Processing Redundancy Pay

Article ID

11922

Article Name

Processing Redundancy Pay

Created Date

19th August 2020

Product

IRIS Payroll Business, IRIS Bureau Payroll

Problem

How to set up and use pay code for redundancy payments

Resolution

Redundancy payments under £30,000 are normally tax and NI free. From the 2020/21 tax year any amounts above this figure will subject to tax and employers class 1A NI contribution.

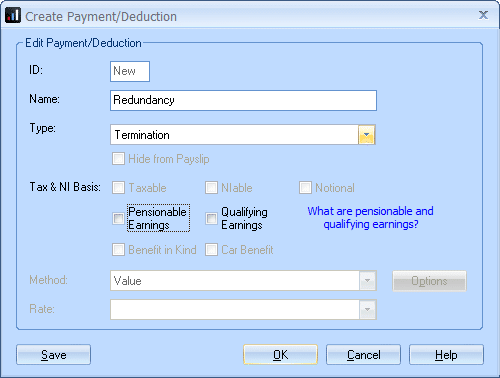

In order to do this you will need to create a new payment code

• Go to “Company” > “Payments & Deductions” > “Configure Payments & Deductions“

• Click “Add new“

• You will need to type in a name for the payment. This is how the item is shown on the payslip.

• Set the Type to “Termination“

• Other options will set automatically.

• Click “OK” to save the payment:

When you use this payment code you no longer need to split redundancy payment over/under £30,000 as was the previous method.

This new payment type will automatically be tax/NI free for values under £30,000. If you use the code with a value over £30,000 tax will be deducted and employers class 1 NIC will be calculated correctly.

Please Note: There is still no employees NI contribution on redundancy payments over £30,000.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.