Overview of changes for 2021/22 tax year

Article ID

12243

Article Name

Overview of changes for 2021/22 tax year

Created Date

5th March 2021

Product

IRIS PAYE-Master, Earnie, IRIS Earnie IQ, IRIS GP Payroll, IRIS Bureau Payroll, IRIS Payroll Business

Problem

Here we will briefly discuss the PAYE legislation changes for the 21/22 tax year.

Resolution

Click here for a printable version of this information

Please see www.iris.co.uk/PAYElegislation for fact cards and pension details.

Off Payroll Working

The legislation for Off-Payroll Working (IR35) in the private sector is being implemented in April 2021. It was initially planned for April 2020 and was delayed by the Government due to the COVID-19 outbreak.

Off-payroll working rules are more commonly known as IR35. This legislation allows HMRC to

collect additional payments, where a worker provides their services through an intermediary to

another person or entity. The intermediary in this case is another individual, a partnership, an unincorporated association, or a company. Off-payroll working rules are changing from 6th April 2021.

From 6th April 2021, all public sector clients and medium or large private sector clients will be responsible for deciding a worker’s employment status. This includes some charities and third sector organisations.

If the off-payroll working rules apply, the fee payer (the public authority, agency or other third party who is responsible for paying the worker’s intermediary) must:

- Calculate a deemed direct payment to account for employment taxes associated with the contract

- Deduct those taxes from the payment to the worker’s intermediary

- Report taxes deducted to HMRC through RTI, Full Payment Submission (FPS)

- Pay the relevant NICs

Here are some useful links with further HMRC guidance on Off-payroll working:

- Understanding-off-payroll-working-ir35

- Fee-payer-responsibilities-under-the-off-payroll-working-rules

- Private sector off-payroll working for intermediaries

- Public sector off-payroll working for clients

- Preparing-for-changes-to-the-off-payroll-working-rules-ir35

Deemed Direct Payment

The deemed direct payment is the amount paid to the worker that should be treated as earnings

for the purposes of the off-payroll rules.

To calculate the deemed direct payment, you must:

- Work out the value of the payment to the worker’s intermediary, having deducted any VAT

due - Deduct the direct costs of materials that have, or will be used in providing their services

- Deduct expenses met by the intermediary, that would have been deductible from taxable

earnings if the worker was employed - The result is the deemed direct payment. If this is nil or negative, there is no deemed

direct payment

Employment Allowance

Off-payroll Workers’ NI Liability cannot be offset against employment allowance. For instance:

▪ Company has 10 workers who are all off-payroll workers. The NI liability is £3,500.

Employment Allowance claimed would be zero

▪ Company has 10 workers where 5 are off-payroll workers and 5 are employees. The

NI liability is £3,500 – £2,000 from off-payroll workers and £1,500 from employees.

The Employment Allowance in this instance would be £1,500

Student Loan Thresholds

With effect from Tax Year 202102022, the Government has introduced Student Loan Plan Type

04 Scotland. HMRC will determine who should be on this new plan type and will issue

instructions via DPS.

Payroll Calculations

Although the threshold differs when calculating Student Loan Plan Type 4, there is no change

to the rate or method when calculating student loan deduction.

Thresholds

The annual thresholds have been updated in line with legislation for 2021/2022.

- Plan Type 1 increased from £19,390 to £19,895

- Plan Type 2 increased from £26,575 to £27,295

- Plan Type 4 is £25,000

- Postgraduate Student Loans remains at £21,000

- Student Loan rate is 9%

- Postgraduate Loan rate is 6%

RTI – Earlier Year FPS

It is now possible to send a Full Payment Submission (FPS) for a previous tax year and after 19th April in the current tax year. From 2020/2021 onwards, you can no longer send an Earlier Year Update (EYU) to correct any mistakes made in the previous tax year – you can only send an EYU for submissions up to Tax Year 2019/2020.

Starter Checklist

HMRC have made some changes to the Starter Checklist.

HMRC have updated statements A, B and C The new statements are:

- Statement A: Do not choose this statement if you’re in receipt of a State, Works or Private Pension. Choose this statement if the following applies. This is my first job since 6 April and since the 6 April I’ve not received payments from any of the following:

- Jobseeker’s Allowance

- Employment and Support Allowance

- Incapacity Benefit

- Statement B: Do not choose this statement if you’re in receipt of a State, Works or Private Pension. Choose this statement if the following applies. Since 6 April I have had another job, but I do not have a P45. And/or since the 6 April I have received payments from any of the following:

- Jobseeker’s Allowance

- Employment and Support Allowance

- Incapacity Benefit

- Statement C: Choose this statement if:

- you have another job and/or

- you’re in receipt of a State, Works or Private Pension

National Minimum Wage and National Living Wage

For April 1st 2021, HMRC has revised the National Minimum Wage (NMW) and National Living

Wage (NLW) age brackets and rates. Two of the age brackets have been changed:

| National Minimum & Living Wage – Age | Rate from April 20 | National Minimum & Living Wage – Age | Rate from April 21 |

| 25 and over | £8.72 | 23 and over | £8.91 |

| 21–24 | £8.20 | 21–22 | £8.36 |

| 18–20 | £6.45 | 18–20 | £6.56 |

| 16–17 | £4.55 | 16–17 | £4.62 |

| Apprentice Rate | £4.15 | Apprentice Rate | £4.30 |

CIS Reverse Charge VAT

From 1st March 2021, the domestic VAT reverse charge must be used for most supplies of

building and construction services. This does not change the way VAT on supplies is accounted

for. The supplies recipient accounts for the VAT, instead of the supplier charging and accounting

for it. This relates to supplies of specified services, together with goods supplied with those

services. The charge applies to standard and reduced-rate VAT services. You are required to use

the reverse charge if you’re VAT registered in the UK, you supply building and construction

services and:

- Your customer is registered for VAT in the UK

- Payments for supplies are reported within the Construction Industry Team (CIS)

You should:

- Check your customer has a valid VAT number

- Check their CIS registration

- Review contracts to decide if the reverse charge is applicable, and inform your

- customers

- Confirm with customers if they are an end user or an intermediary supplier

The types of construction services covered by the reverse charge are defined in the statutory

instrument. These are based on the definition of ‘construction operations’ used in CIS under

Section 74 of the Finance Act 2004 but, will only apply to supplies where payments are required

to be reported for CIS purposes under regulation 4 of the Income Tax (Construction Industry

Scheme) Regulations 2005.

The statutory instrument excludes certain types of supplies of services. This is also based

on CIS definitions under Section 74 of the Finance Act 2004.

The statutory instrument also excludes supplies of specified services to end users. These are

customers that have to report their payments for specified supplies through CIS but do not make

supplies of specified services themselves.

Also excluded are supplies of specified services where the supplier and customer are connected

in a particular way, and for supplies between landlords and tenants. The meaning of connected

is defined in the statutory instrument and only applies where the customer is an end user and

the supplier is part of that customer’s corporate group. These exclusions are defined in the

statutory instrument as excepted supplies. Unlike for CIS, there will be no deemed contractor

provisions whereby purchases become subject to reverse charge because the purchaser buys a

certain amount of such purchases in a given period.

Where a VAT-registered business receives a supply of specified services (which are not excepted

supplies) from another VAT-registered business that become liable to the reverse charge, the

VAT treatment is as follows for invoices with a tax point of:

- Before 1st March 2021 – normal VAT rules will apply. You should charge VAT at the appropriate rate on your supplies

- On or after 1st March 2021 – the domestic reverse charge will apply

The business accounts for that VAT amount through its VAT return instead of paying the VAT

amount to its supplier. It will be able to reclaim that VAT amount as input tax, subject to the

normal rules. The supplier will need to issue a VAT invoice that indicates the supplies are subject

to the reverse charge.

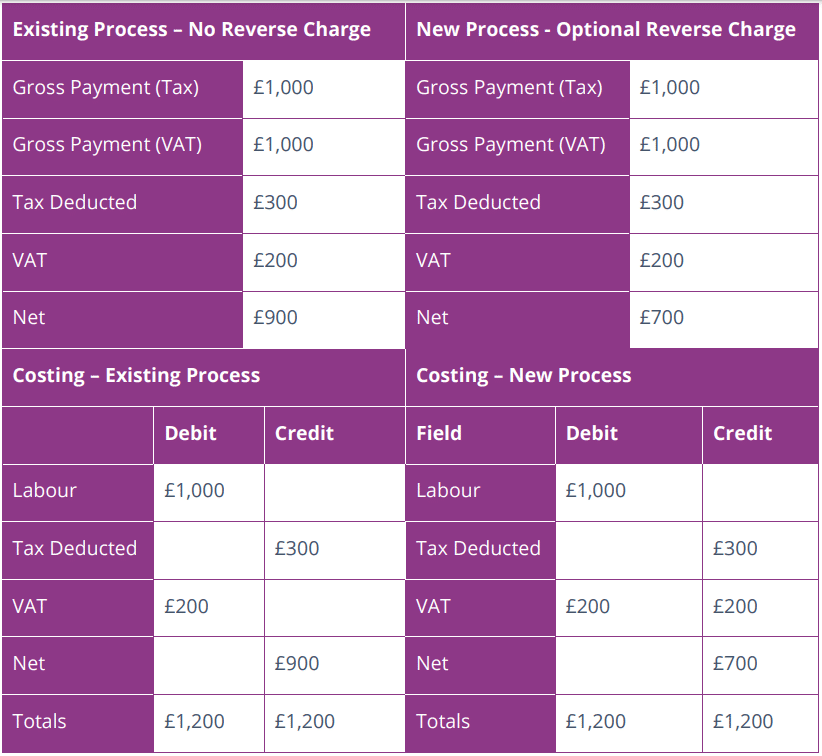

Example of No Reverse Charge v Reverse Charge

Here is an overview of the figures, assuming Tax @ 30% and VAT @ 20%

Click this link for information regarding the VAT reverse charge

NIC Holiday for Veterans

Following a consultation period, from April 2021, HMRC have introduced new legislation for NIC

Holiday for Veterans. This legislation gives NIC relief to veterans in their first year of civilian

employment. The relief is available for employers from April 2021 and there are transitional

arrangements in place until April 2022, at which point employers will be able to claim through

PAYE. IRIS will update the payroll software in readiness for this change in April 2022. Employers

will be able to make a claim to HMRC from April 2022 for Employer NICs paid on the salaries of

eligible veterans employed between April 2021 and March 2022.

Click here for a printable version of this information

Please see www.iris.co.uk/PAYElegislation for fact cards and pension details.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.