Correcting Previous Years Employment Allowance Status

Article ID

11890

Article Name

Correcting Previous Years Employment Allowance Status

Created Date

6th April 2017

Product

IRIS PAYE-Master

Problem

I didn't claim for employment allowance for the previous tax year, can I still claim?

Resolution

You can claim employment allowance for a previous tax. In order to correct the employment allowance status with HMRC, you will need to send another EPS (employer payment summary) to HMRC for the affected tax year. Unfortunately, this cannot be completed using the year-end data option from the File drop down menu and should be completed by restoring a backup.

PLEASE NOTE: While this KB focus is on correcting the previous tax year, the same principal applies to all previous tax years. At the stage below when restoring a backup you will need to select one taken during the appropriate tax year and follow the rest of the steps. The first tax year employment allowance was introduced was 2014/2015.

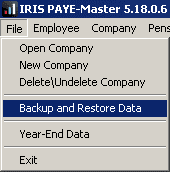

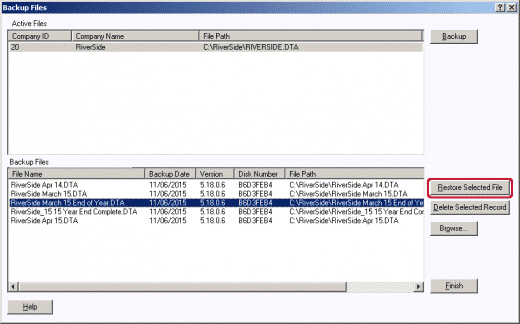

• First, make a backup of your current year payroll. Go to “File” > “Backup and Restore Data” highlight your company and click “Back Up“

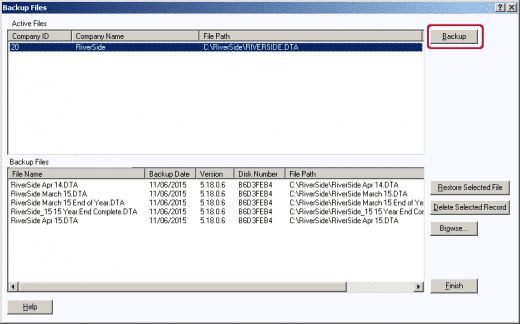

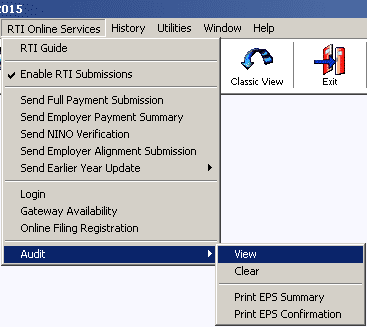

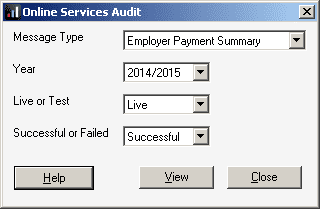

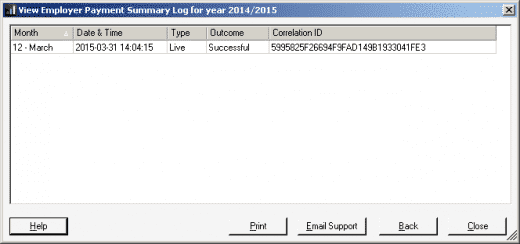

• Now you have a copy of your current data, you need to check your EPS submission history for 15/16. Go to “RTI Online Services” > “Audit” > “View“.

• Select “Employer Payment Summary“, “2015/2016“, “Live” and “Successful” and click “OK“.

• This will then show the audit log of your successful 15/16 EPS submissions.

• You should have at least one successful EPS in this list. If there are no successful submissions shown you didn’t inform HMRC of your intention to claim employment allowance.

• Go to “File” > “Backup and Restore Data” highlight your company. Then select a backup taken at the end of the previous tax year and click “Restore Selected File“. Enter your password when prompted and the system will restore you back to the selected period.

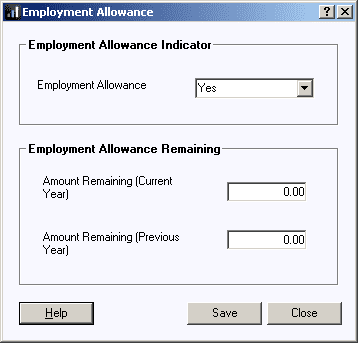

• Once you have restored back go to “Pay” > “Employment Allowance“. You should see the employment allowance status like so:

• Change the “Employment Allowance Indicator” to “No“. Click “Save” and “Close”

• Go back into “Pay” > “Employment Allowance“, change the “Employment Allowance Indicator” to “Yes“. Click “Save” and “Close“.

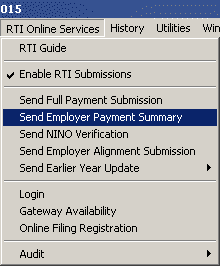

• The EPS is ready to resend, go to “RTI Online Services” > “Send Employer Payment Summary“.

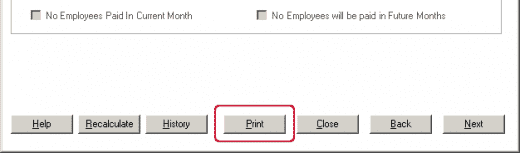

Click “Next“. On the 2nd window, click “Print”

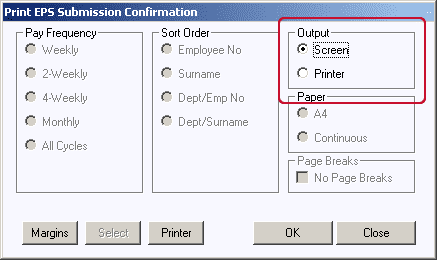

• Select the “Output” as “Screen” and click “OK”

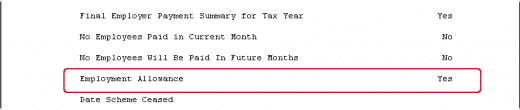

• On the report preview make sure employment allowance shows as “Yes”

• Close the report preview and complete and send the EPS.

• HMRC should now have the correct employment allowance status for the tax year.

• Lastly, go to “File” > “Backup and Restore Data” highlight your company. Then select the backup of your current data you made at the start of this process. Click “Restore Selected File“. Enter your password when prompted and the system will restore you back to the current pay period.

Unable to load company information

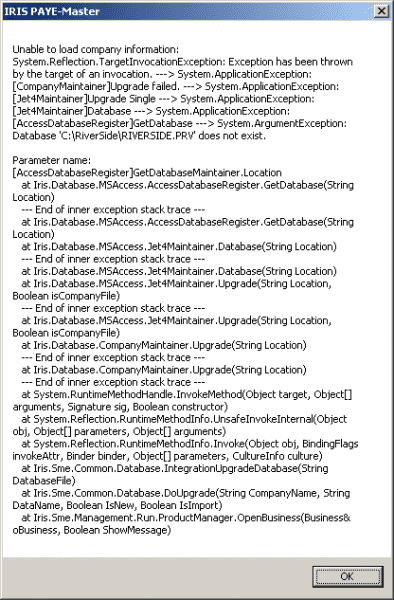

PLEASE NOTE: If you get the following error when you click save after changing the employment allowance status:

This error occurs because you have used the option “File” > “Year-End Data“. This will not work, you must restore a backup as detailed in the steps above.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.