Business Tax- Group Consortium cannot see and claim a loss. 'Brought forward trading loss relief cannot exceed £0' or No Profit/Loss

Article ID

business-tax-group-consortium-this-client-cannot-claim-any-amount-under-group-relief-provisions

Article Name

Business Tax- Group Consortium cannot see and claim a loss. 'Brought forward trading loss relief cannot exceed £0' or No Profit/Loss

Created Date

12th July 2022

Product

Problem

IRIS Business Tax- Group Consortium: cannot see and claim a loss from a loss making company or you get this 'Brought forward trading loss relief cannot exceed £0'

Resolution

How to transfer a loss, read this KB

You have a loss making making company and want to transfer loss to another company with a gain. You are now on the company with the gain in BT and trying to transfer the loss to it but you get the error or missing values:

1.Warning: ‘This client cannot claim any amount under group relief provisions’

2. OR the loss value doesn’t appear / Group loss relief brought forward is not appearing

3. OR you get error ‘Brought forward trading loss relief cannot exceed £0’.

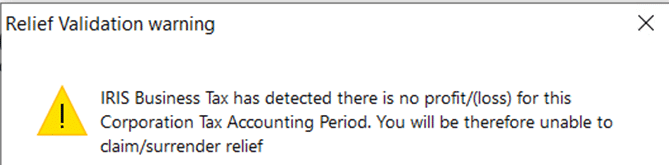

4. OR you get this validation: No Profit/Loss

1.Double check the loss making company – run a tax comp to ensure it has a loss in Period or Loss Brought forward. This company may have been loss making initially but a update to values changed it to profit making.

2. Double check the profit making company – run a tax comp to ensure its profit making, This company may have been profit making initially but a update to values changed it to loss making. If 1 and 2 are correct then follow the steps below:

a. Load the loss making company

b. Edit losses

c. CTAP edit

d. Click on the very top left cell

e. Use the Tab key and along all the way around to you go back to where you started

f. Update totals and close

g. Now load the profit making company and go back to groups/consort screen and check that the loss value now shows which you can now claim.

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.