Guide to Configuring Salary

Article ID

11998

Article Name

Guide to Configuring Salary

Created Date

1st January 2019

Product

IRIS Payroll Business, IRIS Bureau Payroll

Problem

How do I configure an employees salary?

Resolution

In the payroll, gross pay is made up of Salary, Hourly Rates, Payments and Deductions, Attachment of Earnings Orders, Pensions and Loans.

In this KB we will explain how to configure a Salary Payment.

For details on configuring other Payments or Deductions, Click here

For details on configuring Hourly rates and Overtime Factors, Click here

For details on configuring Attachment of Earnings Orders, Click here

For details on configuring Pensions, Click here

For details on configuring Loans, Click here

The most common use for salary is for monthly-paid employees but IRIS Payroll allow you to enter a salary for employees with any Pay Frequency. For this description we will assume the employee is paid monthly.

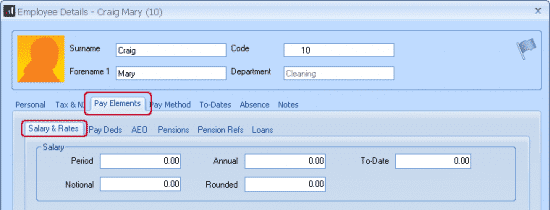

The employee’s Salary is entered in the “Employee Details” > “Pay Elements” > “Salary & Rates” tab.

You can either enter the Annual Salary or the Period Salary (the salary that the employee receives each pay period, in this case each month). If you enter the Period Salary, IRIS Payroll multiplies it by the number of periods (12 in this case) and displays this in the Annual Salary field.

If you enter the Annual Salary, IRIS Payroll divides it by the number of pay periods (12), then rounds the result to 2 decimal places and puts this figure in the Period Salary field. The Annual Salary should always be the Period Salary multiplied by the number of pay periods, so IRIS Payroll adjusts the Annual Salary up or down a few pence – this will not be updated until you have clicked away from the Annual Salary field.

Example

If you enter 23000.00 in the Annual Salary field, the figure 1916.67 appears in the Period Salary field – if you then click in the Rounded field (or any other field) the figure in the Annual Salary field changes to 23000.04.

If you want to keep a record of the original Annual Salary figure you can enter it in the Rounded field.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.