Pay dates and the HMRC Tax Calendar

Article ID

12019

Article Name

Pay dates and the HMRC Tax Calendar

Created Date

1st March 2020

Product

IRIS PAYE-Master, IRIS Payroll Business, IRIS Bureau Payroll, IRIS GP Payroll, IRIS Payroll Professional, Earnie, IRIS Earnie IQ

Problem

What tax period does my pay date fall into? How does the HMRC tax calendar work?

Resolution

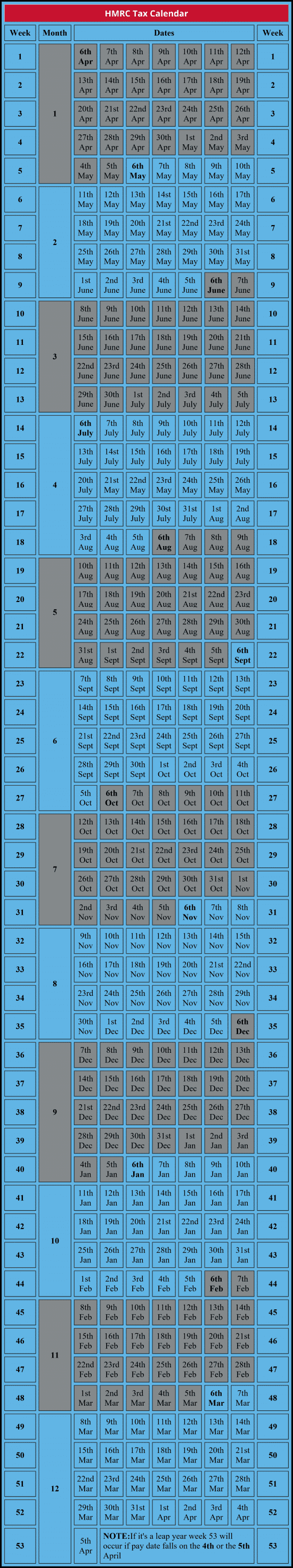

HMRC (Her Majesty’s Revenue and Customs) use their tax calendar to break payroll dates into tax weeks/months. This calendar is fixed and does not change year on year. The tax week/month is always based on the pay date for the period, eg. when the employee actually gets their pay.

• Tax Months always start on the 6th and run to the following 5th eg. Tax Month 1 – 6th April – 5th May

• Tax week 1 starts on the 6th April and runs to 12th April, subsequent weeks run on from that date.

• If you run a 2-weekly payroll you will always process with the 2nd week’s number eg. week 2, 4, 6, 8, 10, etc.

• If you run a 4-weekly payroll you will always process with the 4th week’s number eg. week 4,8,12,16,20, etc.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.