How do I change an employees pay frequency ie. weekly to monthly?

Article ID

8335

Article Name

How do I change an employees pay frequency ie. weekly to monthly?

Created Date

1st January 2019

Product

IRIS Payroll Business, IRIS Bureau Payroll

Problem

How do I change an employee's pay frequency?

Resolution

Let’s consider the example of a weekly employee moving to a monthly pay frequency.

The first thing to consider is whether the month they are next due to be paid will overlap any tax weeks already paid on the Tax Calendar. It is best practice to try and make a change at a natural switching point ie paid up to week 4 and moved to monthly to pick up at month 2. If you cannot practically make the change at a natural switching point don’t worry, the software will calculate overlapping periods correctly but be aware the employee could pay considerably more tax for the first period of the new pay frequency.

Once you have decided on your switching point you will need to set up the payroll calendar for the new frequency. Go to “Company” | “Payroll Calendar”. Click next until you see the page for the new pay frequency. In the box at the top of this window type in the 1st pay date you wish to use on the new frequency.

For more details on the payroll calendar, click here.

Lastly, go to the ‘Tax & NI’ Tab in the employee’s record, select ‘monthly’ from the ‘Pay Frequency’ drop down menu.

If your weekly and monthly payroll are split over two (or more) company files:

If you have split your pay frequencies over multiple payroll companies the situation is a little more complicated.

In order to prevent the employee from being paid in the original company/pay frequency, they will need to be set as a leaver. However, in this situation, you would NOT want to send this leave date on an FPS to HMRC.

To achieve this, before setting the employee as a leaver, we need to enable a system setting:

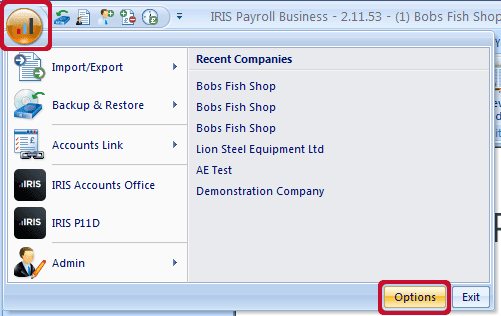

Click on the round menu button in the top left-hand corner and then click on “Options”:

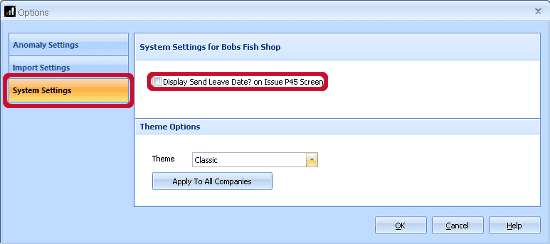

On the options window go to “System Settings” and tick the option “Display Send Leave Date? on issue P45 Screen”:

Click “OK”.

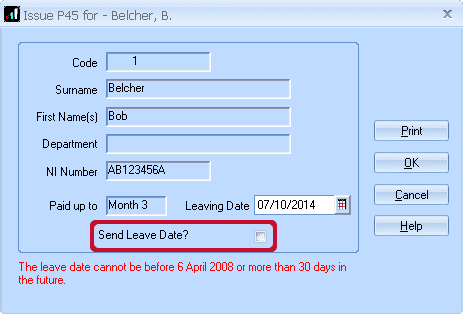

With this option enabled you will now see an additional option when you go to P45 a leaver:

If you untick this option BEFORE you click “OK” the employee will stop being available to pay in this company, but the leave date will not be sent to HMRC. You can now set up a new record for the employee under the new company/pay frequency.

NOTE: These steps apply when moving an employee from one payroll company file to another under the same PAYE reference number, regardless of the reason for the move.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.