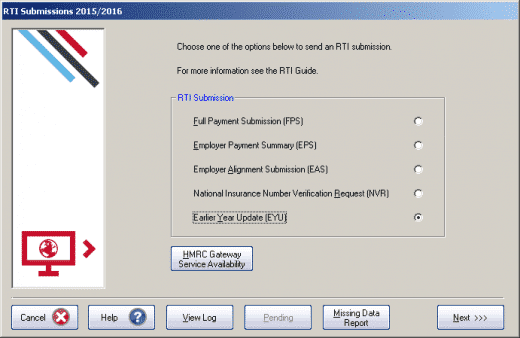

• From the main screen, select RTI Submissions (we recommend you take a backup of your current data first)

• Select Earlier Year Update (EYU) and click Next

• Select the employee and click ‘Employee YTD Values‘ to print a record of the employee’s year to date values that have already been submitted via FPS

• Either recalculate the payroll for the employee for month 12 or click “Change Employee Details” > “Cumulative Figures” then select “View/Change the cumulative figures for tax, NIC, SSP, SMP in any month” and enter the amended year to date figures.

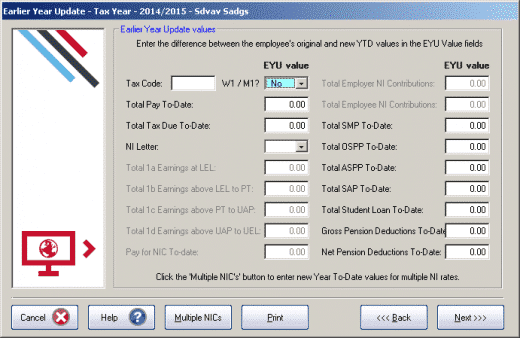

• Manually calculate the difference between the year to date values originally submitted via FPS and the new year to date values

• From the RTI Submissions button on the main screen, select ‘Earlier Year Update’ and click ‘Next’

• Select the tax year and the employee from the drop down lists and click ‘Next’

• Click ‘Yes’ to confirm that the correct tax year and employee have been selected, ‘No’ to cancel and return you to the Select Employee screen

• Enter the difference between the employee’s original year to date values and new year to date values in the EYU value fields

• If the employee had more than one NI letter during the tax year, click ‘Multiple NICs’ to enter the differences between the original year to date values and the new year to date values then click ‘OK’ to save the changes

• If required, click ‘Print’ to obtain the Earlier Year Update – Submitted values for <current tax year> report then ‘Next’

• The Final Confirmation screen will be displayed, click ‘Send’ to start the submission

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.