Uplift of minimum AE pension contribution rates

Article ID

12166

Article Name

Uplift of minimum AE pension contribution rates

Created Date

1st May 2019

Product

IRIS PAYE-Master, IRIS Payroll Business, IRIS Bureau Payroll, IRIS GP Payroll, IRIS Payroll Professional, Earnie, IRIS Earnie IQ

Problem

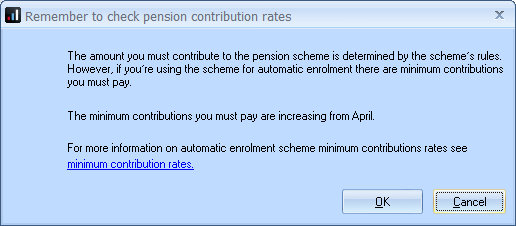

From the 6th April 2019 the minimum contributions for automatic enrolment pensions are increasing.

During the year end restart process you will see the following message:

After completing your year end restart to move into 19/20 tax year you must check your contributions before processing payroll.

Resolution

Click here for Pension Contributions Uplift Guides

How are the contributions changing?

Minimum contributions are changing in line with the table below:

| Date | Employer minimum contribution | Total Minimum contribution |

| Staging Date – 05/04/18 | 1% | 2% (including 1% staff contribution) |

| 06/04/18 — 05/04/19 | 2% | 5% (including 3% staff contribution) |

| 06/04/19 onwards | 3% | 8% (including 5% staff contribution) |

To comply with legislation you must meet or exceed the minimum contributions.

How do I update the contributions?

This process will depend on which payroll software you are using. Please follow the link below for video and written guides for each of our payroll products.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.