Business Tax - Problems with the summary screen for a Ltd company client.

Article ID

business-tax-problems-with-the-summary-screen-for-a-ltd-company-client

Article Name

Business Tax - Problems with the summary screen for a Ltd company client.

Created Date

14th April 2021

Product

Problem

Business Tax - Problems with the summary screen for a Ltd company client.

Resolution

This is a confirmed DEFECT in Version 21.1.652. This issue has been fixed, please click on the link below to download the HOTFIX: –

Please note that the hotfix must be applied to the Central and LPO installations.

Please see the following scenarios relating to a a number of problems with the Summary screen in Business Tax: –

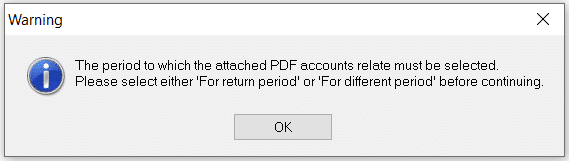

- When the user removes the ticks from “Accounts for the return period” and/or “For different period” we correctly enable the “No iXBRL accounts reason” drop down menu, however it is triggering the attached warning message when the user clicks OK.

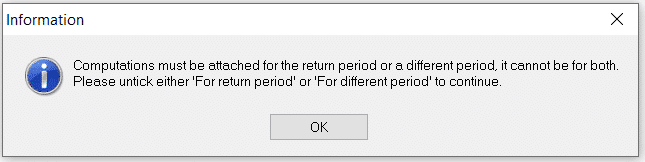

2. Incorrectly ticking the box 85 on the return “ Computations attached for a different period, irrespective of what boxes have been ticked within the summary screen. If you open the summary screen and select Computations for return period and click OK and then reopen the summary screen the “For return period” box has been unticked and the “For a different period” has been ticked.

3. When the user has removed the tick from both Computation – “For return period” and “For different period” boxes this should be enabling the “No iXBRL Computation reason” drop down menu but it is not.

4. When the user ticks the box in the Transfer pricing group to indicate that the “Company qualifies for SME exemption” and then clicks OK, it is triggering the attached warning message regardless of what boxes we have ticked (For return period and/ or for different period).

We are sorry you did not find this KB article helpful. Please use the box below to let us know how we can improve it.