What is a week 1 month 1 tax code?

Article ID

11897

Article Name

What is a week 1 month 1 tax code?

Created Date

1st May 2019

Product

IRIS PAYE-Master, IRIS Payroll Business, IRIS Bureau Payroll, IRIS GP Payroll, IRIS Payroll Professional, Earnie, IRIS Earnie IQ

Problem

What is a week 1/ month 1 tax code? How is this calculated differently from a normal tax code?

Resolution

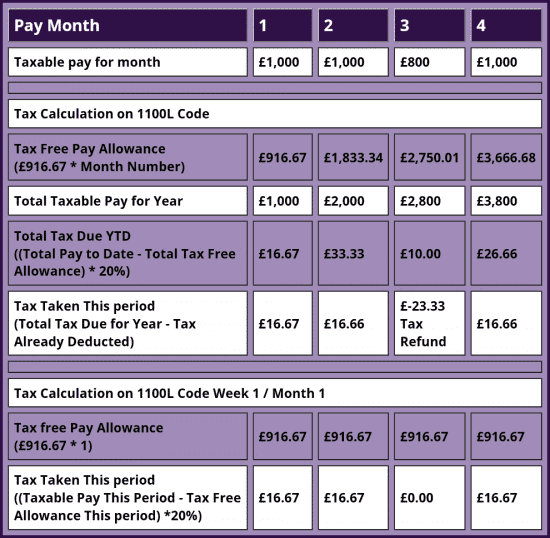

When you use the option week 1/ month 1 with a tax code the software will calculate an employees tax based only on the taxable pay they receive in that pay period and their tax-free allowance for that pay period.

Normal tax calculations work on the total pay an employee has received for the whole tax year against their total tax-free allowance at that point in the year.

Example:

Please Note: The following example is designed to illustrate the difference between week/month 1 tax code and a cumulative tax code only. Under no circumstances should this be taken as advice on what tax code you should use or what tax deductions you should expect.

Employee is on 1100L tax code, paid monthly this is £916.67 tax-free pay each month (£11,000 ÷ 12)

PLEASE NOTE: These values are for illustrative purposes only assuming a flat 20% tax rate.

You can see the difference in month 3 when the employees pay drops. Using the week 1 month 1 option the employee pays no tax. Using the normal cumulative option the employee actually gets a tax refund.

When using a week 1 / month 1 tax code employees will usually pay slightly more tax. This is normally used as a temporary measure when taking on a new starter and we do not know what their earnings have been at a previous employment in the current tax year.

When you create a new employee record and select one of the starter form options the software will apply the correct week 1 / month 1 status to the tax code. HMRC will send messages to the registered contact for the PAYE scheme to inform them if this tax code needs to be amended.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.