Business Tax- 2024/25 Creative/AVEC relief tax credits claim with CT600P and error 9300

Article ID

business-tax-2024-25-creative-avec-relief-tax-credits-claim-with-ct600p-and-error-9300

Article Name

Business Tax- 2024/25 Creative/AVEC relief tax credits claim with CT600P and error 9300

Created Date

8th April 2025

Product

Problem

Business Tax- 2024/25 Creative reliefs and tax credits with error 9300 / 885 and 570. CT600P supplementary page

Resolution

IRIS 25.1.0 version in April 2025. Business Tax- 2024/25 Creative/AVEC relief tax credits claim with error 9300. A new supplementary page has been added for the CT600P -Creative Industries to provide more details on where a company is part of creative and audio-visual industries on the expenditure and audio and visual expenditure credits to calculate the corporation tax charge. Due to a late change from HMRC you will not be able to complete CT600P until April 2026.

For more information, click here.

Currently a submission for Creative Tax credits cannot be made. An future update will be made in the next release to allow for creative tax credit submission for April 2025.

HMRC required the completion of new ‘Creative Industries CT600P‘ supplementary page from April 2025 in respect of any claims to Creative reliefs and tax credits including Audio-visual and Video Games expenditure credits(AVEC).

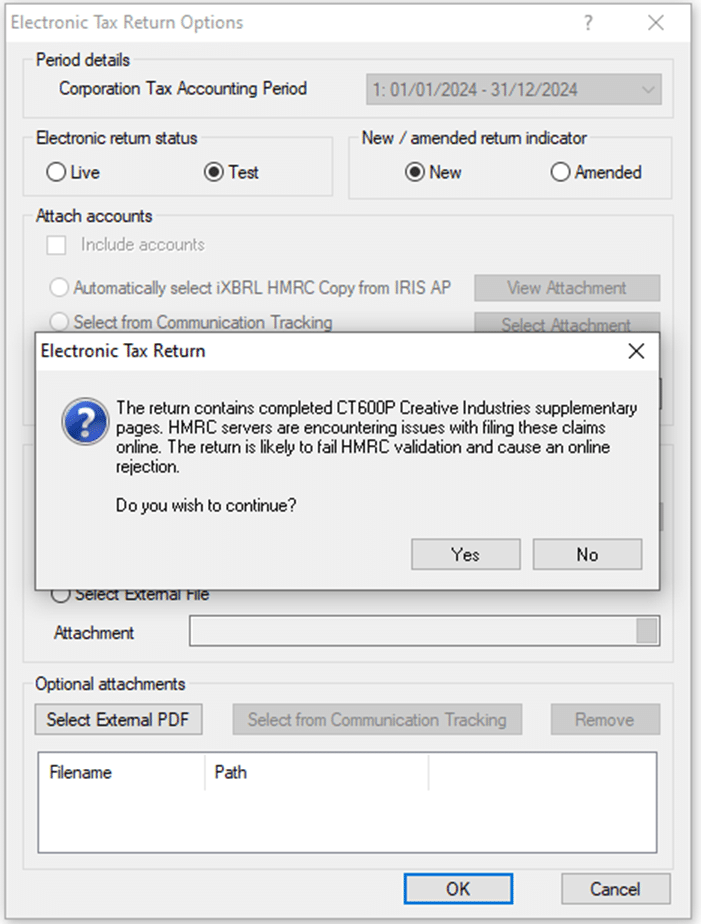

IRIS has incorporated this requirement into IRIS version 25.1. However, due to issues with HMRC online filing service it is not possible to submit a return containing a claim to creative reliefs and tax credits. In light of the issues with the HMRC online service HMRC made a last-minute decision to postpone the implementation of the new supplementary page until April 2026. Unfortunately, this decision was not received with sufficient time for the IRIS software to be updated ahead of the release in April 2025. When attempting to generate an internet return a warning message will appear below:.

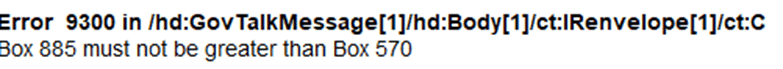

Selecting Yes on this window and proceeding to submit the return a validation error will be received from HMRC: You can either await development from HMRC (Details are still to be TBC) or print and submit by paper.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.