Business/Personal Tax/P11D: Fatal Error 1001 cvc-enumeration-valid: Value 'XXX' is not facet-valid with respect to....

Article ID

business-tax-fatal-error-1001-cvc-enumeration-valid-value-xxx-is-not-facet-valid-with-respect-to

Article Name

Business/Personal Tax/P11D: Fatal Error 1001 cvc-enumeration-valid: Value 'XXX' is not facet-valid with respect to....

Created Date

10th August 2022

Product

IRIS P11D, IRIS Personal Tax, IRIS Business Tax

Problem

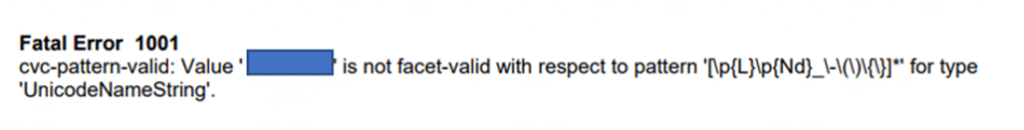

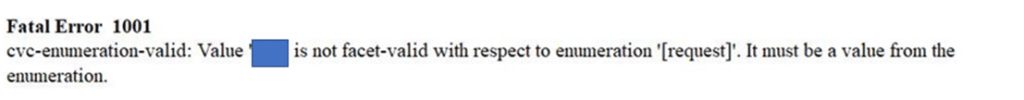

IRIS Business/Personal tax/ P11D - Fatal Error 1001 cvc-enumeration-valid: Value 'poll' is not facet-valid with respect to enumeration '[request]'. It must be a value from the enumeration.

Resolution

This can affect BT, PT and P11D submissions – each has its own checklist below:

1.If in BT/PT then Load the client and select the correct year

2. Client – View – Tax tab

3. If in BT: You may have entered ‘XXX'(or another manual entry) for the Tax District field (or a entry in one of the other fields). You can try and enter ‘NA’ or use a valid District option. Then regenerate the return and submit. If you are unsure of the Tax District then you would need to contact HMRC to advise what to use.

4. If in PT: Check all entries for the specific letters/numbers (behind the Blue box below) under the warning as you cannot use that entry. If not under the TAX tab then check all income and relief entries. You need to correct the entry with a valid value/text.

5. If in P11D: Load the client in P11d and correct year – Top left – go to Client Identifier | Magnifying Glass | highlight the client and ‘View’ | Tax Tab – remove the PAYE Tax District and the REF number and then re-enter and submit. If you get the same error then HMRC is not accepting one of the entries and may not be valid then you would need to contact HMRC to advise what to use. If the error letters/numbers are not listed under Tax district then you need to check all entries you gave made for the company and for each employee/director to search for this entry

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.