Business Tax: 2022 Freeport allowance CT600(M)

Article ID

business-tax-2022-freeport-allowance-ct600m

Article Name

Business Tax: 2022 Freeport allowance CT600(M)

Created Date

6th April 2022

Product

Problem

IRIS Business Tax: 2022 Freeport allowance CT600(M) or CT600M form

Resolution

With the IRIS version 22.1.0 we have added the new form CT600(M).

The government announced that an enhanced SBA is available on Freeports and is available for qualifying assets brought into use on or before 30 September 2026. The enhanced rate is at 10% on a straight-line basis.

In line with this latest legislation, HMRC has released a new supplementary form CT600(M) to cater for allowances claimed against Freeports. We have updated both the capital allowance and structures and building allowance data entry, which will automatically populate the necessary fields on the CT600/CT600(M) to ensure all information required by HMRC is completed.

Field validation has been implemented within the Freeport data (with structures and building allowance), to reduce any validation at the point of generating the return of internet submission.

Load Business Tax and a company – there is a new option on bottom left. The CT600 itself will add a form CT600M called Freeport:

There are two types:

- Structural and Buildings Freeports (SBA)

- Enhanced Capital allowances (ECA)

The data you enter will appear on the CT600M on two different pages.

The Tax comp will show the capital allowance details.

Note: the SBA total capital allowance value on the Tax comp will be auto distributed between Trading and Non trading. (depends on which tick box selected and this is only way to change the distribution).

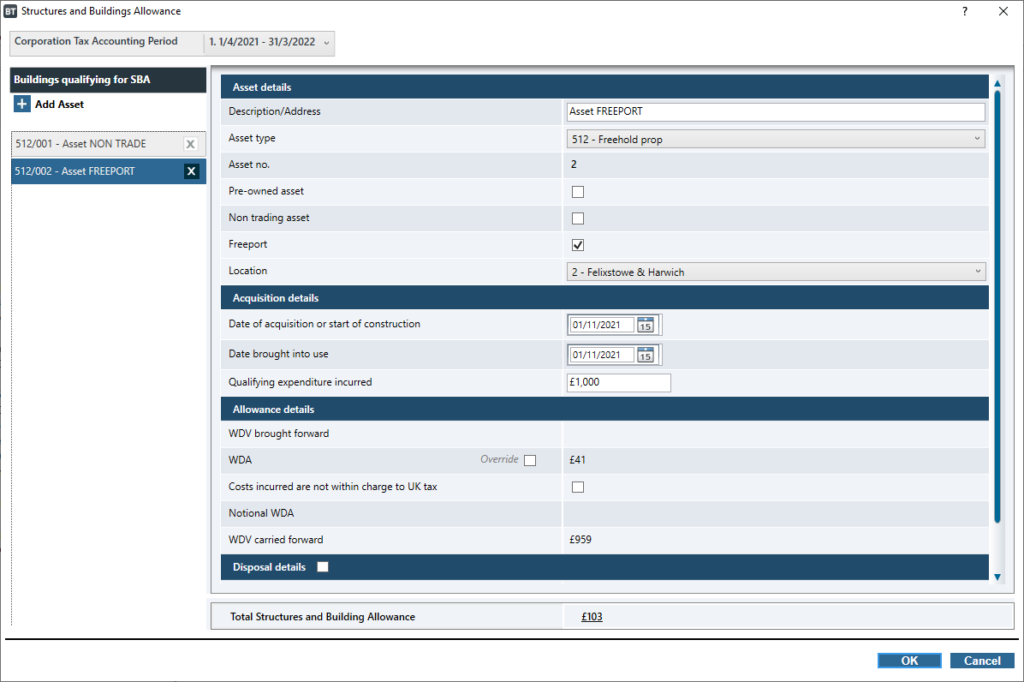

Structural and Buildings Freeports (SBA) Screen

- Add Asset.

- Enter in the details and tick Freeport and select the location, enter date and expenditure. Click OK to Save.

- If Non-Trading, then tick the Non trading asset box and click OK to Save.

The Location list is from HMRC. We will only update/expand this once we have HMRC confirmation.

The allowance calculation will automatically be time apportioned (on date of acquisition) if you note the value is not what you expected.

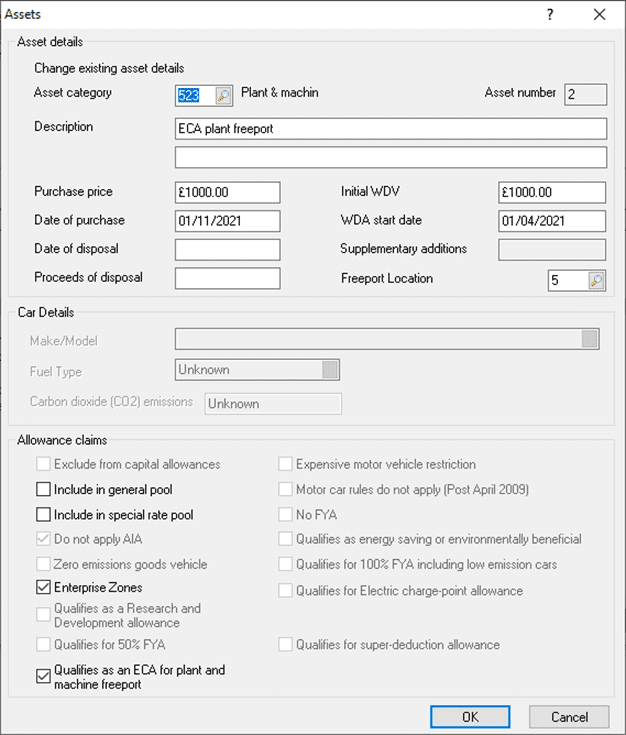

Enhanced Capital allowances (ECA) Screen

When selected, the Fixed Asset Maintenance screen displays. Insert or edit a asset category 523 Plant & machin must be selected. If the Date of purchase is within the HMRC date rules then the options for ECA, Freeport and Enterprise Zones can be selected:

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.