Payment made to an employee after they have left

Article ID

8685

Article Name

Payment made to an employee after they have left

Created Date

19th May 2015

Product

IRIS GP Payroll

Problem

I need to make an additional payment to an employee after I've sent them marked as a leaver on an FPS.

Resolution

If you are recalculating the employee’s final pay

(amending the final payslip, not making another payment)

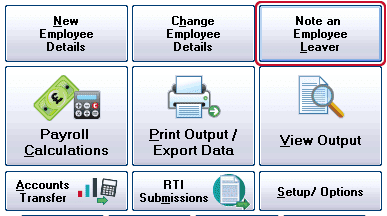

- From the main screen, click on ‘Note an Employee Leaver’:

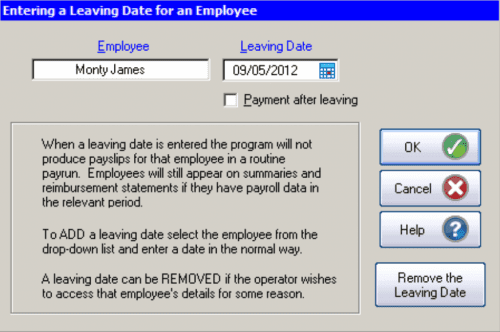

- Select the relevant employee from the drop-down list of employees

- Select ‘Remove the Leaving Date’:

The system will check if the employee has already appeared on an FPS as a leaver. If they have, a warning message will appear:

‘Are you restoring this employee to make adjustments to their current pay rather than making an additional payment after the employee has left?‘

Note: HMRC systems will now allow you to restore a leaver and continue paying them permanently, without having to set up a new employee record. If the employee was marked as a leaver in a previous tax year you still need to create a new employee record.

- Click‘Yes’ to restore the leaver

- Make adjustments as required to the employee’s current pay period

- Remember to enter the Leaving Date again via ‘Note an Employee a Leaver’ prior to sending the FPS. If you wish to carry on paying this employee (ie. they were set as a leaver by mistake, or they decided not to leave) do not re-enter the leave date, carry on with payroll as normal.

If you are making an additional payment after the employee’s leave date:

- From the main screen, click on ‘Note an Employee Leaver’

- Select the relevant employee from the drop-down list of employees

- Tick ‘Payment after leaving’

- The system will check if the employee has already appeared on an FPS as a leaver. If they have, a warning message will appear:

‘Are you restoring this employee to make adjustments to their current pay rather than making an additional payment after the employee has left?

Note: HMRC systems will now allow you to restore a leaver and continue paying them permanently, without having to set up a new employee record. If the employee was marked as a leaver in a previous tax year you still need to create a new employee record.

- Click ‘No’ and the following message will appear:

‘A Full Payment Submission including the leave date has already been sent to HMRC for this employee. Since this is a payment after leaving, the employee’s Tax Code will be set to 0T month 1.’

- Click ‘OK’

- Pay the leaver as needed in the current pay period

- Remember to enter the Leaving Date again via ‘Note an Employee a Leaver’

- The employee will appear on the next FPS submitted

Please Note: If you have selected to do a payment after leaving by mistake and you are due to continue to pay the employee you will need to restore a backup from before you have restored the leaver. Once you have done this you can remove the leaving date again and select the correct option.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.