Business Tax- CT600N Residential Property Developer Tax 2023

Article ID

business-tax-ct600n-residential-property-developer-tax-2023

Article Name

Business Tax- CT600N Residential Property Developer Tax 2023

Created Date

11th August 2023

Product

IRIS Business Tax

Problem

IRUS Business Tax- CT600N Residential Property Developer tax 2023

Resolution

The new CT600N Residential Property Developer Tax full functionality is released in our autumn release IRIS version 23.3.0

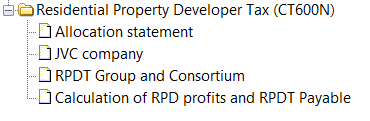

HMRC have released a new supplementary form (CT600N) to support the new supplementary charge that has been imposed on profits earned by corporates from the development for sale of residential property. Functionality for CT600N will appear for accounting periods that straddle the 1st April 2022. This can be accessed by the ‘Residential Property Developer Tax (CT600N)’ folder on the treeview along with the following options and functionality:

- The allocation of the 25 million allowance for the group can be entered to complete the allocation statement via: Residential Property Developer Tax (CT600N) | Allocation Statement.

- Joint venture companies’ information can be added via: Residential Property Developer Tax (CT600N) | Joint Venture Companies.

- Group claims or surrenders of RDP Income or Losses can added via: Residential Property Developer Tax (CT600N) | RPDT Group and Consortium.

- The Summary screen can be used to enter the RPDT profit or loss and view the final Tax charge via: Residential Property Developer Tax (CT600N) | Calculation of RPD Profits and RPDT Payable.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.