Business Tax- Invalid ixbrl (comp) attached does match CT600 submission, company name period start date period end date company?

Article ID

business-tax-invalid-ixbrl-comp-attached-does-match-ct600-submission-company-name-period-start-date-period-end-date-company

Article Name

Business Tax- Invalid ixbrl (comp) attached does match CT600 submission, company name period start date period end date company?

Created Date

3rd April 2023

Problem

IRIS Business Tax- Invalid ixbrl (comp) attached does match CT600 submission, company name period start date period end date company?

Resolution

This can be related to two parts:

1)The IXBRL generated from AP and/or

2) The Tax comp generated in Business tax

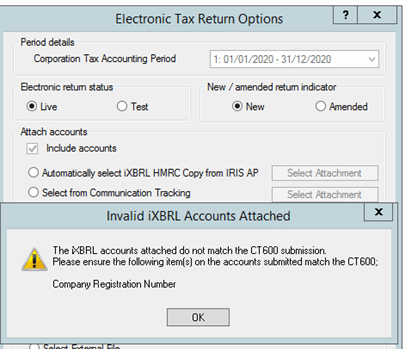

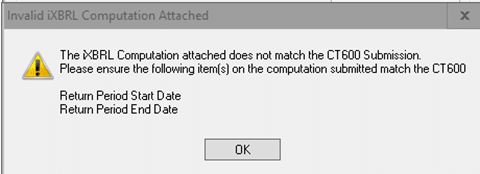

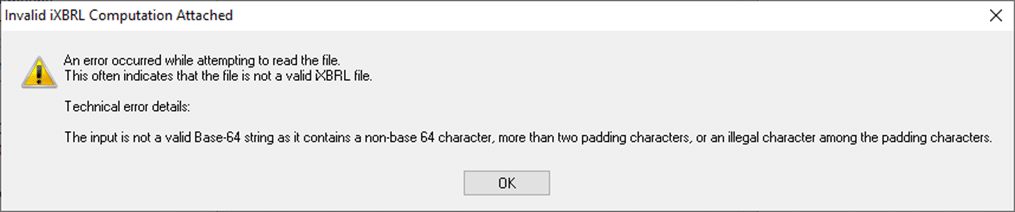

It may look similar to the warnings below ( As it could be the IXBRL and/or Computation): for the example the IXBRL for company registration one has a incorrect number entered into BT/AP OR the return period dates for the Tax comp.

Check your on the latest IRIS version– Go to Help and About and the latest versions are here https://www.iris.co.uk/support/iris-accountancy-suite-support/as-downloads/

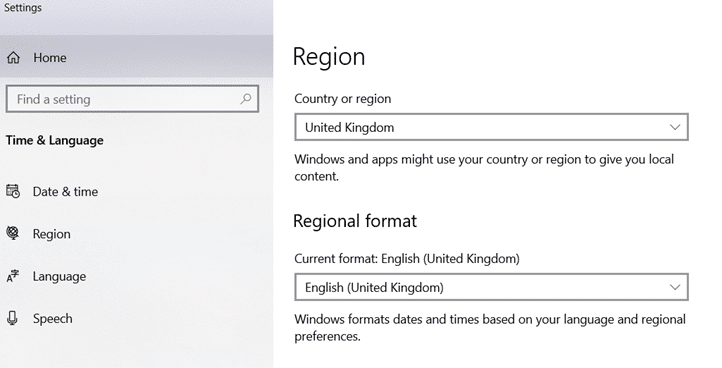

1) Windows could be set to ‘English US’ – this would need to be changed to English UK. Right click on the the time and date | Select Adjust Time/Date | Go to Region located along left side of window and then from the drop down select UK and save. Then regenerate the ixbrl accounts from AP.

2) Client – View – Periods – Remove any incorrect date. Then regenerate the ixbrl accounts from AP

3) Click ok on warning and see if it allows you to proceed. It does allow you to proceed but then says HMRC will reject then read the next steps.

4) Regenerate the ixbrl accounts from AP. Then back to BT and regenerate the return

5) Regenerate the ixbrl accounts from AP as an external ixbrl and attach it externally into BT.

6) Regenerate the ixbrl accounts from AP but you will need to save the ixbrl and/or the Tax comp externally as a PDF (so you may need TWO PDFs). Then attach one or both manually into BT- read this KB below on how to manually attach a IXBRL PDF and Tax comp PDF onto a CT600 submission

If you only attach the IXBRL PDF and still get warning – then you will need to attach the Tax comp as a PDF as well

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.