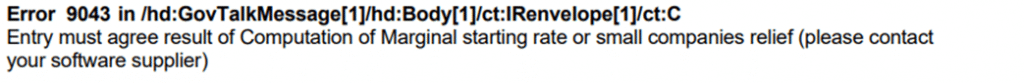

Business Tax- 3001 9043 Entry must agree result of Marginal Starting rate etc (Associated Comp)

Article ID

business-tax-3001-9043-entry-must-agree-result-of-marginal-starting-rate-etc

Article Name

Business Tax- 3001 9043 Entry must agree result of Marginal Starting rate etc (Associated Comp)

Created Date

7th March 2024

Product

IRIS Business Tax

Problem

IRIS Business Tax- 3001 9043 Entry must agree result of Marginal Starting rate etc Associated Companies

Resolution

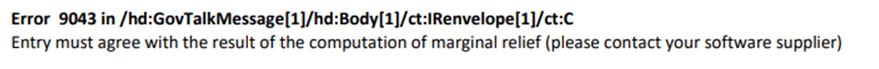

3001 9043 is a HMRC restriction linked to your Associated Companies entry .

1.Load the client in BT and the relevant period

2. Go to Data Entry | Calculation | Tax Calculation | The associated companies only apply from 1/4/2023 and you have a entry which is before this date (as it is not applicable for period before 1/4/2023) and is blocked by HMRC.

For example: If you have split periods or just one period, Associated Companies 2022 = 3, 2023 = 2. Check your period dates as a HMRC rule is being applied, you have to remove the associated companies “3” from the system as this is not applicable for periods before 1/4/2023.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.