Business Tax- 3001 9372. Box 285 must not be greater than box 235, 298/235, 300/235

Article ID

business-tax-error-3001-9372-box-285-must-not-be-greater-than-box-235

Article Name

Business Tax- 3001 9372. Box 285 must not be greater than box 235, 298/235, 300/235

Created Date

4th April 2022

Product

Problem

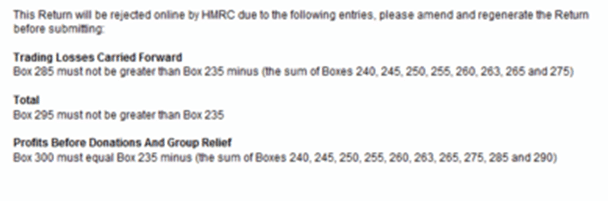

IRIS Business Tax- 3001 9372 9179 9338. Box 285 must not be greater than box 235 minus the sum of boxes 240, 245, 250, 255, 260, 263, 270 and 275 + 298 and 23, 300 and 235:

Resolution

If you have any losses utilized against income but when you generate or submit you get either an error 3001 9372 or Box 285 must not be greater than box 235, 298 and 235, 300 and 235:

- Edit / Losses / untick ‘less utilized against total profit’ figure and enter the correct profit in the year figure; you could be trying to utilize more than you have available (The amount being utilized is more than the allowed amount). Regenerate and try again.

- Edit / Losses / CTAP EDIT – remove the value in the ‘Less utilized against profits’ box.

- Update totals and click OK to close.

- Re-run the Tax comp. If the profit value has changed then note down the new profit.

- Go back to Edit / Losses / CTAP EDIT.

- Add in the new value in the ‘Less utilized against profits‘ box.

- Update totals and click OK to close.

- Regenerate and try again

Note: Box 285 will only be populated when there is an entry in Edit | Losses | Trading losses tab | Edit | Less utilized against non trading income (any income other than trading and/or investment income). If you do not have any of those incomes and try to utilizes losses in these boxes – you will get a internet filing rejection.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.