Director NI Calculation Issue in Final Period of the Tax Year

Article ID

12200

Article Name

Director NI Calculation Issue in Final Period of the Tax Year

Created Date

15th March 2019

Product

IRIS Payroll Professional, Earnie

Problem

An issue has come to light in IPP/Earnie with the directors National Insurance calculation in the final period of the tax year.

Users will be affected if:

• Payroll was started in the software mid tax year &

• Employees were set up with initial figures typed in &

• Directors ticked in the software and set since week 1 &

• The normal NI option was also activated for Directors

Update: This issue has been corrected in v1.32.45, please update to the version to prevent this issue.

Resolution

Update: This issue has been corrected in v1.32.45, please update to the version to prevent this issue.

https://www.iris.co.uk/updates

Advice prior to v1.32.45

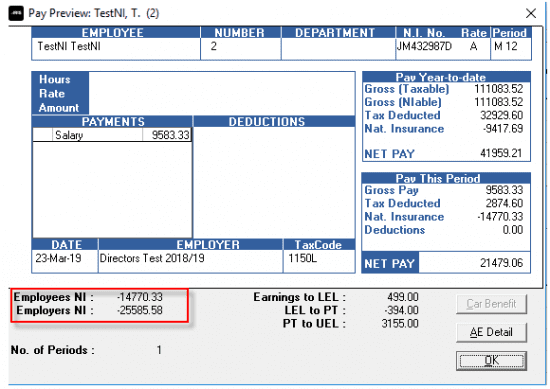

In the scenario detailed above when you calculate the payroll for the director(s) final period of the tax year the NI calculation will be incorrect:

Example:

In order to correct this problem, the final period of the tax year needs to recalculated (ie. calculated twice).

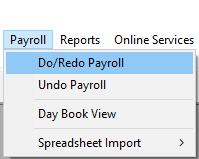

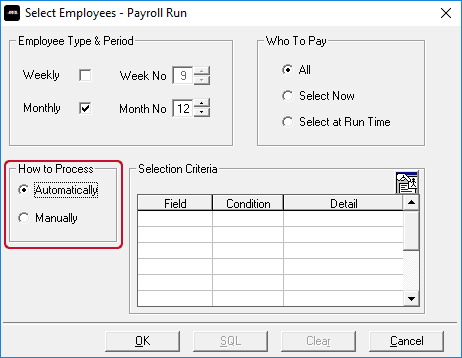

Run your payroll as normal working through and entering and saving any variations as necessary. Once you have worked through and saved all your variations in payroll go to Payroll | Do/Redo Payroll to bring up the Payroll Run options:

On the payroll run options select the option How to Process: Automatically and click OK.

This will trigger payroll to recalculate the period using the same variations you have previously entered.

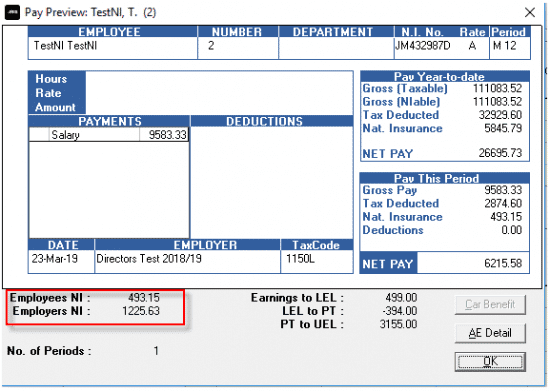

Once this process is complete the Director NI calculation will be correct:

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.