Business Tax- Box L45 must equal the lesser of box L25 and L40. If L25 is not completed then Box l45 must equal 0

Article ID

business-tax-box-l45-must-equal-the-lesser-of-box-l25-and-l40-if-l25-is-not-completed-then-box-l45-must-equal-0

Article Name

Business Tax- Box L45 must equal the lesser of box L25 and L40. If L25 is not completed then Box l45 must equal 0

Created Date

7th July 2022

Product

Problem

IRIS Business Tax: Box L45 must equal the lesser of box L25 and L40. If L25 is not completed then Box l45 must equal 0

Resolution

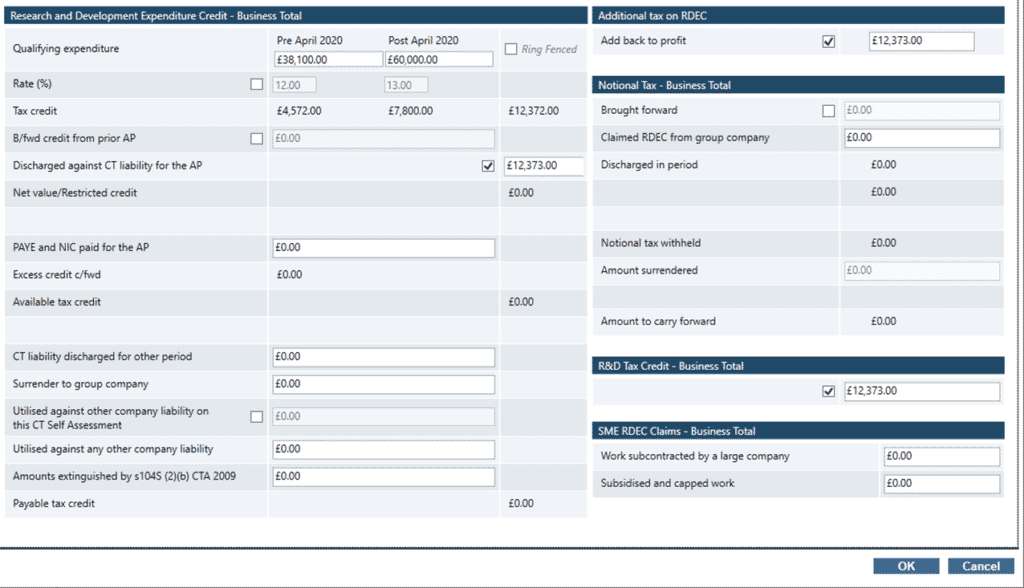

This is linked to your RDEC entries.

First ensure you are on the latest IRIS version – help and about

Open the RDEC and look at all the values

There may be a £ value difference on the RDEC credit claim (Eg £12372 on the very top middle) compared to all 3 boxes with similar value (eg one may show £12373) – you will need change all so they are the same value (they all need to match or you get the L45 error) . This is caused by users manually overriding all or one of the options on the 3 areas.

If you still have the same issue if all the values match then it can be a rounding issue

You may have a penny values on RDEC credit calculation eg £1000.71

Can you change the RDEC qualifying expenditure to a figure that calculated the tax credit as a whole figure like £1001 and also ensure all other similar boxes have the same £1001 value.

If you don’t have a RDEC entry but you have R&D entry – make the same edit there as well to the credit claim.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.