Business Tax- 3001 9466 and 9469 Loans to Participator

Article ID

business-tax-3001-9466-and-9469-loans-to-participator

Article Name

Business Tax- 3001 9466 and 9469 Loans to Participator

Created Date

26th August 2022

Product

Problem

IRIS Business Tax- 3001 9466 and 9469 Loans to Participator

Resolution

If you are on IRIS version 22.2.0 and generate or submit a CT600 and you get error 3001 9466/9469

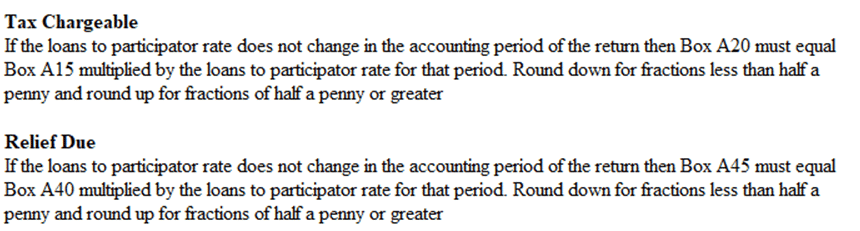

9466: Tax chargeable if the loan to participators rate does not change in the accounting period of the return then Box A20 must equal box A15 multiplied by loan to participator rate for that period.

9469: Tax chargeable if the loan to participators rate does not change in the accounting period of the return then Box A45 must equal box A40 multiplied by loan to participator rate for that period.

OR you get this validation

HMRC have confirmed there servers have not yet been updated in 2022 with the new calc: https://www.gov.uk/guidance/changes-and-issues-affecting-the-corporation-tax-online-service

The Autumn Budget 2021 raised the rate of tax charged under section 455 on loans to participators from 32.5% to 33.75% from 6 April 2022. The HMRC Corporation Tax online service will be updated to reflect this change from 16 September 2022 – so please update to IRIS version 22.3.0 and regenerate.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.